· WeInvestSmart Team · personal-finance · 12 min read

5 Levels of Financial Independence: Find Your Path to FI

Break down the path to FI into manageable stages: 1) Solvency, 2) Stability, 3) Debt Freedom, 4) Coast FI, 5) Full FI. This provides readers with a roadmap and a sense of progress.

Most people think of “Financial Independence” as a mythical, far-off island you either live on or you don’t. It’s a binary state: you’re either working for the man or you’re sipping piña coladas on a beach, funded by your passive income. Going straight to the point, this all-or-nothing mindset is not just wrong; it’s profoundly discouraging. It makes the goal seem so impossibly distant that most people never even bother to start the journey. The uncomfortable truth is that FI isn’t a destination; it’s a progressive journey with distinct, achievable levels.

We’re obsessed with the finish line, but we have no idea where we are on the racetrack. This is an absurd standard. How can you plan a journey without knowing your current location? You need a map, a “You Are Here” sticker, and clear signposts telling you you’re making progress. Without these milestones, the path to financial freedom feels like an endless, demoralizing slog.

Here’s where things get interesting. What if you’re already further along than you think? What if you could unlock a meaningful new degree of freedom and security this year, long before you’re ready to quit your job forever? Breaking the journey down into five clear levels transforms FI from a vague fantasy into a tangible, step-by-step video game. And this is just a very long way of saying that knowing which level you’re on right now is the first, most critical step to reaching the next one.

Level 1: Financial Solvency (Breathing Above Water)

This is the foundational level, the starting block for everyone. Financial Solvency means you can meet your current financial obligations each month without going further into debt. That is to say, your income is equal to or greater than your expenses. You aren’t necessarily saving much, if anything, but you’ve stopped the bleeding. You are no longer actively sinking. For millions of people, reaching this stage is a monumental victory.

The feeling at this level is often one of precarious balance. You might be living paycheck to paycheck, and the thought of a significant unexpected expense is terrifying. But for the first time, you have your head above water. You have a grip on your cash flow. The primary goal at this stage isn’t to build wealth; it’s simply to create a predictable financial environment and prove to yourself that you are in control of the money coming in and the money going out.

This sounds like a trade-off, just surviving instead of thriving, but it’s actually a desirable thing to achieve this equilibrium first. We covet this stability because it’s the essential platform from which all future progress is launched. The action plan here is simple and direct:

- Track Everything: You must know where every dollar is going. Create a basic budget.

- Plug the Leaks: Identify non-essential spending that can be cut immediately.

- The Goal: End the month with a balance of zero or higher, without adding a single dollar to your credit card balance.

You may also be interested in: Set It and Forget It: How to Automate Your Finances in One Weekend

Level 2: Financial Stability (Building a Small Wall)

Once you’ve mastered Solvency, you can move to the next level: Financial Stability. This is where you consciously build your first line of defense against the chaos of life. The defining characteristic of this stage is having a starter emergency fund. You’ve moved beyond just surviving the month; you’re now actively preparing for the inevitable small-scale financial surprises.

The key milestone is saving at least $1,000, or ideally one full month of essential living expenses, in a separate high-yield savings account. The psychological shift at this level is profound. A flat tire is no longer a full-blown crisis that sends you into a debt spiral; it’s just an annoying inconvenience that you can handle with cash. You are no longer living on the knife’s edge. You have created a small but powerful buffer between you and the world.

The funny thing is that the amount of money is less important than the habit you build. The act of consistently setting money aside and paying your future self first rewires your brain. You begin to see yourself as a saver, not just a spender. To level up to Stability:

- Open a Separate Account: Your emergency fund cannot live in your checking account.

- Automate, Automate, Automate: Set up an automatic weekly or bi-weekly transfer to this account, even if it’s just $25.

- Start Sinking Funds: Begin planning for predictable, non-monthly expenses to protect your new emergency fund.

You may also be interested in: Good Debt vs. Bad Debt: A Beginner’s Guide to Understanding and Prioritizing Your Loans

Level 3: Debt Freedom (Breaking the Chains)

This is a massive turning point in the journey. Debt Freedom is the stage where you have eliminated all high-interest, non-mortgage debt. We’re talking about credit cards, personal loans, payday loans, and car loans. (A mortgage is generally excluded as it’s typically low-interest debt secured by an appreciating asset). Reaching this level feels like taking off a heavy backpack you didn’t even realize you were carrying.

Going straight to the point, high-interest debt is a mathematical anchor that makes building wealth nearly impossible. When you pay 20% interest on a credit card, you have to earn a 20% return on an investment just to break even—a feat that is nearly impossible to sustain. By eliminating this debt, you are giving yourself a guaranteed, risk-free return of whatever interest rate you were paying.

The Consumer Financial Protection Bureau provides comprehensive guidance on managing and eliminating debt responsibly.

The feeling here is one of incredible liberation. For the first time, your income is truly your own. The hundreds or thousands of dollars that were being siphoned off by lenders are now yours to command. You can now deploy that money to aggressively build wealth. The path to Debt Freedom requires a battle plan:

- Choose Your Weapon: Pick a debt payoff strategy like the Snowball (paying off smallest balances first for psychological wins) or the Avalanche (paying off highest-interest balances first for mathematical efficiency).

- Go on Offense: Throw every extra dollar you can find at your debt.

- Celebrate Each Kill: When you pay off a card or a loan, take a moment to celebrate. This fuels your motivation for the next target.

You may also be interested in: The Snowball vs. The Avalanche: Which Debt Payoff Method is Right for You?

Level 4: Coast FI (The Point of Inevitability)

This is the level most people don’t know exists, and it’s one of the most powerful. Coast FI is the point where you have invested enough money that, without another single contribution, your existing investments will grow to provide a comfortable retirement by traditional retirement age (e.g., 65). Your retirement is now on autopilot. It’s an inevitability.

And here is where things get interesting. The implication is staggering: you no longer have to save for retirement. You are now free to “coast.” Your primary financial obligation is simply to earn enough to cover your current living expenses. This unlocks an incredible amount of freedom and flexibility decades before traditional retirement. You can take a lower-stress job, pursue a passion project, work part-time, or start a business, all with the peace of mind that your future self is completely taken care of.

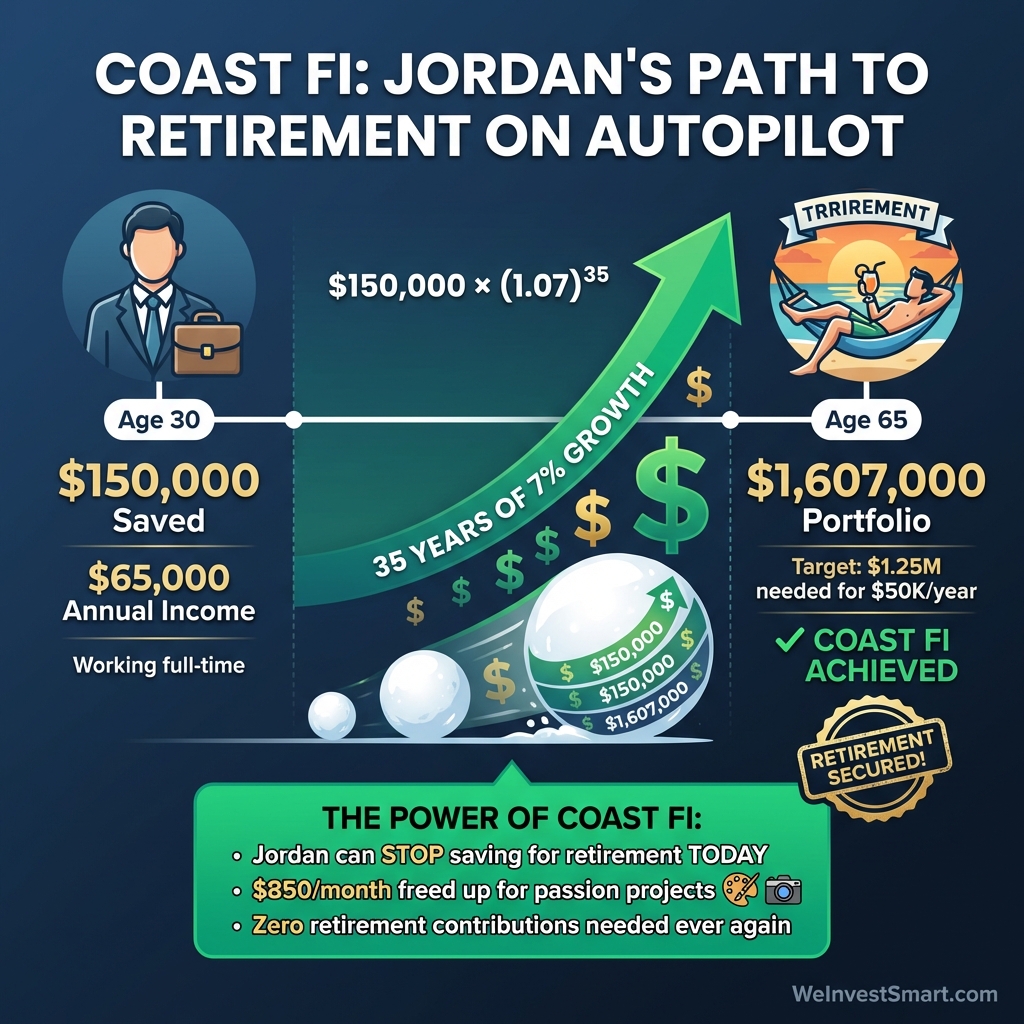

Let me use a case study. Meet Jordan, age 30, who earns $65,000 annually and has already saved $150,000 in retirement accounts. Jordan wants to retire at 65 with $50,000 per year in expenses (needing $1.25 million based on the 4% rule). Here’s the Coast FI math: $150,000 invested at 7% annual growth for 35 years = $1,607,000. Jordan has already reached Coast FI! Even without saving another dollar for retirement, compound growth will deliver a comfortable retirement. Jordan can now redirect the $850/month previously earmarked for retirement toward passion projects, lower-stress work, or covering current expenses.

Think of it like rolling a snowball. You’ve spent years pushing it up the hill. At the peak (Coast FI), you can just let it go. It will roll down the other side, gathering more snow (compound growth), and become a massive avalanche by the time it reaches the bottom (retirement age). The Social Security Administration’s retirement planning tools can help you estimate your full retirement needs. To reach this powerful stage:

- Calculate Your Number: Use an online Coast FI calculator. You’ll need to input your current age, your desired retirement age, your current invested assets, and your expected annual spending in retirement.

- Front-Load Your Investing: The key is to invest as much as you can, as early as you can, in tax-advantaged accounts like a 401(k) and a Roth IRA to reach this number.

You may also be interested in: The 7 Biggest Financial Mistakes Beginners Make (And How to Avoid Them)

Level 5: Full FI (The Ultimate Freedom)

This is the final boss, the island that everyone dreams of. Full Financial Independence is the stage where your passive income from investments is enough to cover all of your annual living expenses. Work is now 100% optional. You have bought back your time, which is the most finite and valuable asset you have.

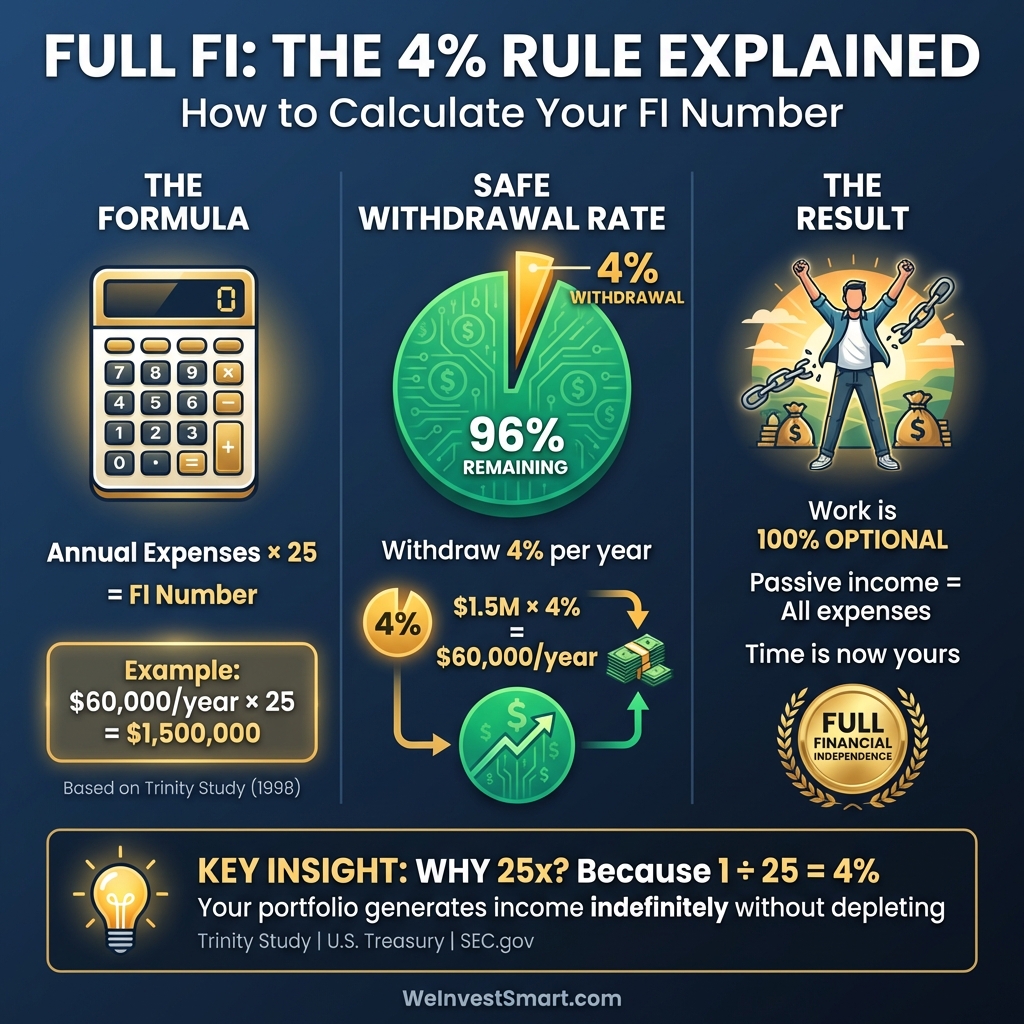

The most common benchmark for this level is based on the 4% Rule of Thumb, derived from the Trinity Study conducted by three finance professors at Trinity University. This rule states that you can safely withdraw 4% of your initial investment portfolio each year, adjusted for inflation, without depleting it over a 30-year retirement. To put it another way, you have reached Full FI when your total invested assets are 25 times your annual expenses. If you spend $60,000 per year, your Full FI number is $1.5 million ($60,000 x 25).

For those seeking safe, government-backed investment vehicles to support this journey, U.S. Treasury securities offer a foundation of stability in a diversified portfolio. Additionally, the SEC’s Guide to Savings and Investing provides authoritative guidance on building a sustainable investment strategy.

The feeling at this level is one of complete agency. You are the sole architect of your days. This doesn’t necessarily mean you’ll stop working. It means you only work on what you want, when you want, with whom you want. The “work” becomes play because it is driven by passion, not necessity. The journey from Coast FI to Full FI is simply about continuing to invest the surplus income that you are no longer required to save.

You may also be interested in: How to Build a $1,000 Emergency Fund in 30 Days (Even on a Tight Budget)

The Bottom Line: Find Your Place on the Map

The path to financial independence isn’t a mystery. It’s a clear, logical progression of steps. Find yourself on this map. If you’re at Level 1, don’t be discouraged. Your mission is clear: achieve Solvency. If you’re at Level 3, you are on the cusp of an incredible inflection point. Celebrate your progress and focus on the next immediate milestone.

The uncomfortable truth is that you can dramatically improve your life and reduce your financial anxiety by simply reaching Level 2 or 3. You don’t have to wait for Full FI to feel the benefits of this journey. And this is just a very long way of saying that financial freedom isn’t found at the destination; it’s built level by level, with each stage unlocking a more secure and intentional life. You get the gist: find your level, take the next step, and start your journey today.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.

The 5 Levels of Financial Independence FAQ

What are the 5 levels of Financial Independence?

The 5 levels provide a roadmap to FI. They are: 1) Solvency (income covers expenses), 2) Stability (you have an emergency fund), 3) Debt Freedom (no high-interest debt), 4) Coast FI (your investments will cover retirement without new contributions), and 5) Full FI (investment income covers all living expenses).

What is Coast FI?

Coast FI (Coast Financial Independence) is the point where you have invested enough money that, due to compound growth, it will become a full retirement fund by traditional retirement age (e.g., 65) without you ever needing to save another dollar for retirement. At this stage, you only need to earn enough to cover your current living expenses.

How is Financial Stability different from Solvency?

Solvency is simply not sinking further into debt; your income meets your monthly obligations. Financial Stability is the next level up, where you have a financial buffer—typically a starter emergency fund of $1,000 to one month’s expenses. Stability means a small unexpected cost is an inconvenience, not a catastrophe.

What kind of debt should I pay off to reach the Debt Freedom level?

The Debt Freedom stage typically refers to eliminating all high-interest, non-mortgage debt. This includes credit card debt, personal loans, payday loans, and often auto loans. A mortgage is generally excluded as it is considered “good debt” secured by an appreciating asset.

How do I know when I’ve reached Full Financial Independence?

You’ve reached Full FI when your passive income from investments is enough to cover all of your annual living expenses indefinitely. A common benchmark for this is the 4% Rule, which states that you have reached Full FI when your investment portfolio is 25 times larger than your annual spending.