· WeInvestSmart Team · personal-finance · 17 min read

The 50/30/20 Rule: The Simplest Budget for People Who Hate Budgeting

Tired of tracking every penny? Discover the 50/30/20 rule, a simple and powerful framework to manage your money without the hassle of a complicated budget.

Most people think budgeting is about creating complex spreadsheets, tracking every single coffee purchase, and feeling a wave of guilt every time they spend money on something fun. But here’s the uncomfortable truth: that’s precisely why most budgets fail. They’re too complicated, too restrictive, and they turn managing money into a soul-crushing chore. Going straight to the point, a budget isn’t a financial prison; it’s a tool for freedom. And the best tool is often the simplest one.

We’ve all been there. You download a budgeting app, spend hours linking your accounts and meticulously categorizing every transaction from the last 90 days. You stick with it for a glorious week and a half, feeling like a true master of your financial universe. Then life happens. An unexpected expense pops up, you overspend on a dinner out with friends, and the whole system collapses. You feel like a failure and give up, concluding you’re just “bad with money.”

But what if we told you the problem isn’t your lack of discipline? The problem is the system itself. The funny thing is that by demanding perfection, traditional budgets set us up for failure. They’re designed for accountants, not for normal people trying to live their lives. In fact, the most effective financial plan is one you can actually stick to, even when you’re not feeling motivated. This is where the 50/30/20 rule comes in.

What is the 50/30/20 Budget Rule and Why Does It Work?

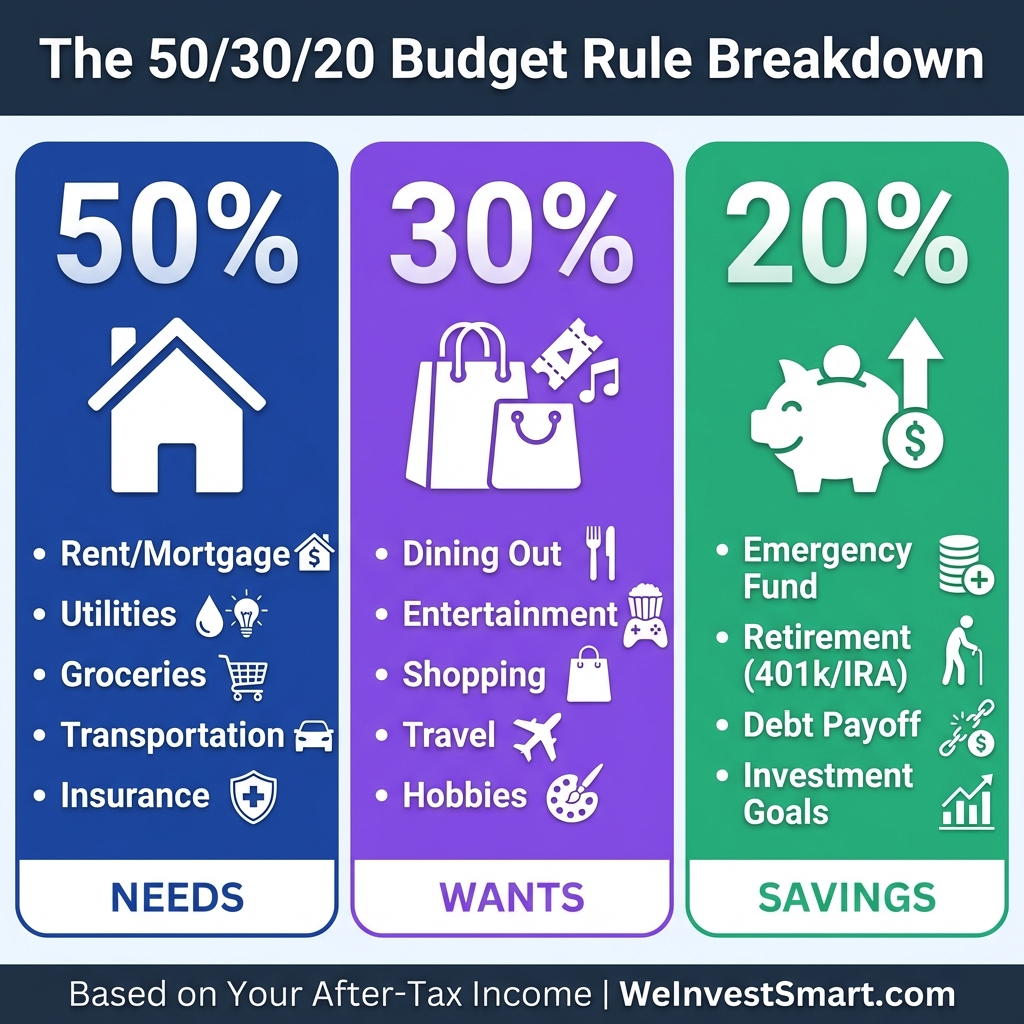

Before we dive deep, let’s establish what this rule actually is. Going straight to the point, the 50/30/20 budget rule is a simple framework for dividing your after-tax income into just three categories:

- 50% for Needs: The essentials you must have to live and function.

- 30% for Wants: The stuff that makes life enjoyable and worth living.

- 20% for Savings & Debt Repayment: The money you use to build your future and achieve financial freedom.

You get the gist: instead of tracking dozens of granular categories, you only have to worry about three. This isn’t about micromanaging every dollar; it’s about making sure your money is flowing in the right general directions. This approach to personal finance is perfect for budgeting for beginners because it prioritizes mindset over minutiae.

Here’s where things get interesting. The real genius of the 50/30/20 rule is psychological. Traditional budgets often fail because they don’t account for human nature. By creating a specific, generous bucket for “Wants,” this method gives you explicit permission to spend money on things you enjoy, completely guilt-free. As long as you stay within your 30%, you haven’t broken the budget; you’ve followed it perfectly. This built-in flexibility is what makes it sustainable for the long haul.

Decoding the 50% “Needs” Category: Your Essential Expenses

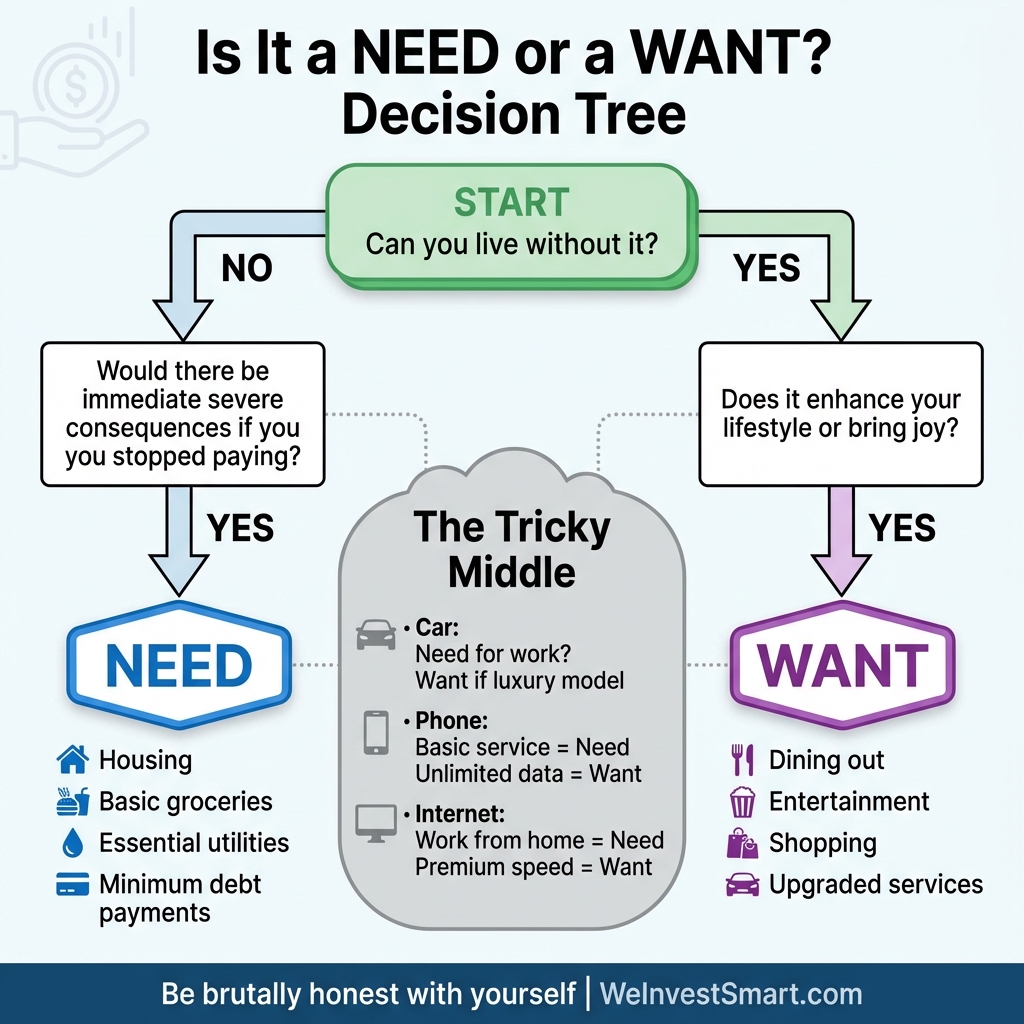

The first and largest bucket is for your Needs. But what do we mean by that? In other words, Needs are the non-negotiable expenses you have to pay each month to survive and maintain your life. If you stopped paying for it, the consequences would be immediate and severe.

Here’s a concrete example of what typically falls into the 50% Needs category:

- Housing: Rent or mortgage payments (principal and interest).

- Utilities: Electricity, water, natural gas, and essential internet service.

- Transportation: Car payments, fuel, car insurance, and public transit passes necessary for you to get to work.

- Groceries: Basic food for cooking meals at home.

- Insurance: Health insurance premiums, renters or homeowners insurance.

- Minimum Debt Payments: This is a crucial distinction. The minimum required payment on your student loans, credit cards, and personal loans is a Need. Anything extra is not.

- Essential Supplies: Things like toiletries, cleaning supplies, and other basic household necessities.

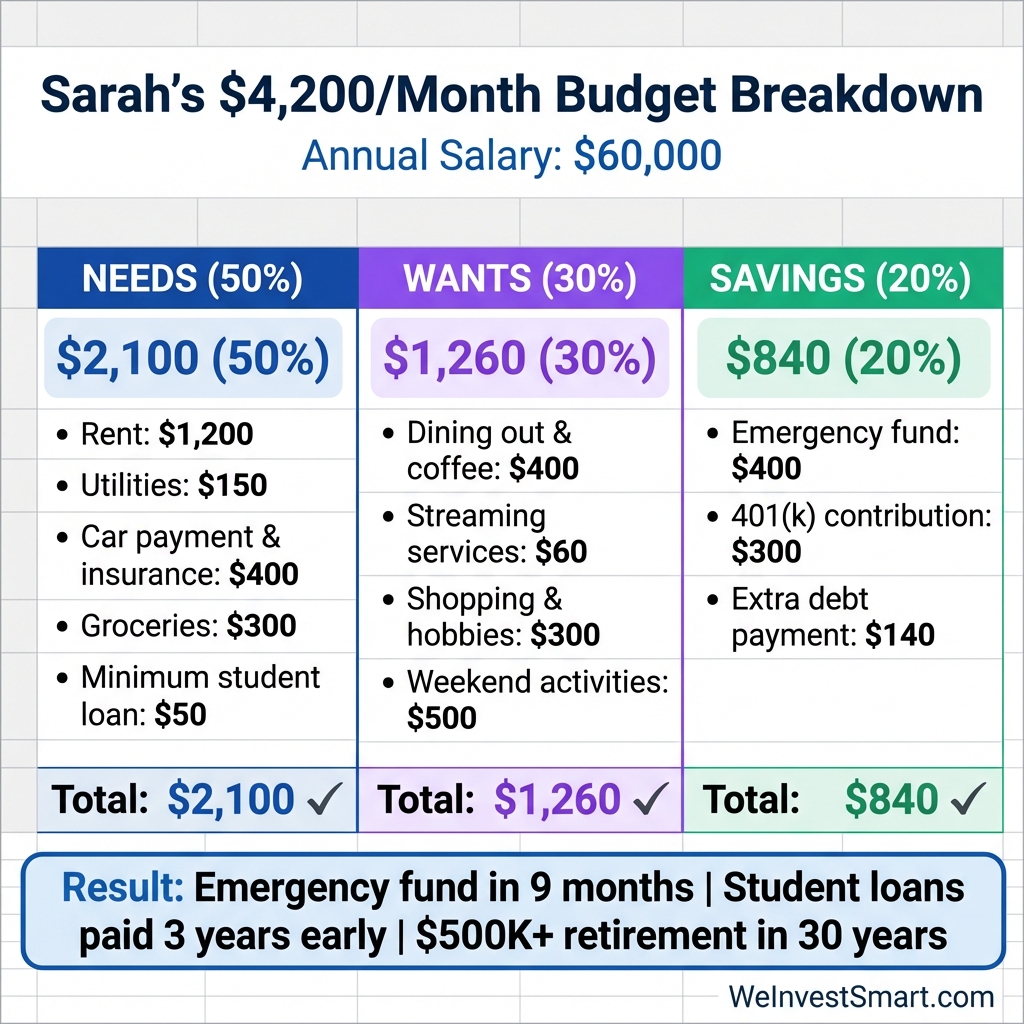

Let’s use a case study: Meet Sarah, who earns an annual salary of $60,000. After taxes and deductions, she takes home roughly $4,200 per month. According to the 50/30/20 rule, she would aim to spend no more than $2,100 (50% of $4,200) on all the items listed above.

Sarah’s Needs Budget Breakdown:

- Rent: $1,200 (28.6% of income)

- Utilities (electric, water, internet): $150

- Car payment & insurance: $400

- Groceries: $300

- Minimum student loan payment: $50

- Total Needs: $2,100 ✅ Fits perfectly

The line between needs vs wants can get blurry. Is your daily Starbucks a need? No. Is a basic internet connection so you can work from home a need? Absolutely. Is a car a need? This is where things get interesting. A reliable 10-year-old car that gets you to your job 30 miles away is a need. A brand-new luxury SUV with a $900 monthly payment is mostly a want. The key is to be brutally honest with yourself. Ask: “Could I live without this?” If the answer is a hard no, it’s likely a need.

According to the Bureau of Labor Statistics Consumer Expenditure Survey, the average American household spends approximately 60-70% of their income on needs alone, which is why the 50% target can feel challenging initially.

The 30% “Wants” Category: How to Spend Guilt-Free

This is the category that makes the 50/30/20 rule a game-changer. Your “Wants” are everything you buy for lifestyle, entertainment, and enjoyment. This is your guilt-free spending money. As long as you stay within this 30% allocation, you can spend it on whatever you like without derailing your financial planning.

Wants typically include:

- Dining Out & Takeout: Restaurants, bars, coffee shops, and food delivery services.

- Entertainment: Movie tickets, concerts, sporting events, and streaming subscriptions like Netflix, Spotify, and Disney+.

- Hobbies & Shopping: New clothes, gadgets, video games, gym memberships, and decor for your home.

- Travel: Vacations, weekend trips, and flights to see family.

- Upgraded Services: A premium cable package, a faster internet plan than you strictly need, or an unlimited phone data plan.

For Sarah’s $4,200 monthly income, this gives her $1,260 (30%) to spend on fun. This sounds like a trade-off, but it’s actually a desirable thing: by intentionally creating a generous and explicit space for “fun money,” you’re far less likely to feel deprived and abandon your budget altogether. This category acts as a pressure-release valve, which is why this simple budget is so effective for people who have failed at budgeting before. It embraces the idea that enjoying your life is a critical part of a healthy financial plan.

Sarah’s guilt-free Wants budget:

- Dining out & coffee: $400

- Netflix, Spotify, gym membership: $60

- Shopping & hobbies: $300

- Weekend activities: $500

- Total Wants: $1,260 ✅ Within 30% allocation

You may also be interested in: Values-Based Budgeting: Align Your Spending With What Matters Most

Your 20% “Future Self” Fund: Savings and Debt Repayment

This is the most powerful category. Going straight to the point, this 20% is where you pay your future self first. It’s the engine of building wealth and achieving your long-term goals. That is to say, this is the money that will buy your freedom from financial stress.

This 20% category is dedicated to powerful financial moves, including:

- Building an Emergency Fund: Your first priority should be saving 3-6 months of essential living expenses in a liquid savings account.

- Investing for Retirement: Contributions to your 401(k), Roth IRA, or other retirement accounts.

- Saving for Big Goals: A down payment on a house, a new car, a wedding, or your kids’ education.

- Extra Debt Payments: Paying more than the minimum on high-interest debt like credit cards or personal loans. This is how you accelerate your debt repayment journey.

With a $5,000 monthly income, you’d be putting $1,000 toward these powerful goals every single month. By automating this 20%—setting up automatic transfers to your savings and investment accounts the day you get paid—you ensure your future self is taken care of before you even have a chance to spend that money elsewhere. And this is just a very long way of saying that your saving money goals should be non-negotiable.

For Sarah’s $4,200 income:

Emergency fund (currently building): $400

401(k) contribution (with match): $300

Extra student loan payment: $140

Total Savings & Debt: $840 (20%) ✅

The Power of Consistency: If Sarah maintains this $840/month savings rate, she’ll have her emergency fund fully funded in ~9 months, student loans paid off 3 years faster, and $300/month into 401(k) grows to ~$500,000+ by retirement (assuming 7% annual return over 30 years).

You may also be interested in: How to Build an Emergency Fund (Even on a Tight Budget)

For help eliminating debt faster, check out: Debt Snowball vs. Debt Avalanche: Which Payoff Method Wins?

How to Apply the 50/30/20 Rule: A Step-by-Step Guide

Enough theory—let’s make this practical. Here’s how to budget using this framework today.

- Calculate Your After-Tax Income: This is the most crucial first step. Look at your pay stub or bank statement to find the exact amount that hits your bank account after all taxes and deductions (like health insurance or 401(k) contributions) are taken out. This is your starting number.

- Track Your Spending (Temporarily): Yes, the irony is not lost on us. For a budget designed for people who hate tracking, you do need to track your spending for a short period—say, one month. You can’t know where to go if you don’t know where you are. Use an app or just a simple notebook to get a baseline of where your money is currently going.

- Categorize Your Spending: Once you have a month’s worth of data, go through every single expense and assign it to one of the three categories: Needs, Wants, or Savings/Debt.

- Analyze and Adjust: Add up the totals for each category and see how they compare to the 50%, 30%, and 20% targets. This is your moment of truth. Are your percentages aligned with the rule, or are they out of whack?

Common Problems and Solutions: What If Your Numbers Don’t Fit?

You might be doing the math right now and thinking, “My needs are way more than 50%!” or “I’m barely saving 5%, let alone 20%!” But what do we do when our reality doesn’t match the ideal? And here is where things get interesting: the rule hasn’t failed you. In fact, it has done its job perfectly.

The 50/30/20 rule acts as a diagnostic tool. It shines a bright light on the areas of your financial life that are under the most pressure.

Problem 1: My “Needs” are 70% of my income. This is the most common issue, especially for those living in high-cost-of-living areas. It usually points to one of two things:

- The “Big Two” are too big: Your housing or transportation costs are disproportionately high for your income. This is an uncomfortable truth, but it might mean you need to consider bigger changes like getting a roommate, downsizing your apartment at the next lease renewal, or trading in an expensive car for a more affordable one.

- You have “Wants in Disguise”: You might be categorizing some wants as needs. That premium cable package, daily DoorDash lunch, or unlimited phone data plan are likely wants, not needs. Be honest and recategorize them.

Problem 2: I have a mountain of high-interest credit card debt. In this scenario, you might need to temporarily adjust the rule to aggressively tackle the debt. A “debt-shredding” version could look like 60/10/30 (Needs/Wants/Debt Repayment). This means drastically cutting back on Wants for a set period to free up more cash to throw at your debt. The pain is short-term, but the financial freedom you gain is long-term.

Problem 3: My income is too low or inconsistent. If you’re a freelancer or work on commission, your income can vary wildly. In this case, calculate your baseline “Needs” and make sure you cover them with your worst-case monthly income. When you have a good month, you can “catch up” on your Wants and aggressively fund your 20% goals. The percentages remain a guide, but your focus is on a “bare-bones” budget for lean months and a “surplus” budget for good months.

You may also be interested in: Budgeting With Irregular Income: The System That Actually Works

How the 50/30/20 Rule Scales Across Income Levels

One common question is: “Does this rule work for everyone, regardless of income?” The short answer is: the percentages work universally, but the absolute dollar amounts reveal interesting patterns.

Lower Income Example ($30,000/year, ~$2,000/month take-home):

- Needs (50%): $1,000 - Often challenging in high cost-of-living areas

- Wants (30%): $600 - Provides breathing room for enjoyment

- Savings (20%): $400 - Builds emergency fund and retirement

Challenge: Housing often exceeds 50% at this income level. Consider roommates, location trade-offs, or temporarily adjust to 60/20/20 while working to increase income.

Middle Income Example ($75,000/year, ~$5,000/month take-home):

- Needs (50%): $2,500 - More comfortable, easier to maintain

- Wants (30%): $1,500 - Generous lifestyle spending

- Savings (20%): $1,000 - Strong wealth-building pace

This is the “sweet spot” where the rule works most naturally for most locations.

Higher Income Example ($150,000/year, ~$9,000/month take-home):

- Needs (50%): $4,500 - Needs don’t scale linearly with income

- Wants (30%): $2,700 - Substantial discretionary spending

- Savings (20%): $1,800 - Accelerated wealth accumulation

Opportunity: At higher incomes, Needs rarely hit 50%. Consider upgrading to a more aggressive savings rate like 40/30/30 or 35/25/40.

Tools and Apps That Make the 50/30/20 Rule Effortless

The beauty of this framework is that you don’t need expensive software. However, a few tools can make implementation even easier:

Free Tools:

- Spreadsheet Template: Create three simple columns for Needs, Wants, and Savings. Total each and calculate percentages.

- Envelope System (Digital): Many banking apps let you create sub-accounts or “buckets” for each category.

- Automated Transfers: Set up automatic transfers on payday—20% to savings, leaving 80% for Needs & Wants.

Recommended Budgeting Apps:

- YNAB (You Need A Budget): Category-based budgeting that aligns perfectly with 50/30/20.

- Mint: Free automatic tracking that categorizes transactions.

- PocketGuard: Simplified interface showing your “money left over after goals.”

- EveryDollar: Zero-based budgeting that can be adapted to the 50/30/20 framework.

The Consumer Financial Protection Bureau offers a free budget worksheet that you can adapt to the 50/30/20 framework.

You may also be interested in: How to Automate Your Finances and Never Miss a Bill

Common Mistakes People Make With the 50/30/20 Rule (and How to Avoid Them)

Mistake #1: Using Gross Income Instead of After-Tax Income

The rule is based on your take-home pay (after taxes, 401(k) contributions, health insurance, etc.), not your gross salary. Using gross income will make your percentages meaningless.

How to Fix: Look at your actual bank deposit or pay stub. Use the amount that hits your checking account.

Mistake #2: Forgetting About Irregular Expenses

Most people budget for monthly expenses but forget about annual or quarterly costs: car insurance (paid every 6 months), Amazon Prime ($139/year), holiday gifts, etc.

How to Fix: Calculate your annual irregular expenses, divide by 12, and include that monthly amount in your Needs or Wants categories.

Example:

- Car insurance: $800/year ÷ 12 = $67/month

- Gifts & holidays: $1,200/year ÷ 12 = $100/month

- Annual subscriptions: $300/year ÷ 12 = $25/month

- Total irregular expenses: $192/month to factor in

Mistake #3: Being Too Rigid

Life happens. Some months you’ll overspend on Wants. Some months an unexpected car repair will spike your Needs. The 50/30/20 rule is a guideline, not a law.

How to Fix: Track your 3-month average. If your average over 3 months is close to 50/30/20, you’re succeeding.

Mistake #4: Not Prioritizing High-Interest Debt

If you have credit card debt at 18-24% interest, you might want to temporarily adjust the rule to 50/20/30 or even 50/15/35 to aggressively attack that debt.

How to Fix: Treat high-interest debt as a financial emergency. Adjust percentages temporarily until the debt is gone.

Mistake #5: Ignoring the “Why” Behind the Numbers

The rule works best when you understand why you’re budgeting. Without clear goals (“I want to retire early,” “I want to buy a house,” “I want to quit my soul-crushing job”), it’s just math.

How to Fix: Define 1-3 specific financial goals before you start. Make your 20% savings category purposeful, not just a number in a spreadsheet.

When the 50/30/20 Rule ISN’T the Right Fit

This framework works for most people, but not everyone. Here are situations where you might need a different approach:

You Have a Specific Short-Term Goal: If you’re aggressively saving for a house down payment in 18 months, you might need a temporary 50/10/40 or 40/10/50 split.

You’re in Extreme Debt: If you’re drowning in high-interest debt, you might need a “debt annihilation” budget like 60/5/35 until you’re free.

You Live in an Extremely High Cost-of-Living Area:

In cities like San Francisco or New York, housing alone might consume 40-50% of your income, making 50% for all Needs nearly impossible. You may need to adjust to 60/20/20 or consider relocating.

You’re Extremely Low-Income: If you’re earning minimum wage or very low income, your Needs might consume 70-80% of your income. In this case, focus on survival first, then work on increasing income before optimizing percentages.

You’re Pursuing Financial Independence:

If you’re aiming to retire early or achieve FIRE (Financial Independence, Retire Early), 20% savings may not be aggressive enough. You might target 40-60% savings rates with drastically reduced Wants.

The Federal Reserve’s Survey of Household Economics found that nearly 40% of Americans would struggle to cover a $400 emergency, highlighting why building that 20% savings cushion is critical.

The Bottom Line: Freedom Through Simplicity

The 50/30/20 rule isn’t about restriction; it’s about intention. It gives you a simple, sustainable framework to make conscious decisions with your money. It provides permission to spend on things you enjoy while ensuring you are systematically building wealth for the future. You get the gist: it’s a framework for making mindful choices, not for punishing yourself.

And this is just a very long way of saying that the best budget is the one you don’t have to think about constantly. By automating your savings, being mindful of your big essential expenses, and giving yourself the freedom to enjoy the rest, you can finally take control of your money without letting it control you.

50/30/20 Budgeting Rule FAQ

What is the 50/30/20 budgeting rule?

The 50/30/20 budgeting rule is a simple framework for dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. It’s designed to make budgeting easy and sustainable.

How do I apply the 50/30/20 rule?

To apply the 50/30/20 rule, first calculate your after-tax income. Then allocate 50% to needs (essentials like housing, utilities, groceries), 30% to wants (entertainment, dining out, hobbies), and 20% to savings and debt repayment. Track your spending for a month to categorize expenses and adjust as needed.

What are examples of needs, wants, and savings in the 50/30/20 rule?

Needs include housing, utilities, groceries, transportation, and minimum debt payments. Wants include dining out, entertainment, travel, and shopping. Savings covers emergency funds, retirement contributions, and extra debt payments beyond minimums.

What if my expenses don’t fit the 50/30/20 rule?

If your expenses don’t fit, the rule acts as a diagnostic tool. If needs exceed 50%, consider reducing housing or transportation costs. If savings are below 20%, temporarily adjust to 60/10/30 to build savings faster. The rule is flexible and should be adapted to your situation.

Is the 50/30/20 rule suitable for everyone?

The 50/30/20 rule works well for most people, especially beginners, but may need adjustment based on circumstances. It’s less suitable for very low-income households or those with high debt. Consider consulting a financial advisor for personalized advice.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.