· WeInvestSmart Team · financial-planning · 14 min read

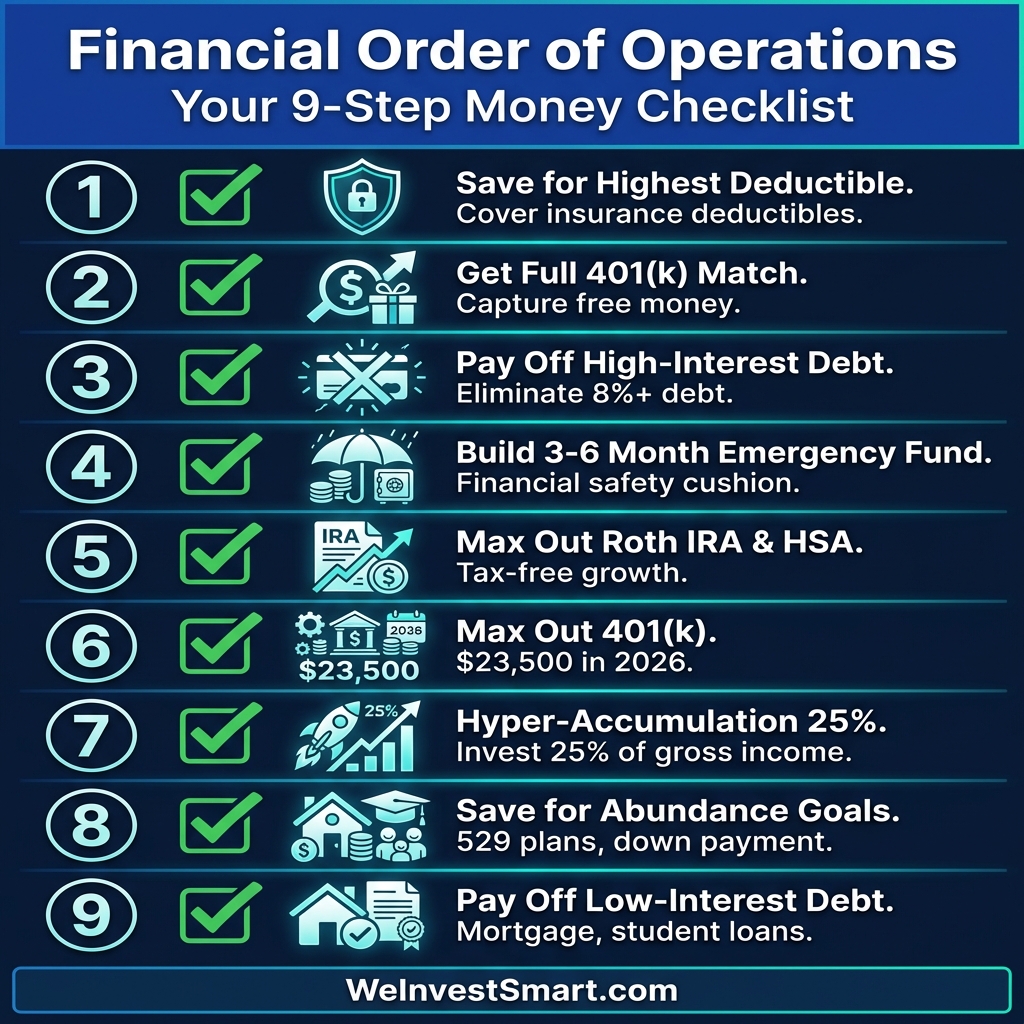

Financial Order of Operations: 9-Step Money Checklist

Stop guessing what to do with your money. This 9-step, prioritized checklist tells you exactly where your next dollar should go—from 401(k) matches to debt, IRAs, and beyond.

Most people’s financial plan is a chaotic mix of guesswork, anxiety, and conflicting advice from the internet. They treat their money like a game of whack-a-mole: a car repair pops up, they whack it. A student loan payment is due, they whack it. A friend mentions a hot stock, they throw money at it. There is no system, no logic, no priority. And here’s the uncomfortable truth: this financial randomness is by far the biggest obstacle to building wealth. It ensures you’re always playing defense, never able to get ahead.

We’ve all been told a thousand different “smart” things to do with our money. “Max out your 401(k)!” “Pay off your mortgage early!” “You need to be in a Roth IRA!” But for someone trying to make progress, this advice is paralyzing. What comes first? What’s most important? When every expert screams that their priority is the priority, the result is inaction. You end up doing a little bit of everything and accomplishing nothing.

But what if we told you there’s a clear, sequential, and logical system for your finances? A checklist that removes all the guesswork? This is the Financial Order of Operations (FOO), a concept popularized by financial experts to provide a step-by-step guide for your money. It’s a 9-step priority list that tells you exactly what to do with your next dollar. This isn’t about restriction; it’s about optimization. It’s about building a financial fortress, brick by logical brick, in the correct order. And this is just a very long way of saying that the FOO is your declaration of war against financial chaos.

You may also be interested in: Planning for Life’s Big Moments: How to Financially Prepare for a Wedding, a Baby, and a New Home

Why Order Is Everything in Finance

Before we lay out the 9 steps, we have to address the “why.” Why does the sequence matter so much? The problem isn’t that you’re bad with money; it’s that you’re trying to build a skyscraper without a blueprint. You’re putting up drywall before the foundation is poured. In finance, as in construction, order dictates stability. Making the right move at the wrong time can be just as damaging as making the wrong move.

Going straight to the point, your financial journey is a series of trade-offs. Should you pay off a 5% student loan or invest in the stock market, which has historically returned more? Should you build a massive emergency fund or get your employer’s 401(k) match? Your brain, wired for immediate gratification and loss aversion, is terrible at answering these questions. It sees a credit card balance and panics, not realizing that the “free money” from a 401(k) match is a guaranteed 100% return that far outweighs the 22% interest on the card.

The Financial Order of Operations fixes this. It’s a system designed to maximize your returns, minimize your risks, and build momentum in the most efficient way possible. Each step builds upon the last, creating a stable foundation that allows you to take on more advanced strategies later. You get the gist: this isn’t just a checklist; it’s a strategic framework for wealth creation.

How the Financial Order of Operations Works: The 9 Steps

Alright, enough theory. Let’s get to the game plan. This is your step-by-step guide to financial clarity. Follow it, and you’ll never again have to wonder what to do with your next dollar.

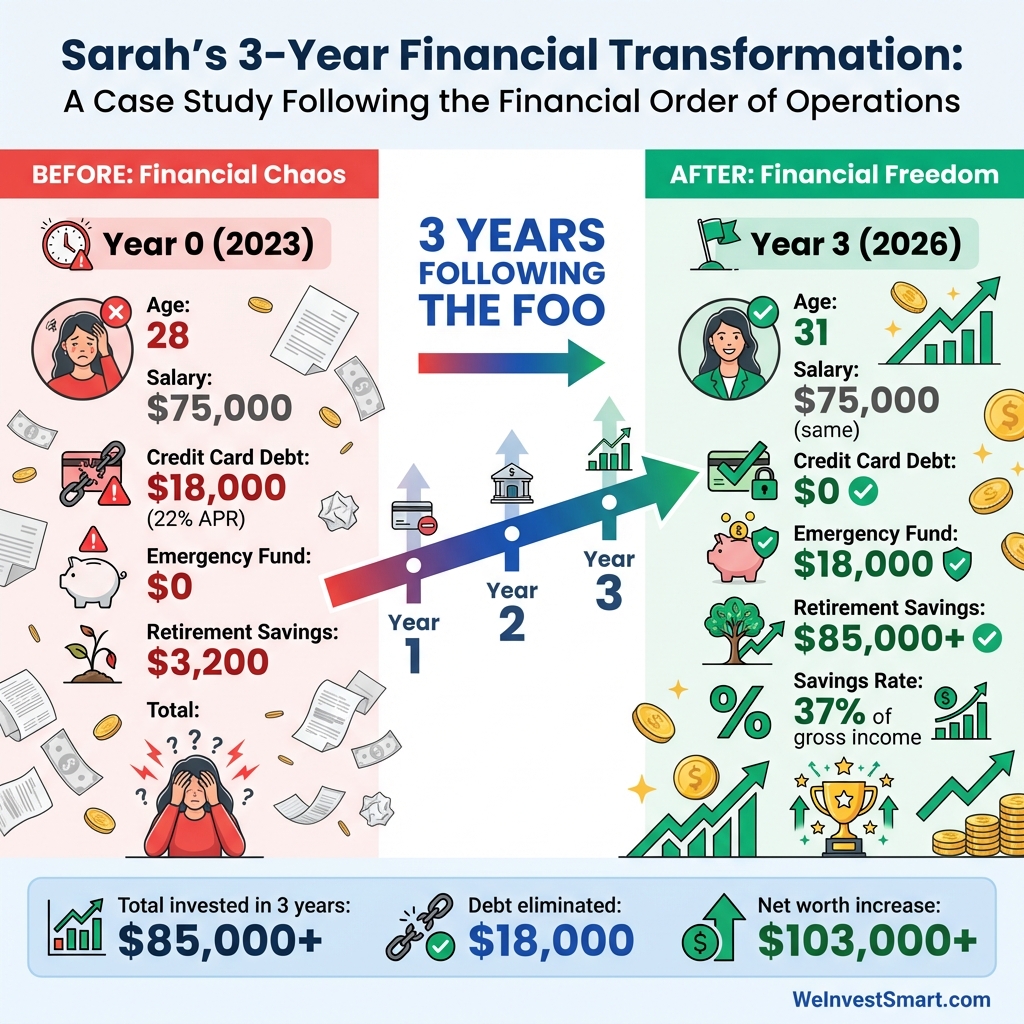

Let’s use a case study: Meet Sarah, a 28-year-old marketing manager who earns an annual salary of $75,000. When she discovered the Financial Order of Operations, she was drowning in $18,000 of credit card debt, had no emergency fund, and was randomly contributing small amounts to various accounts without a plan. Here’s how she systematically transformed her finances by following the FOO:

Sarah’s Financial Order of Operations Journey:

- Step 1: Sarah identified her highest insurance deductible ($3,000 for health insurance) and saved that amount in a high-yield savings account over 4 months by cutting discretionary spending.

- Step 2: Her employer offered a 50% match on the first 6% of salary. Sarah immediately started contributing 6% ($4,500/year) to get the full $2,250 employer match—an instant 50% return.

- Step 3: With her deductible covered and employer match secured, Sarah attacked her $18,000 credit card debt (averaging 21% APR) using the debt avalanche method. She put every extra dollar toward it and paid it off in 18 months, saving over $3,500 in interest.

- Step 4: She then built a 6-month emergency fund of $18,000 (covering rent, food, utilities, insurance, and transportation).

- Step 5: Next, Sarah maxed out her Roth IRA at $7,000/year.

- Step 6: She increased her 401(k) contribution to the 2026 maximum of $23,500.

- Step 7: By now, Sarah was saving 37% of her gross income ($27,750/year), exceeding the 25% hyper-accumulation target.

Sarah’s Calculation: $75,000 salary × 37% = $27,750 saved annually = $4,500 (401k match included) + $23,500 (total 401k) + $7,000 (Roth IRA) - $6,750 (employer contribution) = $28,250 total

Within 3 years of following the FOO, Sarah went from financially chaotic to a wealth-building machine with zero high-interest debt, a fully-funded emergency fund, and over $85,000 in retirement accounts. More importantly, she now knows exactly what to do with every dollar she earns.

Step 1: Save for Your Highest Insurance Deductible

The very first step isn’t about investing; it’s about defense. Before you can build wealth, you must protect yourself from being knocked out of the game. Most financial crises start with a single, unexpected event that insurance is supposed to cover—a car accident, a medical emergency, a leaky roof. The problem is the deductible. If your health insurance has a $5,000 deductible and you don’t have $5,000, you’re one bad day away from a debt spiral.

Your first goal is to save up enough cash to cover your single highest insurance deductible and store it in a high-yield savings account. Look at your policies: auto, health, home, or renters. Find the highest deductible among them. That’s your target. This sounds like a trade-off, but it’s actually a desirable thing. This small cash buffer is the firewall between a manageable problem and a financial catastrophe.

Step 2: Get Your Full Employer 401(k) Match

Here’s where things get interesting. We immediately pivot from defense to the most powerful offensive move in personal finance. If your employer offers a 401(k) or 403(b) with a company match, contributing enough to get the full match is your second, non-negotiable priority.

Going straight to the point, this is free money. A common employer match is 100% of your contributions up to a certain percentage of your salary. That is an immediate, guaranteed 100% return on your investment. You will not find that return anywhere else on earth—not in stocks, not in real estate, not anywhere. Failing to get your match is equivalent to taking a voluntary pay cut. Before you pay off debt, before you max out any other account, you must capture this free money.

Step 3: Pay Off All High-Interest Debt

Now we pivot back to defense, but with a vengeance. High-interest debt is a financial cancer. It actively works against you, growing at a rate that makes it nearly impossible to build wealth. While there’s no official definition, we generally classify “high-interest” as any debt with a rate of 8% or more. This typically includes credit cards, personal loans, and payday loans.

Think of it this way: paying off a credit card with a 22% interest rate is like earning a guaranteed, risk-free 22% return on your money. You can’t beat that. You must attack this debt with ferocious intensity. Use any method that works for you—the debt snowball (paying off smallest balances first for psychological wins) or the debt avalanche (paying off highest-interest balances first for mathematical efficiency). The method doesn’t matter as much as the commitment. Eliminate this toxic debt from your life.

You may also be interested in: Debt Snowball vs. Debt Avalanche: Which Strategy Is Right for You?

Step 4: Build a Full 3-6 Month Emergency Fund

With the immediate threats handled, it’s time to build your fortress walls. Your Step 1 savings was a fire extinguisher; this is a full-blown sprinkler system. A proper emergency fund should contain 3 to 6 months’ worth of essential living expenses. This is the money that lets you sleep at night. It covers you in case of a job loss, a major illness, or any other significant life disruption without forcing you to sell investments or go into debt.

Calculate your bare-bones monthly survival number: mortgage/rent, utilities, food, transportation, and insurance. Multiply that by three to six. Six months is better if you’re a single-income household, self-employed, or have dependents. This money should be liquid and safe, ideally in a high-yield savings account where it’s accessible but separate from your daily checking account.

You may also be interested in: How to Build an Emergency Fund (Even on a Tight Budget)

Step 5: Max Out a Roth IRA and/or HSA

Now the real fun begins. You’ve built your defenses, and it’s time to go on a full-scale wealth-building offensive. The next priority is to take advantage of the most powerful tax-advantaged accounts available to you.

- Roth IRA: You contribute with after-tax money, but your investments grow completely tax-free, and all qualified withdrawals in retirement are also tax-free. A Roth IRA offers incredible tax diversification and flexibility, often with a wider range of investment options than a 401(k). For 2026, you can contribute up to $7,000 to a Roth IRA ($8,000 if you’re 50 or older).

- Health Savings Account (HSA): If you have a high-deductible health plan, the HSA is the ultimate investment vehicle. It has a triple tax advantage: your contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free. Many people use an HSA as a stealth retirement account, paying for current medical expenses out-of-pocket and letting the HSA investments grow for decades.

You may also be interested in: How to Open a Roth IRA and Start Investing

Step 6: Max Out Your Remaining 401(k)/403(b)

After you’ve maxed out your IRA and/or HSA, you circle back to your workplace retirement plan. You’re already contributing enough to get the match (Step 2), but now the goal is to contribute the absolute maximum allowed by the IRS. For 2026, that limit is $23,500 for 401(k) contributions. If you are 50 or older, you can contribute an additional $7,500 as a catch-up contribution.

This step is about brute-force saving. By maxing out your 401(k), you are systematically putting away a significant portion of your income into a tax-advantaged account, dramatically accelerating your path to retirement. According to Social Security Administration retirement data, consistently maxing out tax-advantaged accounts is a common characteristic among financially secure retirees. This is how you build a multi-million dollar nest egg over the course of a career. It requires discipline, but the long-term payoff is immense.

You may also be interested in: How to Set SMART Financial Goals You’ll Actually Achieve This Year

Step 7: Hyper-Accumulation (Invest 25% of Your Gross Income)

Here’s where you shift from following limits to setting your own ambitious goals. The target in this step is to be saving and investing at least 25% of your gross income for the future. For many high-earners, completing Steps 5 and 6 will already get them to or beyond this 25% threshold. If not, this is where you open a taxable brokerage account.

A taxable brokerage account has no contribution limits and no withdrawal restrictions, offering maximum flexibility. You invest after-tax money, and you’ll pay capital gains taxes on your earnings when you sell. This is the vehicle for “hyper-accumulation”—the stage where you are aggressively deploying capital to build wealth beyond the confines of retirement accounts. This 25% figure isn’t arbitrary; it’s the savings rate that can allow you to reach financial independence in a reasonable timeframe.

Step 8: Save for Abundance Goals (College, Home Down Payment)

Notice how far down the list this is? The funny thing is that most people make this their Step 1. They try to save for a house or their kids’ college before their own financial foundation is secure. This is a critical mistake. And this is just a very long way of saying that you must secure your own oxygen mask before assisting others. There are loans for college, but not for retirement.

Once you are saving 25% for your own future, you can start allocating additional capital to other major life goals. This is where you fund 529 college savings plans for your children’s education, save for a down payment on a home, or plan for other large purchases. By waiting until this step, you ensure these goals don’t derail your own long-term financial security.

Step 9: Pay Off Low-Interest Debt

The final step is to clean up any remaining low-interest debt, such as your mortgage or student loans with rates below 5-6%. Why is this last? Because mathematically, it makes sense. The expected long-term return from investing in the stock market is historically higher than the interest rate on these loans. Therefore, your money works harder for you by being invested rather than by paying off this “good” debt early.

This sounds like a trade-off, but it’s actually about opportunity cost. Every extra dollar you send to your 4% mortgage is a dollar that isn’t earning a potential 8-10% in the market over the long term. However, there’s an emotional component here.

Some people despise all forms of debt and find immense peace of mind in being completely debt-free. Once you’ve completed the first eight steps, you have the financial power to make that choice without compromising your future.

You may also be interested in: The “One-Fund Portfolio”: The Simplest and Most Effective Financial Plan for Most People

The Bottom Line: From Chaos to Clarity

The Financial Order of Operations is more than a list; it’s a philosophy. It is the tangible proof that you are in control of your financial destiny. It replaces anxiety with a clear plan and replaces guesswork with a proven strategy. By following these steps in order, you are not just managing your money—you are systematically engineering a future of wealth and security.

Remember, the goal isn’t to be perfect overnight. It’s about knowing what the next right step is and taking it. You get the gist: start with Step 1, be disciplined, and give your future self the gift of a life built on a solid financial foundation.

This article is for educational purposes only and should not be considered personalized financial advice. Contribution limits and tax laws are subject to change. Consider consulting with a financial advisor for guidance specific to your situation.

The Financial Order of Operations FAQ

What is the Financial Order of Operations?

The Financial Order of Operations is a 9-step, prioritized checklist that tells you the most effective sequence for allocating your money. It guides you on what to do first, from getting your 401(k) match and paying off high-interest debt to maxing out retirement accounts, ensuring you build a strong financial foundation.

Should I pay off debt or invest first?

It depends on the interest rate. The Financial Order of Operations prioritizes getting your employer’s 401(k) match first (as it’s a 100% return), then aggressively paying off high-interest debt (like credit cards, often 8%+). After that, the focus shifts to investing in tax-advantaged accounts like IRAs and 401(k)s before paying off low-interest debt.

What are the 9 steps of the Financial Order of Operations?

The 9 steps are: 1) Save for your highest insurance deductible. 2) Get your full employer 401(k) match. 3) Pay off all high-interest debt. 4) Build a 3-6 month emergency fund. 5) Max out a Roth IRA and/or HSA. 6) Max out your remaining 401(k)/403(b). 7) Hyper-accumulation: invest 25% of your gross income. 8) Save for abundance goals (college, home down payment). 9) Pay off low-interest debt.

Why is getting the 401(k) match so important?

Going straight to the point, an employer 401(k) match is free money. A common match is 100% on the first 3-6% of your salary. This is an immediate, guaranteed 100% return on your investment, which you cannot find anywhere else. Skipping this step is like refusing a pay raise.

What is considered high-interest debt?

While there’s no strict universal definition, high-interest debt is generally considered any debt with an interest rate of 8% or higher. This typically includes credit card debt, payday loans, and some personal loans. This debt is financially toxic because the interest costs more than you can reliably earn from investing, making it a top priority to eliminate.