· WeInvestSmart Team · personal-finance · 14 min read

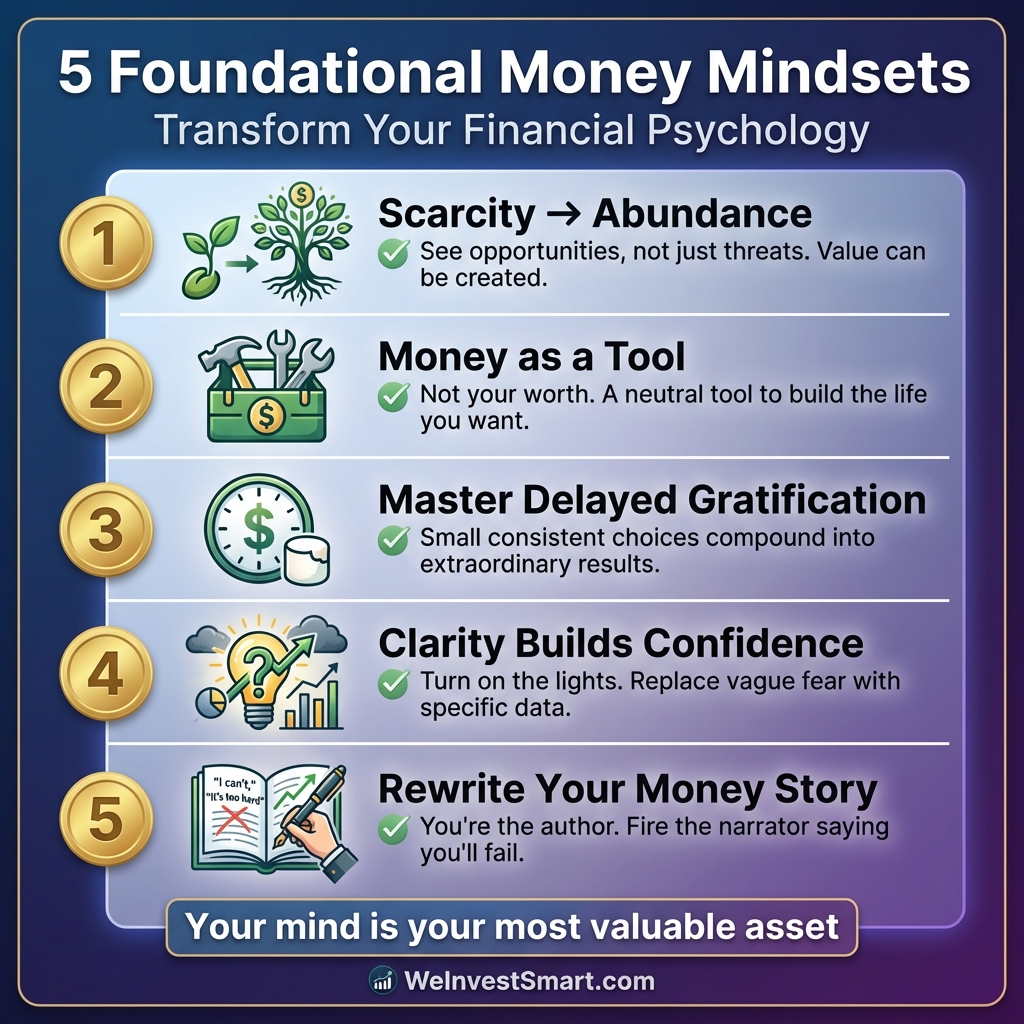

Before You Even Make a Budget: The 5 Foundational Money Mindsets You Need to Adopt

A budget is useless if your mindset is broken. Discover the 5 core psychological shifts you must make—from scarcity to abundance—before you even think about a spreadsheet.

Most people believe the first step to fixing their finances is to download a budgeting app, create a spreadsheet, and start tracking every penny. But here’s the uncomfortable truth: that’s like trying to install new software on a computer riddled with viruses. The budget is the software, but your mind is the operating system. Going straight to the point, if your underlying beliefs about money—your core money mindset—are corrupted, no budget on earth will save you. It will crash, every single time.

You may also be interested in: The Complete Guide to Personal Budgeting

We’ve all seen it happen. A person gets a raise and their spending magically expands to consume it. Another person tries to follow a budget but feels so deprived and anxious that they rebel by going on a shopping spree. They blame their lack of willpower or the complexity of the budget itself. But what if we told you the problem isn’t discipline? The problem is the psychological framework through which you view money.

Here’s where things get interesting: your financial results are a lagging indicator of your psychology of money. The numbers in your bank account today are a direct reflection of the stories you’ve been telling yourself for years. To change the numbers, you must first change the stories. And this is just a very long way of saying that true financial success isn’t about math; it’s about psychology. Before you ever open a spreadsheet, you need to adopt these five foundational money mindsets.

1. From Scarcity to Abundance: The First Money Mindset Shift for Building Wealth

Most of us are raised with a scarcity mindset. Going straight to the point, this is the deep-seated belief that there’s a limited pie, and if someone else gets a slice, there’s less for you. It’s a zero-sum game. This scarcity mindset is a major driver of financial anxiety, manifesting as a constant fear: fear of running out, fear of not having enough, fear of losing what you have. A person with a scarcity mindset hoards money, is terrified of investing, and views every expense as a painful loss, making building wealth feel impossible.

The funny thing is that this mindset can persist even when someone becomes wealthy. We all know stories of millionaires who live in constant anxiety, unable to enjoy their money because they’re terrified of losing it. Their financial reality changed, but their psychological operating system didn’t. Their beliefs about money remained stuck in a loop of fear.

The alternative is an abundance mindset. That is to say, it’s the belief that there is more than enough to go around and that value can be created. It sees opportunities, not just threats. An abundance mindset understands that money is a form of energy that needs to circulate, not just be hoarded. It’s a core component of healthy financial psychology.

Research from Stanford University’s Carol Dweck on growth mindset has shown that our beliefs about our abilities—including financial abilities—directly shape our outcomes. When applied to money, those with an abundance mindset are more likely to take calculated risks, invest in their skills, and build sustainable wealth.

Here’s where things get interesting. Shifting from a scarcity to an abundance mindset isn’t about pretending you’re a millionaire when you’re broke. It’s about changing your focus. Instead of obsessing over saving the last dollar, you start thinking about how to create the next ten. Instead of seeing an educational course as a $500 expense, you see it as a potential investment in skills that could generate thousands in future income. It’s a fundamental shift in your relationship with money.

This sounds like a trade-off, because it feels riskier, but it’s actually a desirable thing: we covet this mindset because it unlocks growth and is fundamental to building wealth. Scarcity tells you to protect your one seed by burying it in a vault. Abundance tells you to plant that seed, knowing it can grow into a tree that produces thousands more. You get the gist: one mindset is about fear and contraction; the other is about opportunity and expansion. Which operating system do you want to run your life on?

2. Money as a Tool: Redefining Your Relationship with Money

For many people, money isn’t just a number; it’s a scorecard for their self-worth. This is a common trap in the psychology of money. A good month means they’re a “successful” person. A bad month means they’re a “failure.” This is an incredibly dangerous way to live, as it ties your entire identity to the unpredictable fluctuations of your income and expenses.

Going straight to the point, you need to fundamentally reframe your relationship with money. Money is not a measure of your worth. It is a tool. That’s it. It’s as amoral and neutral as a hammer. A hammer can be used to build a home for a family, or it can be used to smash a window. The hammer itself isn’t good or evil; its value comes from the intention of the person wielding it.

But what do we do with this insight? We stop asking, “How can I make more money?” and start asking a much more powerful question: “What kind of life do I want to build, and what tools do I need to build it?” This simple question can transform your entire approach to financial planning.

You may also be interested in: How to Create a Financial Plan That Actually Works

Let me explain. If your goal is “make more money,” you’ll be perpetually unsatisfied because there’s no finish line. But if your goal is “achieve the freedom to work on projects I love and spend three weeks a year traveling,” you’ve changed the game. Suddenly, money becomes a specific tool for a specific purpose. You can calculate exactly how much money you need to build that life. It becomes a finite, achievable project, not an endless, soul-crushing pursuit of more. This mindset shift is crucial for long-term happiness and achieving your personal version of financial success.

And this is just a very long way of saying that when money is your master, you will never have enough. But when money is your tool, you can use it to build a life of purpose and freedom. Stop letting your tools define you. Pick them up and start building.

3. Master Delayed Gratification: The Key to Long-Term Financial Success

We live in the age of instant gratification. We can summon food, entertainment, and transportation with a few taps on a screen. Our brains are being rewired to expect rewards now. This conditioning is a financial disaster, undermining your chances of long-term financial success. It makes us prioritize the fleeting pleasure of today over the profound security and freedom of tomorrow.

Going straight to the point, building wealth requires mastering the art of delayed gratification. This is the ability to resist the impulse for an immediate reward to receive a more substantial reward later. Most people think this is about deprivation and sacrifice. They see it as saying “no” to the fancy dinner out, a core reason why they hate the idea of budgeting.

But here’s the uncomfortable truth: you’re not saying “no.” You’re saying “yes” to something better. You’re not depriving your current self; you’re rewarding your future self. This is a strategic trade, not a punishment, and a vital part of a healthy money mindset.

Think of it this way: every dollar you have is a little time-traveling soldier. You can either deploy it today for a small mission (buying a coffee), or you can send it into the future, where it will meet up with other soldiers (compounding interest) and become a powerful army capable of conquering huge goals, like buying your financial freedom. This principle is a cornerstone of effective financial planning.

This sounds like a trade-off, but it’s actually a desirable thing. We covet this discipline because it’s the mechanism that turns small, consistent actions into extraordinary results. The famous Stanford marshmallow experiment, conducted by psychologist Walter Mischel and validated by the American Psychological Association, showed that young children who could resist eating one marshmallow now in exchange for two later had better life outcomes years down the line. That’s the power of this mindset.

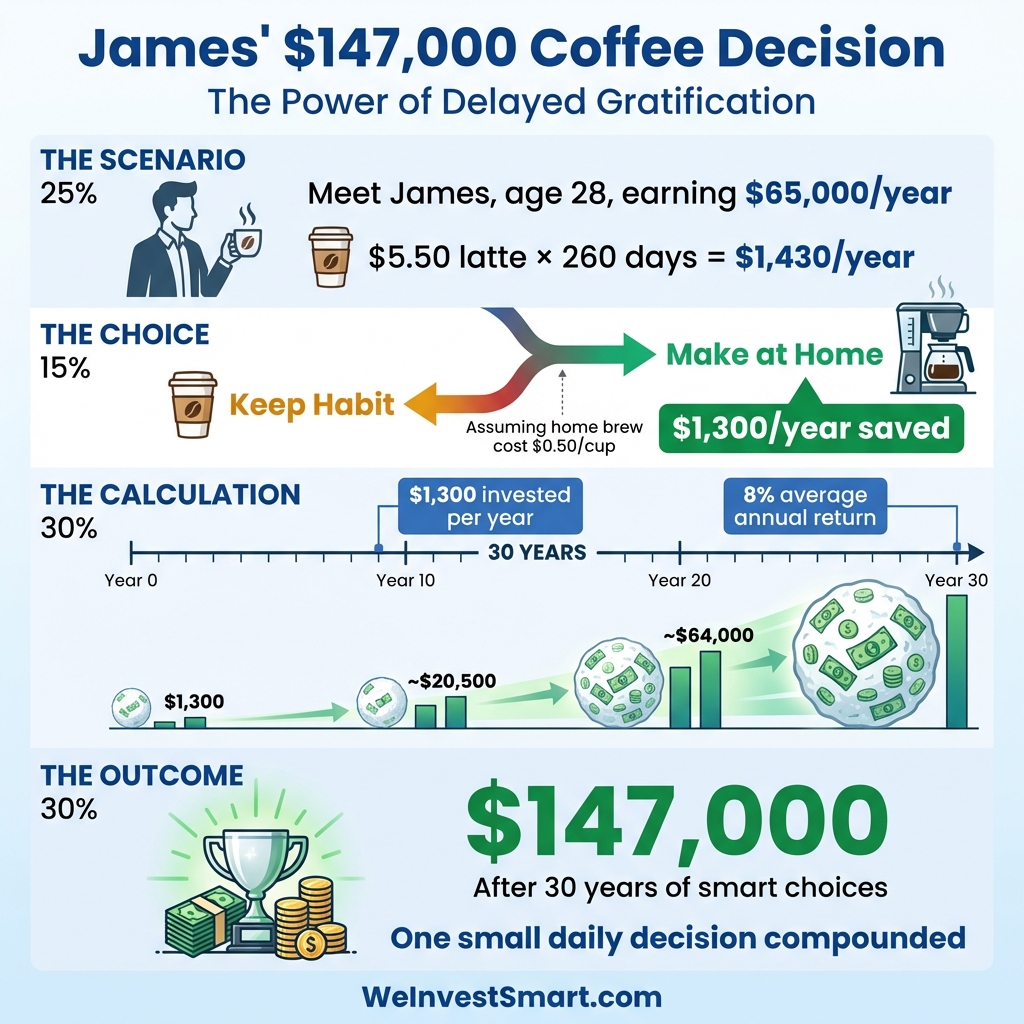

Let’s use a case study to make this concrete: Meet James, a 28-year-old who earns $65,000 annually. He has a daily $5.50 latte habit (skipping weekends, that’s 260 days × $5.50 = $1,430 per year). If James practices delayed gratification and makes coffee at home instead (costing roughly $0.50 per cup), he saves $1,300 annually. If he invests that $1,300 each year into a low-cost index fund earning an average 8% return, after 30 years he’ll have accumulated approximately $147,000. That’s the power of one small daily decision compounded over time. This isn’t deprivation—it’s strategic wealth building.

You may also be interested in: How to Build an Emergency Fund (Even If You Live Paycheck to Paycheck)

So the next time you’re tempted by an impulse purchase, don’t frame it as “I can’t have this.” Frame it as, “Do I want this thing more than I want to be financially independent in ten years?” You’re not a victim of your budget; you are the powerful architect of your future, and practicing delayed gratification is how you build the blueprint.

4. Overcoming Financial Anxiety: How Clarity Builds Confidence

Money is one of the biggest sources of stress in the modern world. For many, this financial anxiety manifests in one of two ways:

- The Obsessor: They check their bank accounts constantly, run financial models in their head at 3 AM, and agonize over every penny spent.

- The Ostrich: They are so terrified of what they might find that they never look at their bills, don’t know their account balances, and live in a state of willful ignorance.

The funny thing is that both behaviors are driven by the exact same emotion: fear of the unknown. This kind of financial stress thrives in darkness and uncertainty.

Going straight to the point, the only antidote to financial anxiety is clarity. You cannot fix a problem you refuse to look at. The anxiety you feel from not knowing is almost always worse than the reality of the situation, whatever it may be.

So, what do we do? We turn on the lights. Here’s where things get interesting. The first step isn’t to create a budget or a complex financial plan. The first step is simply to look. Open your bank statements. Look at your credit card bills. Calculate your net worth for the very first time.

This isn’t an exercise in judgment. You are not allowed to feel guilty or ashamed. You are a scientist gathering data. That’s it. Your only job is to get a clear, honest picture of your current reality.

Why does this work? Because once you know the numbers, the vague, shapeless monster of “money stress” transforms into a concrete set of problems. And concrete problems have concrete solutions. This clarity is the first step to overcoming financial anxiety and building a solid plan. You might discover you’re spending more on takeout than you realized, or that a subscription you forgot about is still charging you. These are small, fixable issues. By replacing vague anxiety with specific data, you move from a position of fear to a position of power. You can’t fight a monster you can’t see. So turn on the lights.

The Consumer Financial Protection Bureau has found that financial well-being isn’t just about how much money you have—it’s about having control and the security to handle financial shocks. That control starts with awareness.

5. Rewriting Your Money Story: Overcoming Limiting Beliefs About Money

“I’m just not a numbers person.” “I’m too creative to be good with money.” “My family has always struggled, so I will too.”

Listen closely. These are not facts. These are stories. And they are the most dangerous and self-limiting beliefs you can have about your finances. Going straight to the point, if you have a core identity that says “I am bad with money,” you will unconsciously sabotage any and every effort you make to improve your situation. These limiting beliefs about money will ensure you find a way to fail, because failure aligns with your story of who you are and undermines your journey to financial success.

But where do these stories come from? Most were written for us in childhood. We absorb the financial habits and beliefs about money from our parents. A single offhand comment from a teacher about our math skills can cement itself as a lifelong identity.

The most empowering thing you can do is recognize that you are the author of your own story. You have the power to edit it. That is to say, you can fire the narrator who’s been telling you you’re a failure and hire a new one. This is the deepest work in financial psychology.

Here’s a practical way to start. For the next week, start a “money wins” journal. Write down every single positive financial action you take, no matter how small.

- Chose to make coffee at home instead of buying it? Write it down.

- Paid a bill on time? Write it down.

- Talked yourself out of an impulse buy online? Write it down.

- Spent 15 minutes reading an article about investing? Write it down.

Each entry is a piece of evidence that contradicts your old, negative story. You are building a case file for your new identity: “I am a person who is learning and growing. I am capable and conscious with my money. I am building a secure future.” Over time, this new story will become your new reality, and a positive money mindset will become your default.

You may also be interested in: 7 Financial Mistakes Beginners Make (And How to Avoid Them)

The Bottom Line: Your Mind is Your Most Valuable Asset

A budget is a map. It can show you the path from where you are to where you want to go. But if your vehicle—your money mindset—has flat tires, a broken engine, and is pointed in the wrong direction, the most beautiful map in the world is utterly useless.

By adopting these five mindsets, you are repairing your vehicle. You are building a psychological foundation strong enough to support the weight of your financial goals. You are shifting from a state of reactive fear to one of proactive intention, mastering the psychology of money in your own life.

And this is just a very long way of saying that managing your money isn’t about becoming a different person. It’s about clearing away the old, limiting beliefs so you can become more truly yourself—a person whose financial life is a reflection of their deepest values and highest aspirations. Start there. The spreadsheets can wait.

You may also be interested in: The 50/30/20 Rule: The Simplest Budget for People Who Hate Budgeting

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.

Foundational Money Mindsets FAQ

What is scarcity mindset?

Scarcity mindset is the belief that there’s a limited pie and if someone else gets a slice, there’s less for you. It leads to fear, hoarding, and anxiety about money.

What is abundance mindset?

Abundance mindset is the belief that there is more than enough to go around and that value can be created. It sees opportunities, not just threats, and focuses on growth and expansion.

Why is delayed gratification important?

Delayed gratification is resisting the impulse for an immediate reward to receive a more substantial reward later. It turns small, consistent actions into extraordinary results through compounding.

How can I overcome financial anxiety?

Overcome financial anxiety by gaining clarity. Look at your bank statements, calculate your net worth, and create concrete solutions. Replace vague anxiety with specific data and action.

What is a money story?

A money story is a limiting belief about money, often formed in childhood. Examples include ‘I’m bad with money’ or ‘Money is evil.’ You can rewrite these stories to create positive financial habits.