· WeInvestSmart Team · personal-finance · 13 min read

How to Build a $1,000 Emergency Fund in 30 Days (Even on a Tight Budget)

A practical, challenge-oriented guide with actionable tips for quickly saving a starter emergency fund. This gives beginners a quick, tangible win and a buffer against unexpected costs.

Most people are living in a state of quiet financial terror, and they don’t even realize it. They’re one flat tire, one unexpected medical bill, one broken appliance away from a full-blown financial crisis. But here’s the uncomfortable truth: the problem isn’t the surprise expense; it’s the complete lack of a shock absorber. Going straight to the point, living without an emergency fund is like driving a car with no seatbelt or airbags. You might be fine for a while, but you’re inviting catastrophe.

We’ve all heard the advice: “You need to save for a rainy day.” But for someone on a tight budget, that advice feels like a cruel joke. Save? With what money? When every dollar is already spoken for, the idea of building a financial safety net seems like a fantasy.

But what if we told you that you could build a meaningful buffer—a starter emergency fund of $1,000—in the next 30 days? And what if this single action could fundamentally change your relationship with money forever? Here’s where things get interesting. Saving your first $1,000 isn’t really about the money. It’s about proving to yourself that you are in control. It’s the first and most critical step to breaking the cycle of living paycheck to paycheck. And this is just a very long way of saying that this 30-day challenge is your declaration of financial independence.

Why Your Brain Is Sabotaging Your Savings (And How to Fix It)

Before we talk about the “how,” we have to address the “why.” Why is saving so hard? The problem isn’t that you’re “bad with money.” The problem is that your brain is wired to prioritize immediate survival and gratification over long-term security.

Going straight to the point, when you’re living on a tight budget, your brain enters a state of scarcity. This scarcity mindset narrows your focus to the immediate problem: making it to the next paycheck. It cripples your ability to think long-term. Saving money feels like depriving your present self for a future that feels distant and uncertain.

The funny thing is that the stress caused by not having savings makes it even harder to save. Financial anxiety floods your system with cortisol, a stress hormone that encourages impulsive, short-term decision-making. You buy something you don’t need to get a quick dopamine hit and escape the stress, which only makes the financial situation worse. It’s a vicious cycle.

So, how do you break it? You need to reframe the goal. A $1,000 emergency fund isn’t about restriction; it’s about buying freedom.

- It’s the freedom to say “no” to a predatory payday loan.

- It’s the freedom to fix your car without going into credit card debt.

- It’s the freedom from the sleepless nights spent worrying about what might go wrong.

This sounds like a trade-off, but it’s actually a desirable thing. We covet this small pile of cash because every dollar in it is a vote for peace of mind. It’s a tangible buffer against chaos. Once you see the emergency fund not as money you can’t touch, but as a product you’re buying—the product being “a good night’s sleep”—your entire motivation changes.

The Federal Reserve’s Survey of Household Economics and Decisionmaking reveals a sobering reality: nearly 37% of adults would struggle to cover a $400 emergency expense using cash or its equivalent. That’s more than one in three Americans living on the edge of financial crisis. You’re not alone in this struggle, but you also don’t have to stay there.

You may also be interested in: The 7 Biggest Financial Mistakes Beginners Make (And How to Avoid Them)

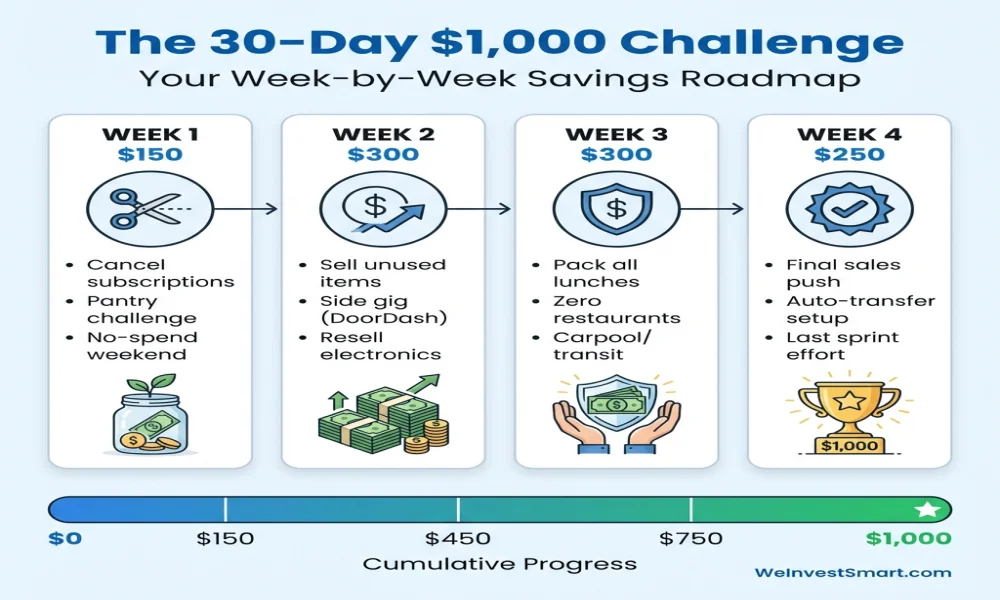

The 30-Day Challenge: Your Game Plan to Save $1,000 Fast

Alright, enough psychology. Let’s get practical. We’re going to break this down into a week-by-week action plan. The goal is to average $250 in savings per week. This will require a combination of cutting expenses and boosting income. It will be intense, but it’s temporary and transformative.

Meet Sarah: A Real $1,000 Challenge Success Story

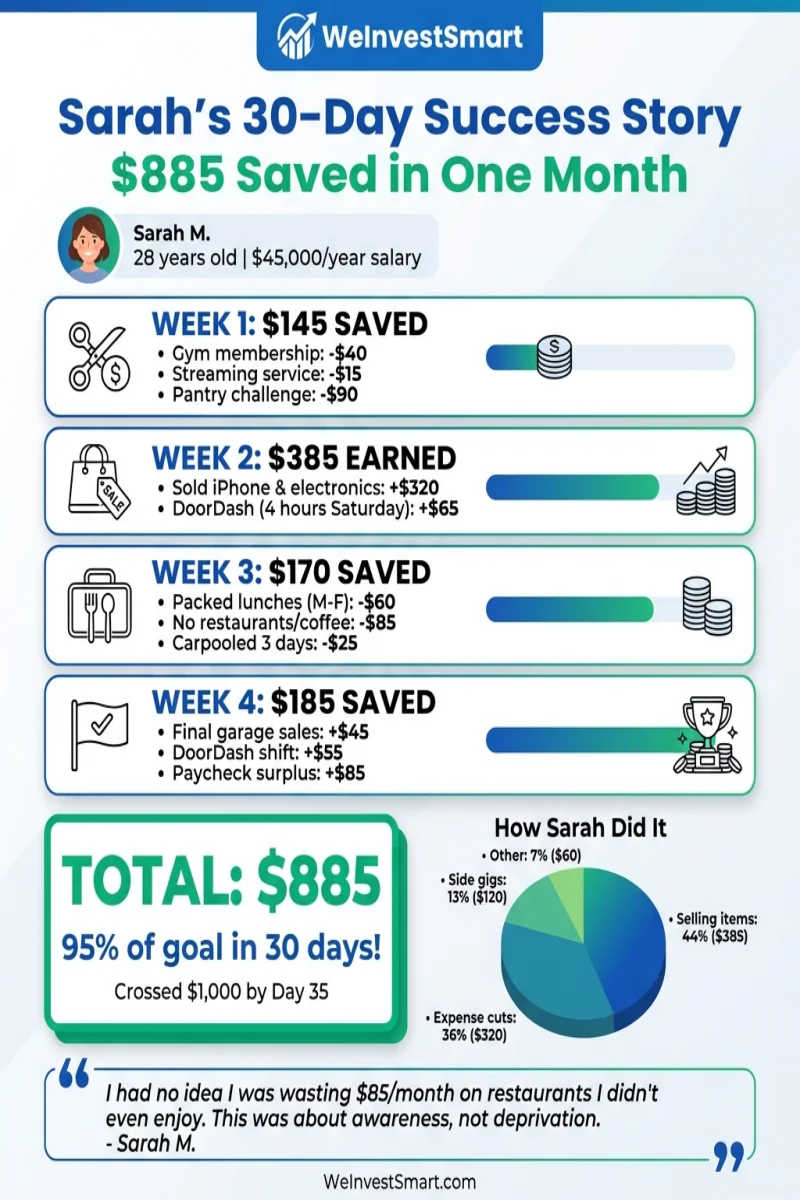

Let’s use a case study: Meet Sarah, a 28-year-old administrative assistant who earns $45,000 annually ($3,125/month after taxes).

Sarah’s Starting Point:

- Monthly take-home: $3,125

- Essential monthly expenses: $2,900

- Discretionary spending: $200-250/month

- Available cushion: $25-75/month

- Emergency fund: $0

Sarah’s 30-Day Transformation:

- Week 1: Canceled unused gym membership ($40) and one streaming service ($15), completed pantry challenge saving $90 in groceries = $145 saved

- Week 2: Sold old iPhone, laptop bag, and clothes on Facebook Marketplace ($320), plus worked 4 hours DoorDash on Saturday night ($65) = $385 earned

- Week 3: Packed lunch every workday (saved $60), skipped all restaurant meals and coffee shops (saved $85), carpooled 3 days (saved $25) = $170 saved

- Week 4: Final garage sale items ($45), one more DoorDash shift ($55), set up automatic $25 transfer, persuaded herself to contribute final paycheck surplus ($85) = $185 saved

Sarah’s Final Result: $885 saved in 30 days

While Sarah didn’t quite hit the full $1,000, she proved something far more valuable: she could radically alter her financial trajectory when focused. More importantly, she now has an $885 buffer that didn’t exist 30 days ago. Her next challenge? Keep the momentum going and cross the $1,000 threshold by day 35.

Sarah’s biggest revelation? “I had no idea I was wasting $85 a month on restaurants I didn’t even enjoy. The pantry challenge alone showed me I had $150 worth of food I’d forgotten about. This wasn’t about deprivation—it was about awareness.”

Week 1 (Days 1-7): The Financial Autopsy & Quick Wins ($150 Goal)

The first week is about shining a harsh light on where your money is actually going and cutting the obvious fat. You can’t fix a leak you can’t see.

- Conduct a Spending Audit: Going straight to the point, you need to track every single dollar. For one week, write down everything you spend. Use an app or a simple notebook. This will feel tedious, but it’s non-negotiable. The goal isn’t to judge yourself; it’s to gather data. The numbers will reveal the uncomfortable truth of your spending habits.

- Hunt Down Subscription “Vampires”: Comb through your bank and credit card statements and identify every recurring charge. That gym membership you haven’t used in six months? Cancel it. The three streaming services when you only watch one? Cut two. Be ruthless. Bureau of Labor Statistics data shows Americans significantly increased subscription spending in recent years, with many households carrying 4+ active subscriptions. This alone could easily save you $50-$100 this month.

- Execute a “Pantry Challenge”: For the rest of the week, your mission is to cook and eat only with the food you already have in your pantry, freezer, and fridge. Get creative. This single action can dramatically reduce your grocery bill for the week and eliminate all restaurant and takeout spending. Potential savings: $50-$150.

- Declare a “No-Spend Weekend”: From Friday to Sunday, challenge yourself to spend zero dollars. Find free entertainment: go to the park, visit the library, have a board game night, tackle a home project you’ve been putting off. This breaks the habit of spending out of boredom.

Week 2 (Days 8-14): The Offensive Strategy - How to Boost Your Income ($300 Goal)

Cutting expenses is only half the battle, especially on a tight budget. The fastest way to reach your goal is to play offense and find ways to make extra money.

- Sell Everything That Isn’t Nailed Down: Go through your home and gather everything you haven’t used in the last year: old electronics, clothes, books, furniture, sports equipment.

- For clothes: Use Poshmark or ThredUP.

- For electronics and everything else: Use Facebook Marketplace or OfferUp. Aim for quick sales, not top dollar. Price things to move. A flurry of small sales ($20 here, $40 there) can add up incredibly fast.

- Dip Your Toes in the Gig Economy: Sign up for a flexible side hustle you can do in your spare time.

- Food Delivery: DoorDash or Uber Eats. You can work for just a few hours during peak dinner times on a Friday or Saturday and easily make an extra $50-$100.

- Task-Based Work: TaskRabbit is great for handyman services, moving help, or furniture assembly.

- Surveys and Micro-tasks: Sites like Amazon Mechanical Turk or Prolific won’t make you rich, but spending an hour a day on them can genuinely add an extra $10-$20 to your daily income.

- Leverage a Skill (Even One You Think Is Minor): Do you write well? Are you organized? Good with pets? Offer your skills for a quick cash injection. Post on local community Facebook groups offering services like proofreading, resume editing, dog walking, or babysitting.

Here’s where things get interesting: the income from these side hustles should go directly into your emergency fund account. Do not let it touch your checking account. This creates a psychological separation and prevents you from accidentally spending it.

Week 3 (Days 15-21): The Defensive Strategy - Aggressive Cost Cutting ($300 Goal)

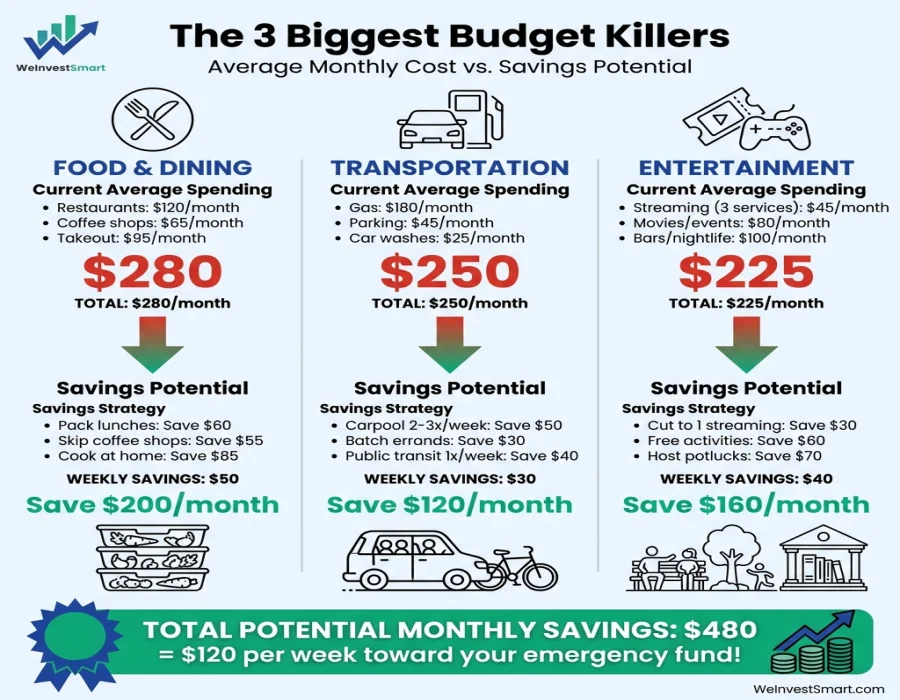

Now that you’ve got some income momentum, it’s time to double down on defense and slash your three biggest budget-killers: food, transportation, and entertainment.

- The “Scorched Earth” Food Budget: For one week, you are committing to zero restaurant meals, zero takeout, and zero coffee shop visits.

- Meal Prep Everything: Plan every single meal for the week—breakfast, lunch, and dinner. Make a detailed grocery list and stick to it. Focus on cheap, versatile ingredients like rice, beans, eggs, oats, and seasonal vegetables.

- Pack Your Lunch: This is non-negotiable. The average bought lunch costs $10-$15. Packing your own costs $2-$4. Over a week, that’s a savings of $40-$55.

- Optimize Your Transportation:

- Carpool or Use Public Transit: If possible, leave your car parked for a few days a week.

- Batch Your Errands: Plan one single trip to run all your errands for the week to save on gas.

- Gas Apps: Use an app like GasBuddy to find the cheapest fuel in your area.

- Embrace Free Entertainment: Cancel all plans that cost money. No movies, no bars, no concerts. This is temporary. Replace them with free alternatives. Host a potluck instead of going out. Explore local hiking trails. Find free museum days.

Week 4 (Days 22-30): Solidify the Habit and Cross the Finish Line ($250 Goal)

This final week is about pushing through to the end and setting yourself up for future financial success.

- Open a Separate Savings Account: This is critical. Your emergency fund cannot live in your regular checking account. It’s too easy to spend. Open a separate, no-fee, FDIC-insured high-yield savings account online. (Learn more about how high-yield savings accounts work.) Naming the account “Emergency Fund” or “Freedom Fund” will psychologically reinforce its purpose.

- Set Up Automatic Transfers: As soon as you open the account, set up a small, automatic weekly transfer from your checking account. It could be as little as $25. The amount doesn’t matter at first; the goal is to build the habit of paying yourself first.

- The Final Push: Look at your progress. How much more do you need to hit $1,000? This is the time for one last sprint. Can you work one extra shift? Sell one more big-ticket item? Do a final, deep pantry dive?

You may also be interested in: Before You Even Make a Budget: The 5 Foundational Money Mindsets You Need to Adopt

What If I Fail? Handling Obstacles on Your Journey

But what do we do when life inevitably gets in the way? What if your car breaks down during your 30-day challenge?

And here is where things get interesting: this is not a failure. This is the system working exactly as intended. If you have an emergency and have to spend the $400 you’ve saved, you are not back at square one. You are at a place where a $400 emergency was just an inconvenience, not a catastrophe that forced you into high-interest debt. You handled it. Then you start again.

The goal isn’t perfection. If you end the 30 days with $700 instead of $1,000, you are still infinitely better off than you were when you started. You have $700 you didn’t have before, and more importantly, you have a proven system and the confidence that you can do it.

You may also be interested in: The 50/30/20 Rule: The Simplest Budget for People Who Hate Budgeting

The Bottom Line: This Is More Than Just $1,000

Completing this challenge and having a $1,000 emergency fund in a separate account is a profound psychological victory. It is the tangible proof that you are no longer a victim of your financial circumstances. You are the one in control. That feeling of security, of knowing you have a buffer between you and the chaos of the world, is priceless.

Remember, the best time to start building your financial safety net was yesterday. The second-best time is today. And this is just a very long way of saying that the next 30 days can be the turning point for your entire financial life. You get the gist: start now, be intense, and give your future self the gift of security.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.

How to Build an Emergency Fund FAQ

What is an emergency fund?

An emergency fund is a savings account with 3-6 months of living expenses to cover unexpected costs like medical bills, car repairs, or job loss. It provides financial security and prevents high-interest debt.

How much should I save in an emergency fund?

Aim for 3-6 months of essential living expenses. Start with $1,000 as a beginner goal, then build to 3 months minimum. More is better for those with irregular income or dependents.

How do I build an emergency fund quickly?

Cut expenses by tracking spending, canceling subscriptions, and meal prepping. Increase income through side hustles, selling items, or asking for raises. Automate transfers and use a 30-day challenge to save $1,000 fast.

What if I can’t save $1,000?

Start smaller with $500 or even $100. Focus on creating a budget that frees up consistent savings. Every dollar counts, and building the habit is more important than the amount initially.

Why is an emergency fund important?

An emergency fund prevents financial crises by covering unexpected expenses without debt. It reduces stress, protects your credit, and gives you freedom to make decisions without financial pressure.