· WeInvestSmart Team · financial-planning · 12 min read

How to Create Your First Written Financial Plan (In Under 2 Hours)

Stop drifting financially. This template-driven guide walks you through creating a powerful one-page financial plan covering goals, net worth, debt, and investments—in less than two hours.

Most people navigate their financial lives with all the strategic foresight of a leaf in the wind. They float from paycheck to paycheck, tossed about by unexpected bills and impulsive purchases, hoping to eventually land in a comfortable place called “retirement.” They have vague ideas—“I should save more,” “I should invest”—but no concrete plan. And here’s the uncomfortable truth: a goal without a plan is just a wish. Wishing your way to wealth is a losing strategy, yet it’s the default for millions.

We’ve all heard the advice to “get our finances in order,” but what does that actually mean? For most, it feels like an impossibly complex task, requiring dense spreadsheets, arcane knowledge of the stock market, and hours of tedious work. The sheer inertia is paralyzing. So we put it off, telling ourselves we’ll do it “someday,” while our financial future remains a blurry, anxiety-inducing fog.

But what if we told you that you could create a clear, powerful, and effective financial plan—a literal roadmap for your money—in less than two hours? And what if this plan could fit on a single page? This isn’t about complex financial modeling. It’s about clarity. It’s about making a few key decisions that will automate 90% of your financial success. This is just a very long way of saying that in the time it takes to watch a movie, you can take back control of your financial destiny.

Why Your Brain Needs a Written Plan

Before we open the template, we need to understand why this exercise is so critical. The problem isn’t that you’re “bad with money.” The problem is that your brain is not designed for modern personal finance. It’s wired for short-term survival and immediate rewards, not for calculating the compounding growth of a 401(k) over 30 years. Without a written plan, you’re relying on willpower to fight millions of years of evolution every time you see an ad or walk into a store.

Going straight to the point, a written financial plan acts as an external executive function for your brain. It outsources the hard, long-term thinking to a simple document, freeing up your mental energy. When you have a written plan, financial decisions are no longer a stressful, in-the-moment debate. They become a simple question: “Does this align with my plan?” It removes emotion from the equation.

The funny thing is that the act of writing the plan itself is transformative. It forces you to confront the reality of your situation and be brutally honest about your goals. You can’t just wish for a comfortable retirement; you have to write down the number. You can’t just feel bad about your credit card debt; you have to write down the balance and the interest rate. This act of documentation turns vague anxieties into a series of solvable problems. You get the gist: the plan isn’t a cage; it’s the blueprint for your freedom.

The One-Page Financial Plan: Your 2-Hour Blueprint

Alright, enough psychology. Grab a piece of paper, open a new document, and let’s build your plan. We’re going to tackle five critical sections. Don’t overthink it; the goal is to get a working draft done quickly. Perfection is the enemy of progress here.

Section 1: Financial Goals (Approx. 30 Minutes)

This is the “why.” You cannot create a roadmap until you know your destination. Vague goals like “be wealthy” are useless. You need to be specific, measurable, achievable, relevant, and time-bound (SMART). Divide your goals into three categories.

- Short-Term (1-3 Years): These are about building stability.

- Example: “I will build a $5,000 emergency fund in the next 12 months by saving $417 per month.” (You may also be interested in: How to Build an Emergency Fund That Actually Works)

- Example: “I will pay off my $3,500 Visa credit card (21% APR) in 10 months by paying an extra $350 per month.”

- Mid-Term (3-10 Years): These are often for major life events.

- Example: “I will save a $40,000 down payment for a house in 5 years by investing $550 per month in a low-cost index fund.”

- Example: “I will save $20,000 for a new car in 4 years by saving $417 per month in a high-yield savings account.”

- Long-Term (10+ Years): This is almost always about financial independence.

- Example: “I will have $1.5 million saved for retirement by age 65 by investing $1,500 per month.” According to the Social Security Administration’s retirement planning guide, the average American will need 70-80% of their pre-retirement income to maintain their lifestyle in retirement.

Write down 1-2 goals for each category. Be specific with the numbers and timelines. This section gives your money a purpose.

Section 2: Net Worth Snapshot (Approx. 25 Minutes)

Here’s where things get interesting. Your net worth is the single best measure of your financial health. It’s a snapshot of where you are today. The formula is simple: Assets (what you own) - Liabilities (what you owe) = Net Worth.

- List Your Assets: Go through your accounts and make a quick list. Don’t strive for perfect accuracy; good estimates are fine.

- Cash: Checking, savings accounts.

- Investments: 401(k), IRAs, brokerage accounts.

- Real Estate: The current market value of your home.

- Vehicles: The Kelley Blue Book value of your cars.

- Other Valuables: Jewelry, art (only if significant).

- List Your Liabilities: Now, list everything you owe money on.

- Mortgage balance.

- Student loan balances.

- Car loan balances.

- Credit card balances.

- Any other personal loans.

Subtract your total liabilities from your total assets. The number you get is your net worth. It might be negative, and that’s okay. This isn’t a judgment; it’s a starting line. You will update this number once a year, and your primary goal is to make it go up.

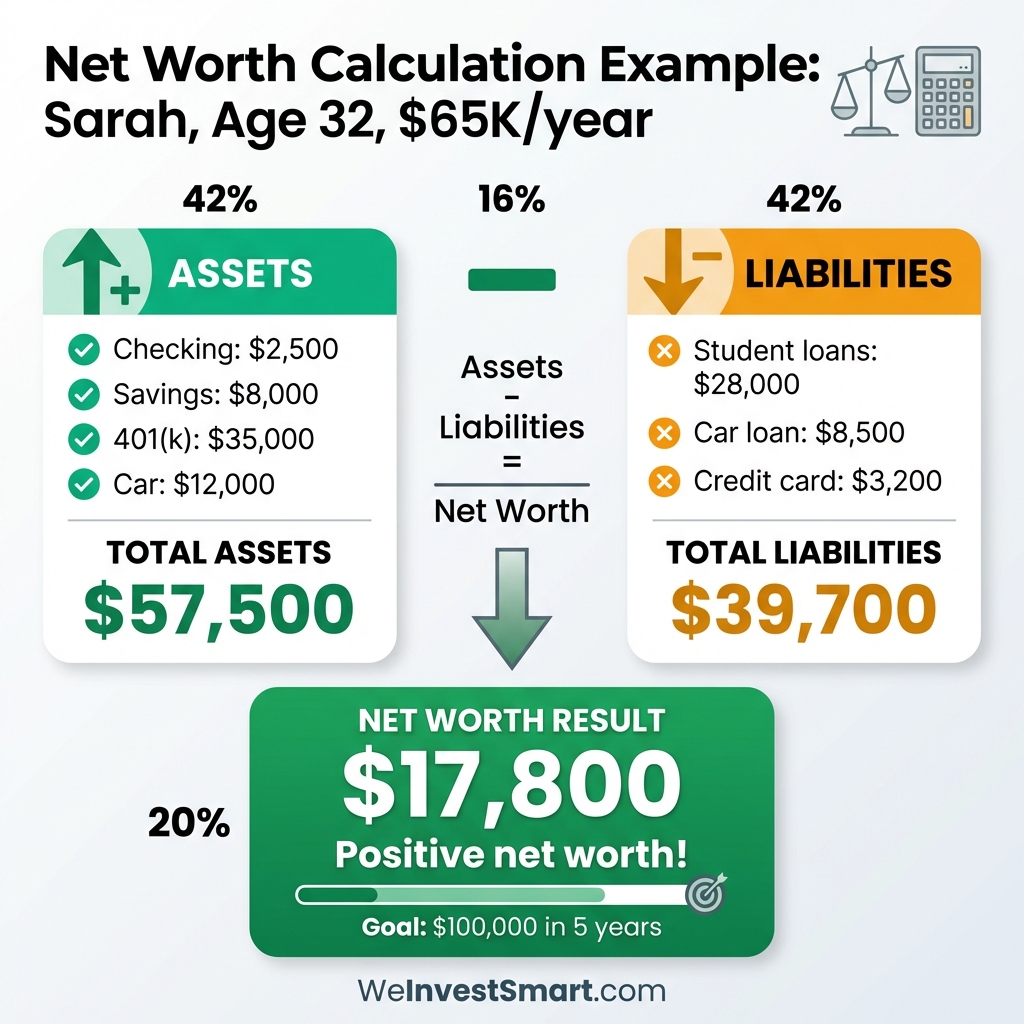

Let’s use a case study: Meet Sarah, a 32-year-old marketing manager who earns an annual salary of $65,000. When Sarah first calculated her net worth, here’s what she found:

Sarah’s Assets:

- Checking account: $2,500

- High-yield savings: $8,000

- 401(k) balance: $35,000

- Car (market value): $12,000

- Total Assets: $57,500

Sarah’s Liabilities:

- Student loans: $28,000

- Car loan: $8,500

- Credit card balance: $3,200

- Total Liabilities: $39,700

Sarah’s Net Worth: $57,500 - $39,700 = $17,800

Sarah’s net worth is positive, which is excellent progress for someone in their early 30s. The key insight: net worth grows over time as you pay down debt and your investments compound. Sarah’s goal is to increase this number to $100,000 within five years by consistently saving 22% of her income and eliminating her consumer debt.

For a deeper dive into this concept, check out: How to Calculate Your Net Worth (And Why It Matters More Than Your Salary)

Section 3: The Debt Plan (Approx. 25 Minutes)

High-interest debt is a five-alarm fire in your financial house. You need a plan to put it out. For this section, we will focus only on high-interest debt (think credit cards, personal loans—anything over 8% APR).

- List Your Debts: Create a small table with four columns: Creditor Name, Total Balance, Interest Rate (APR), and Minimum Monthly Payment.

- Choose Your Strategy: There are two proven methods. Pick one.

- The Avalanche Method: Focus all extra payments on the debt with the highest interest rate first, while paying minimums on everything else. This saves you the most money in interest.

- The Snowball Method: Focus all extra payments on the debt with the smallest balance first. This gives you quick psychological wins and builds momentum.

This sounds like a trade-off, but it’s actually just a choice between math and motivation. Both work. On your one-page plan, write down: “My debt strategy is the [Avalanche/Snowball] method. My priority debt is [Name of Credit Card/Loan].”

For a detailed breakdown of both strategies with real calculations and comparison, read: Debt Snowball vs. Debt Avalanche: Which Saves You More Money?

Section 4: Your Savings Rate (Approx. 15 Minutes)

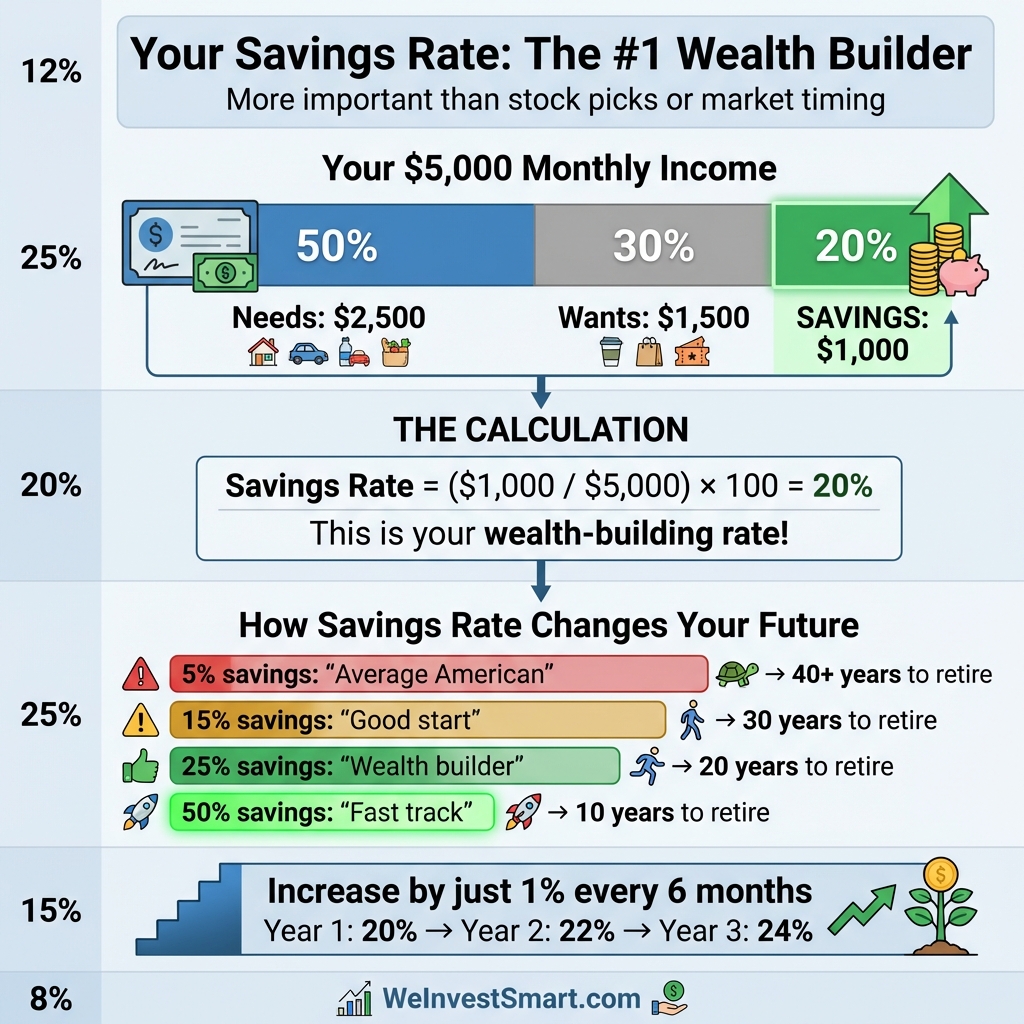

Your savings rate is the most powerful lever you have for building wealth. It is the percentage of your income that you are saving and investing. Far more than stock market returns, this number will determine how quickly you reach your goals.

According to the U.S. Bureau of Economic Analysis, the average American personal saving rate hovers around 3-5%—far below what most financial experts recommend for long-term wealth building.

- Calculate Your Gross Monthly Income: This is your total salary before any taxes or deductions are taken out. Using gross income is the industry standard and provides the most accurate picture.

- Calculate Your Total Monthly Savings: Add up everything you put away for the future in a typical month. Include your 401(k) contributions (which receive favorable IRS tax treatment), your employer’s 401(k) match, IRA contributions, and any transfers to savings or brokerage accounts.

- Find Your Savings Rate: The formula is: (Total Monthly Savings / Gross Monthly Income) x 100.

Now, set a target. If you’re just starting, a 15% savings rate is a great goal. If you’re behind, you might aim for 20-25%. Many people find the 50/30/20 budgeting framework helpful for hitting their savings targets. You may also be interested in: The 50/30/20 Rule: The Simplest Budget for People Who Hate Budgeting

On your plan, write: “My current savings rate is [X]%. My target savings rate is [Y]%. I will achieve this by increasing my 401(k) contribution by 1% every six months.”

Section 5: Your Investment Strategy (Approx. 25 Minutes)

This section intimidates people the most, but it can be incredibly simple. You do not need to be a stock-picking genius. In fact, you shouldn’t try to be. Your goal is to create a simple, automated, long-term strategy.

- Define Your Philosophy: For 99% of people, the best philosophy is passive index fund investing. It’s low-cost, diversified, and historically outperforms most active managers. On your plan, write: “My investment philosophy is to use low-cost, diversified index funds for long-term growth.” For more on the basics, read: Introduction to Smart Investing: Index Funds, ETFs, and Long-Term Growth

- Choose Your Asset Allocation: This is the mix of stocks and bonds in your portfolio. A simple rule of thumb for your stock allocation is 110 minus your age. So, if you’re 30, you’d have 80% in stocks and 20% in bonds. Stocks provide growth; bonds provide stability. Learn more: Stocks vs. Bonds vs. Index Funds: What’s the Difference?

- Select Your Investments: Don’t overcomplicate this. You can build a globally diversified portfolio with just two or three funds.

- Example: “I will invest in a Total Stock Market Index Fund (70%), an International Stock Market Index Fund (20%), and a Total Bond Market Index Fund (10%).”

- Understand Your Retirement Accounts: Your investment strategy should leverage tax-advantaged accounts like 401(k)s, Traditional IRAs, and Roth IRAs. Each has different contribution limits and tax treatment. You may also be interested in: Retirement Accounts Explained: 401(k), IRA, Roth IRA, and More

On your plan, write down your chosen philosophy and your target asset allocation. That’s it. You’ve just created an investment strategy that is more robust than 90% of the investing public’s.

The Bottom Line: This Is Your Compass

You’ve done it. In about two hours, you’ve created a document that provides more clarity and direction than most people ever achieve in their financial lives. This one-page plan is now your compass. It’s a living document that you should review every six months and update once a year.

But what does financial freedom mean to you? That’s the question this plan helps you answer. For some, it’s retiring early. For others, it’s the peace of mind that comes from having zero debt and a fully-funded emergency fund. Whatever your definition, this plan is your roadmap to get there.

Completing this plan is a profound psychological victory. It’s the tangible proof that you are no longer drifting. You are now the deliberate architect of your financial future. The path is clear, the steps are defined, and the destination is of your own choosing. This is just a very long way of saying that you’ve turned your financial anxiety into an actionable plan. You get the gist: the journey to wealth isn’t about complexity; it’s about having a plan and sticking to it.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.

How to Create a Financial Plan FAQ

What is a one-page financial plan?

A one-page financial plan is a concise, high-level summary of your financial life. It distills your most important goals, current financial snapshot (like net worth), and your strategies for debt, savings, and investing into a single, easy-to-reference document.

Why do I need a written financial plan?

A written financial plan transforms vague financial hopes into a concrete roadmap. It forces you to define your goals, understand your current situation (your starting point), and create a deliberate strategy for your money. This clarity helps you make better day-to-day financial decisions and significantly increases your chances of achieving your long-term objectives.

What are the essential components of a simple financial plan?

A simple but effective financial plan should include five key components: 1) Clearly defined financial goals (short, mid, and long-term), 2) A net worth statement (assets minus liabilities), 3) A clear debt repayment plan, 4) Your target savings rate, and 5) A basic investment strategy.

How do I calculate my net worth?

To calculate your net worth, you subtract your total liabilities (what you owe) from your total assets (what you own). First, list all your assets like cash, investments, retirement accounts, and the market value of your home and car. Then, list all your liabilities like credit card balances, mortgages, student loans, and car loans. The final number is your net worth, a snapshot of your financial health.

What is a good savings rate for a beginner?

Many experts suggest aiming for a savings rate of at least 20% of your income, often following the 50/30/20 budget model. However, the best starting rate is one that is achievable for you. The key is to start, even if it’s a smaller percentage, and gradually increase it over time as your income grows or expenses decrease. The goal is to build a consistent habit.