· WeInvestSmart Team · investment-strategies · 15 min read

Your First Investment: A Step-by-Step Guide to Opening a Roth IRA and Buying an Index Fund

A true how-to post, potentially with screenshots. Walk the reader through choosing a brokerage (like Vanguard, Fidelity, or Schwab), opening the account, funding it, and making their very first trade for a simple, low-cost index fund.

Most people spend their entire lives standing on the edge of the investing pool, paralyzed by fear and confusion. They hear the jargon—stocks, bonds, expense ratios, asset allocation—and it all sounds like an arcane language designed to keep them out. But here’s the uncomfortable truth: the single biggest risk in your financial life is not investing; it’s the risk of doing nothing at all. Going straight to the point, every day you wait, you are losing your most valuable asset: time. Time for your money to grow, to compound, and to build a future where you are in control.

We’re taught that investing for beginners is a monumental task. But what if we told you that the most powerful, wealth-building action you can take can be completed in less time than it takes to watch a movie on Netflix? What if you could go from “I know nothing about investing” to “I am an investor” in about 30 minutes?

Here’s where things get interesting. Today, we are going to do exactly that. This is not a theoretical article. This is an actionable, step-by-step guide to making your very first investment. We will walk you through choosing a trusted company, opening the most powerful retirement account available—the Roth IRA—and using it to buy your first index fund. And this is just a very long way of saying that it’s time to stop learning and start doing. By the end of this guide, you will be an investor.

The “Why” Before the “How”: The Roth IRA Superpower

Before we start clicking buttons, let’s quickly recap why the Roth IRA is the perfect vehicle for your first investment. As we’ve discussed before, a retirement account is just a special “container” with tax advantages. The Roth IRA has the best tax advantage of all.

Think of it like this: You can either pay taxes on a small seed today, or you can pay taxes on the giant, fruit-bearing tree that grows from that seed in 30 years.

- A Traditional IRA/401(k) lets you plant the seed tax-free, but then taxes the entire tree when you harvest it in retirement.

- A Roth IRA makes you pay taxes on the tiny seed (your contribution is made with after-tax money). But in exchange, the government lets you keep the entire tree—the trunk, the branches, and all the fruit it ever produces (the growth)—completely tax-free forever.

You get the gist: For most young and mid-career investors, paying taxes now at a likely lower tax rate is a brilliant strategic move. According to the IRS guidelines on Roth IRAs, this account offers tax-free growth and tax-free withdrawals in retirement—making it one of the most powerful wealth-building tools available. This is the account we’re going to open.

You may also be interested in: Understanding Market Capitalization: Why Large-Cap, Mid-Cap, and Small-Cap Stocks Matter

The Pre-Game Checklist: What You’ll Need to Get Started

To make this process as smooth as possible, gather the following information before you begin. This is standard information required by federal law (the Patriot Act) to verify your identity and prevent money laundering. It’s the same stuff you’d need to open a bank account.

- Your Social Security Number or Taxpayer Identification Number

- Your Driver’s License or other government-issued ID (You may not need it, but have it handy)

- Your physical address (and mailing address, if different)

- Your date of birth

- Your employment status and address (and your spouse’s, if applicable)

- Your bank account information (routing and account number) to link for funding.

You may also be interested in: Saving vs. Investing: Why Your Savings Account Won’t Make You Rich

Step 1: Choosing Your Brokerage - The “Big Three” Explained

The first decision is where to open your account. You can’t open an IRA at a normal bank; you need a “brokerage.” A brokerage is simply a company that is licensed to buy and sell investments like stocks, bonds, and index funds on your behalf.

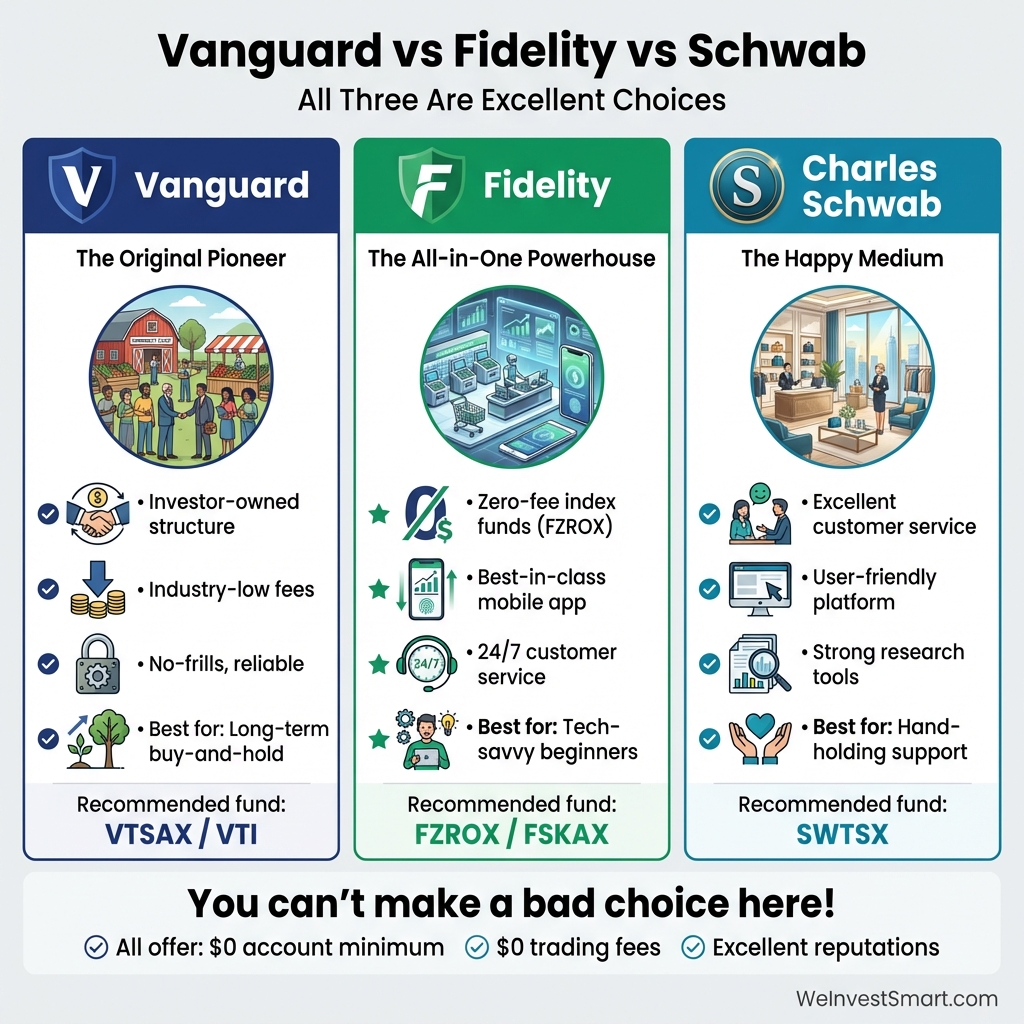

Going straight to the point, for beginners, there are three companies that are overwhelmingly recommended for their low fees, excellent reputations, and massive selections of great investment products: Vanguard, Fidelity, and Charles Schwab.

The funny thing is that beginners often get stuck here for weeks, suffering from “analysis paralysis,” trying to pick the “perfect” one. Let’s break them down with simple analogies to make the choice easier.

Vanguard: The “Original Pioneer.” Vanguard is structured differently from other companies; it’s owned by its own funds, which are in turn owned by the investors in those funds (that’s you!). Its entire philosophy is built around driving costs down for investors.

- Analogy: Think of Vanguard as the reliable, no-frills, community-owned food co-op. It might not be the flashiest store, but its mission is pure, and the quality of its products is top-notch. It’s built for investors, by investors.

Fidelity: The “All-in-One Powerhouse.” Fidelity is a massive, privately-owned company known for its cutting-edge technology, incredibly user-friendly website and app, excellent 24/7 customer service, and its revolutionary ZERO expense ratio index funds.

- Analogy: Think of Fidelity as the high-tech, customer-obsessed supermarket (like a Wegmans or a high-end Whole Foods). It has everything you could possibly want, the checkout process is seamless, and there are always helpful staff available to answer your questions.

Charles Schwab: The “Happy Medium.” Schwab is another publicly-traded giant that competes directly with Fidelity. It’s known for its fantastic customer service, a very user-friendly platform, and a long history of being investor-friendly.

- Analogy: Think of Schwab as another excellent, modern supermarket. It offers a similar high-quality experience to Fidelity, just with a slightly different layout and branding.

But what do we do with this information? Here is the crucial takeaway: You cannot make a bad choice here. All three are titans of the industry with rock-solid reputations. The differences are now minimal. The best brokerage for you is the one you actually open and fund. For the rest of this guide, we’ll use language that is generally applicable to all three platforms. Just pick the one whose “vibe” you like best and move on to the next step.

You may also be interested in: The Ultimate Guide to Rebalancing Your Portfolio

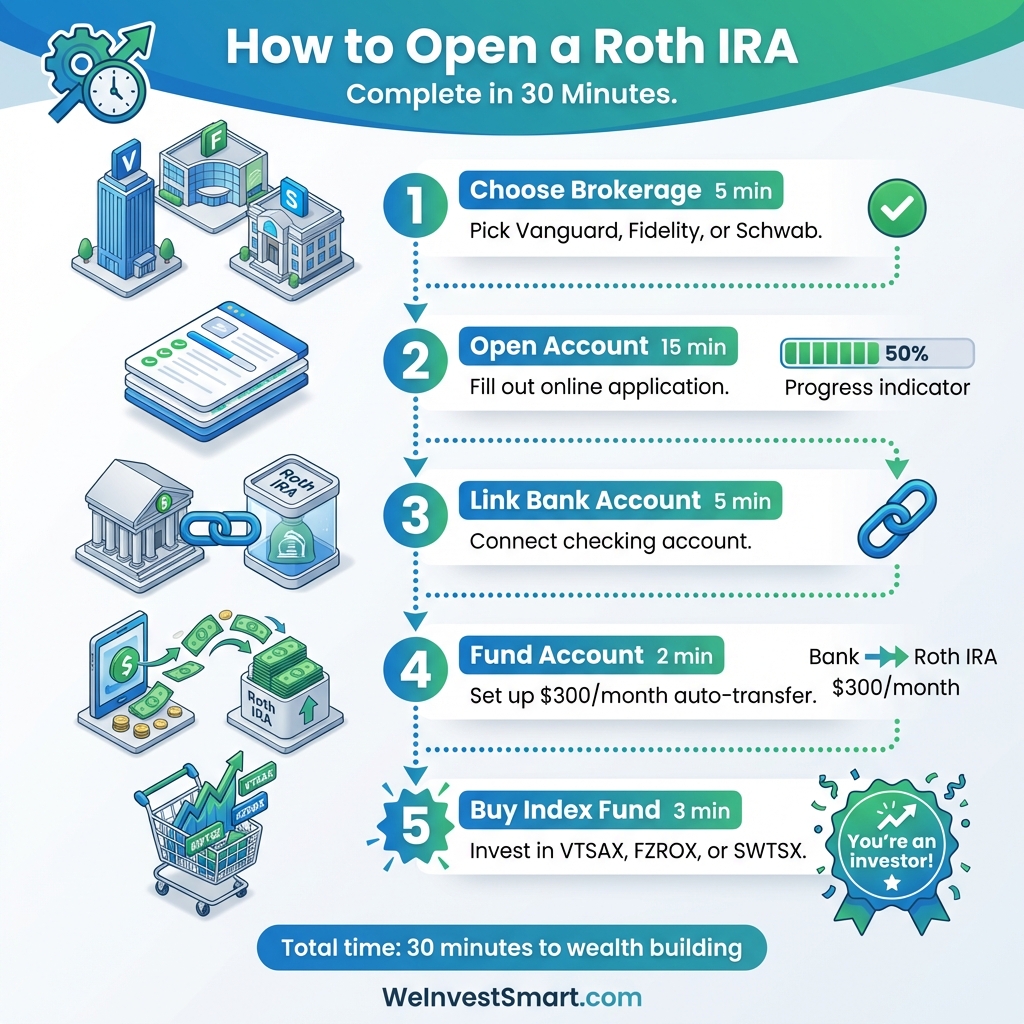

Step 2: Opening the Roth IRA Account - The 15-Minute Task

You’ve chosen your brokerage. Now it’s time to open the “container.”

- Navigate to the homepage of Vanguard, Fidelity, or Schwab.

- Look for a prominent button that says “Open an Account.” Click it.

- You will be presented with a list of account types. This is the first critical choice. You are not opening a standard “Brokerage” or “Trading” account. You are looking for the Retirement category.

- Within the Retirement category, select “Roth IRA.”

[SCREENSHOT: A brokerage website showing the account selection screen with "Roth IRA" highlighted.]

- Now, the application process will begin. This is where you’ll use the information from your pre-game checklist. The application is typically divided into 4-5 sections:

- Personal Information: This is where you’ll enter your name, address, SSN, date of birth, etc.

- Contact Information: Phone number and email address.

- Financial Profile: They will ask for your employment status, annual income, and an estimate of your net worth. Don’t stress about this. These are regulatory questions; your answers don’t need to be perfect down to the penny.

- Review and Agree: You’ll review all your information and agree to the terms and conditions.

That’s it. You’ve now officially opened a Roth IRA. It’s an empty container, a financial vessel waiting to be filled. The entire process should take you about 15 minutes.

You may also be interested in: What is Asset Allocation and Why Is It More Important Than Stock Picking?

Step 3: Funding Your Account - Moving the Money

Now that the account exists, you need to put money into it.

- Link Your Bank Account: During the application or immediately after, you’ll be prompted to link an external bank account. You will need your checking or savings account number and routing number for this. This creates a secure connection to transfer money.

- Make Your First Contribution: You have two primary ways to move money into your Roth IRA:

- One-Time Transfer: You can push a lump sum of money into the account. You can contribute up to the annual maximum ($7,000 in 2026, or $8,000 if you’re age 50 or older). The IRS sets these contribution limits annually based on inflation.

- Automatic Investment Plan: This is the method we strongly recommend. You can set up a recurring transfer from your bank account to your Roth IRA every month or every payday.

This sounds like a trade-off, setting aside money automatically, but it’s actually a desirable thing. We covet automation because it is the secret to disciplined, long-term investing success. It removes emotion, timing, and forgetfulness from the equation. You are systematically “paying yourself first” and ensuring that your most important financial goal is always taken care of.

Action: Set up an automatic transfer for an amount you are comfortable with, even if it’s just $50 or $100 a month to start. You can always change it later.

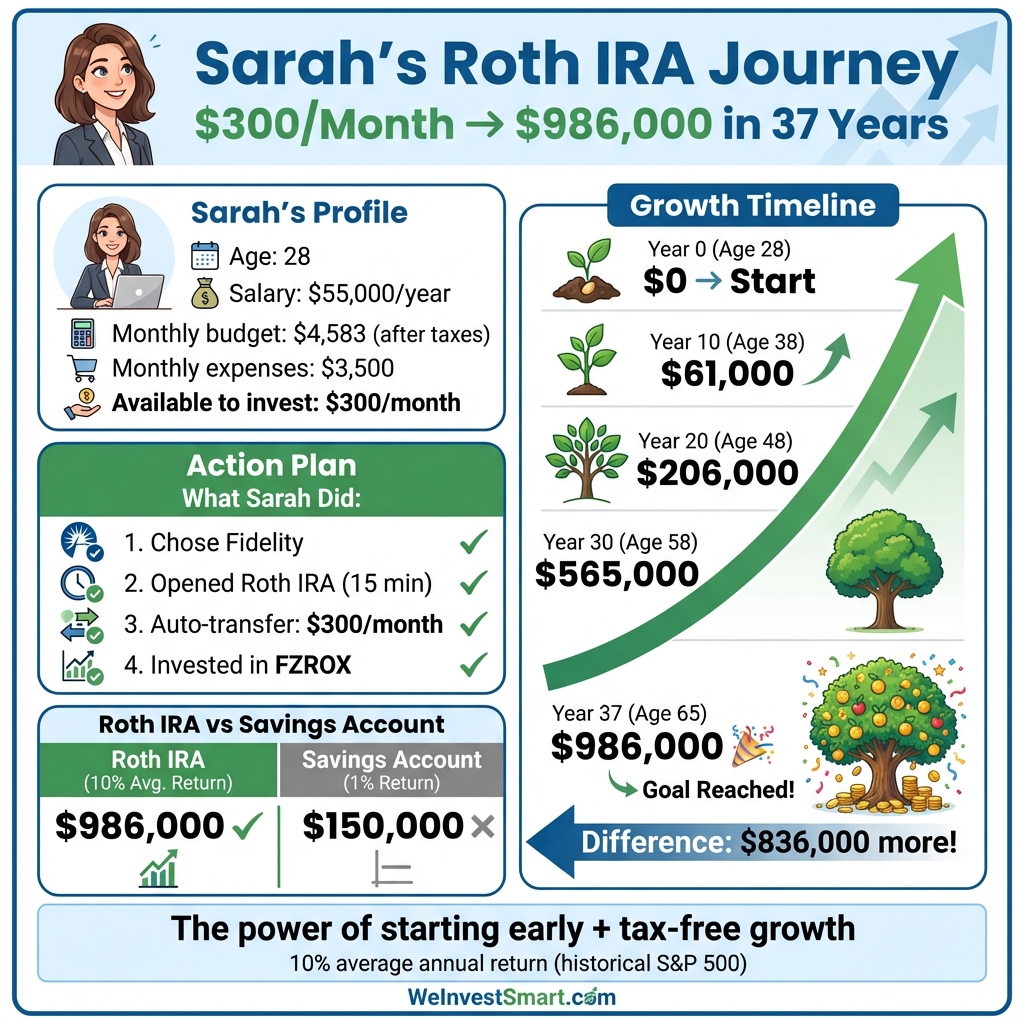

Real-World Example: Meet Sarah, The 28-Year-Old Who Started Investing

Let’s use a case study to make this concrete: Meet Sarah, a 28-year-old marketing coordinator who earns an annual salary of $55,000. She has been putting off investing for years, convinced that she “didn’t make enough” or “didn’t know enough.” But after reading this guide, Sarah decided to take action.

Sarah’s Financial Snapshot:

- Annual income: $55,000 (roughly $4,583/month after taxes)

- Monthly expenses: $3,500 (rent, utilities, food, car, etc.)

- Available for investing: $300/month

Sarah’s Action Plan:

- She chose Fidelity because she liked the user-friendly app.

- She opened a Roth IRA in 15 minutes during her lunch break.

- She linked her checking account and set up an automatic $300/month transfer.

- She invested in FZROX (Fidelity’s zero-fee total market index fund).

The Math:

- Monthly contribution: $300

- Annual contribution: $300 × 12 = $3,600/year

- Assuming 10% average annual return (historically, the S&P 500 has returned about 10% annually), here’s what Sarah’s Roth IRA could look like:

- After 10 years: ~$61,000

- After 20 years: ~$206,000

- After 30 years (at age 58): ~$565,000

- At retirement age 65 (37 years): ~$986,000

All of this growth—every single dollar of the $986,000—is completely tax-free because she used a Roth IRA. If Sarah had kept that $300/month in a savings account earning 1% interest, she’d have only about $150,000 after 37 years.

The Outcome: By taking 30 minutes to open an account and setting up automation, Sarah potentially added over $800,000 to her retirement future. This is the power of starting early, even with modest amounts.

You may also be interested in: Market Order vs. Limit Order: The Critical Difference That Can Save You Money

Step 4: Making Your First Investment - From Cash to Asset

This is the final, most crucial, and often most intimidating step. Let’s be crystal clear: funding your account is NOT the same as investing. When you transfer money, it initially lands in your Roth IRA as cash, sitting in a “settlement fund” or “money market fund.” It is not yet working for you.

Here’s where things get interesting. To make your money grow, you have to use that cash to buy an investment. This is where we buy our “pie basket,” the index fund.

Find the “Trade” Button: Once your money has settled in the account (which can take 1-2 business days), log in and look for a button or menu option that says “Trade” or “Transact.”

Choose Your Investment (The Index Fund): This is the choice that paralyzes most beginners. We’re going to make it incredibly simple. We recommend starting with a single, broadly diversified, low-cost U.S. Total Stock Market Index Fund. This fund gives you a slice of almost every public company in America. Each brokerage has its own version, identified by a five-letter ticker symbol.

- At Vanguard: Use VTSAX (the mutual fund) or VTI (the ETF version).

- At Fidelity: Use FSKAX (their traditional index fund) or FZROX (their ZERO expense ratio fund).

- At Charles Schwab: Use SWTSX.

Fill Out the “Trade Ticket”: The trade screen will look like a simple order form. This is where you tell the brokerage what you want to buy.

[SCREENSHOT: A sample "trade ticket" on a brokerage website.]- Action: Select “Buy.”

- Symbol/Ticker: Type in the ticker symbol of the fund you chose (e.g., FZROX).

- Amount: You can choose to buy a number of “shares” or, more simply, just enter the Dollar Amount you want to invest. If you transferred $500 into your account, you can simply type in “$500.”

- Order Type: It will default to “Market Order.” For a beginner buying an index fund, this is perfectly fine. It just means you’ll buy at the next available market price.

Review and Confirm: A final screen will pop up asking you to confirm your trade. It will summarize what you’re buying and for how much. Click “Submit” or “Place Trade.”

Congratulations. You have done it. The order will be processed, and within a day, you will see that the cash in your account has been converted into shares of the index fund. You are no longer just a saver. You are an owner. You are an investor.

The SEC’s Guide to Savings and Investing emphasizes that owning diversified index funds is one of the safest, most effective ways to build long-term wealth for retirement.

Putting It All on Autopilot: The Final Step to True Smart Investing

You’ve made your first trade manually. Now, let’s automate it so you never have to do that again. Go back to your “Automatic Investments” setup. You should see an option to have your recurring transfer automatically invest in the fund you just purchased. Select your fund (e.g., FZROX) and confirm.

Now, every month, your brokerage will pull the money from your bank, and without any further action from you, it will automatically buy more shares of your chosen index fund. You have created a seamless, automated wealth-building machine.

What Happens Next: The First Year and Beyond

Here’s what you can expect in the weeks and months after making your first investment:

Week 1-2: You’ll probably check your account every day. That’s normal. You’ll see the value of your investment fluctuate—sometimes up, sometimes down. Remember: this is long-term money. Daily movements don’t matter.

Month 1-3: Your automatic contributions will continue. You’ll start to see your account balance grow—not just from contributions, but from market gains (and yes, sometimes losses). Stick with the plan.

Month 6-12: You’ll likely experience your first market pullback. The value of your investments might drop 5%, 10%, or more. This is when discipline matters. Do NOT panic and sell. In fact, this is when your automatic contributions are buying shares “on sale” at lower prices.

Year 2-5: You’ll start to see meaningful compound growth. The earnings from your investments begin generating their own earnings. This snowball effect is the key to wealth building.

What to do along the way:

- Resist the urge to sell during downturns. Market volatility is normal and expected.

- Increase contributions when possible. Got a raise? Increase your monthly contribution by even $25-$50.

- Max out if you can. The annual limit is $7,000 (or $583/month). Work toward this goal over time.

- Review annually, not daily. Check your account once or twice a year, not every day.

- Stay educated. Continue learning about investing, but resist the temptation to tinker with a winning strategy.

The Bottom Line: You Are Now an Investor

The journey into investing seems like a monumental climb, but the first step—the one you just took—is the hardest and most important. You have broken through the inertia, faced the jargon, and taken decisive action. You have set up a system that will now work for you in the background, powered by the growth of the global economy and the magic of compound interest.

The secret to investing for beginners isn’t about being a genius or timing the market. It’s about having a simple, repeatable plan and the discipline to stick with it. You have just built that plan.

And this is just a very long way of saying that the power to build a secure financial future has been in your hands all along. You just had to take the first step to claim it. Welcome to the club.

How to Open a Roth IRA and Invest FAQ

What is a Roth IRA?

A Roth IRA is a retirement savings account that allows you to contribute after-tax money, which then grows tax-free. You can withdraw the money tax-free in retirement if you follow the rules.

How do I open a Roth IRA?

To open a Roth IRA, choose a brokerage like Vanguard, Fidelity, or Schwab. Visit their website, select Roth IRA as the account type, provide your personal information, and complete the application process.

What brokerage should I choose for my Roth IRA?

Popular brokerages for Roth IRAs include Vanguard, Fidelity, and Charles Schwab. They offer low fees, excellent customer service, and a wide selection of investment options. Choose based on your preferences.

How do I fund my Roth IRA?

You can fund your Roth IRA by linking a bank account and transferring money. Set up automatic contributions for consistent investing, or make one-time transfers.

How do I make my first investment in a Roth IRA?

Once funded, use the brokerage’s trading platform to buy an index fund like VTSAX, FZROX, or SWTSX. Place a market or limit order, and set up automatic investments for ongoing contributions.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.