· WeInvestSmart Team · personal-finance · 14 min read

How Your Credit Score Works: Build & Improve It

Demystify the five factors that make up a credit score (payment history, amounts owed, etc.). Provide actionable tips on how to build a good score from scratch or improve a poor one.

Most people think of their credit score as a mysterious, judgmental grade handed down by some shadowy financial institution. It’s a number that seems to control our lives, dictating whether we can get a car, an apartment, or a house, yet no one ever sits us down to explain the rules of the game. But here’s the uncomfortable truth: your credit score isn’t a grade on your character. It’s not magic. It is simply a summary of your habits, calculated by a predictable and transparent algorithm. Going straight to the point, your credit score is not something that happens to you; it is something you actively build, one decision at a time.

We live in a world where a three-digit number, the FICO score, holds immense power. A low score can cost you tens or even hundreds of thousands of dollars over your lifetime in the form of higher interest rates. A high score acts as a key, unlocking the best financial products at the lowest possible cost. Yet, we treat it with a mixture of fear and ignorance.

But what if we told you that you could not only understand but also strategically influence this number? Here’s where things get interesting. The entire credit scoring system is based on just five core factors. Master these five concepts, and you will have the blueprint for building an excellent credit score, transforming it from a source of anxiety into a powerful tool for achieving your financial goals. And this is just a very long way of saying that it’s time to stop being a passive subject of your credit score and start being the active architect of it.

The Foundation: What Is a Credit Score and Why Does It Matter?

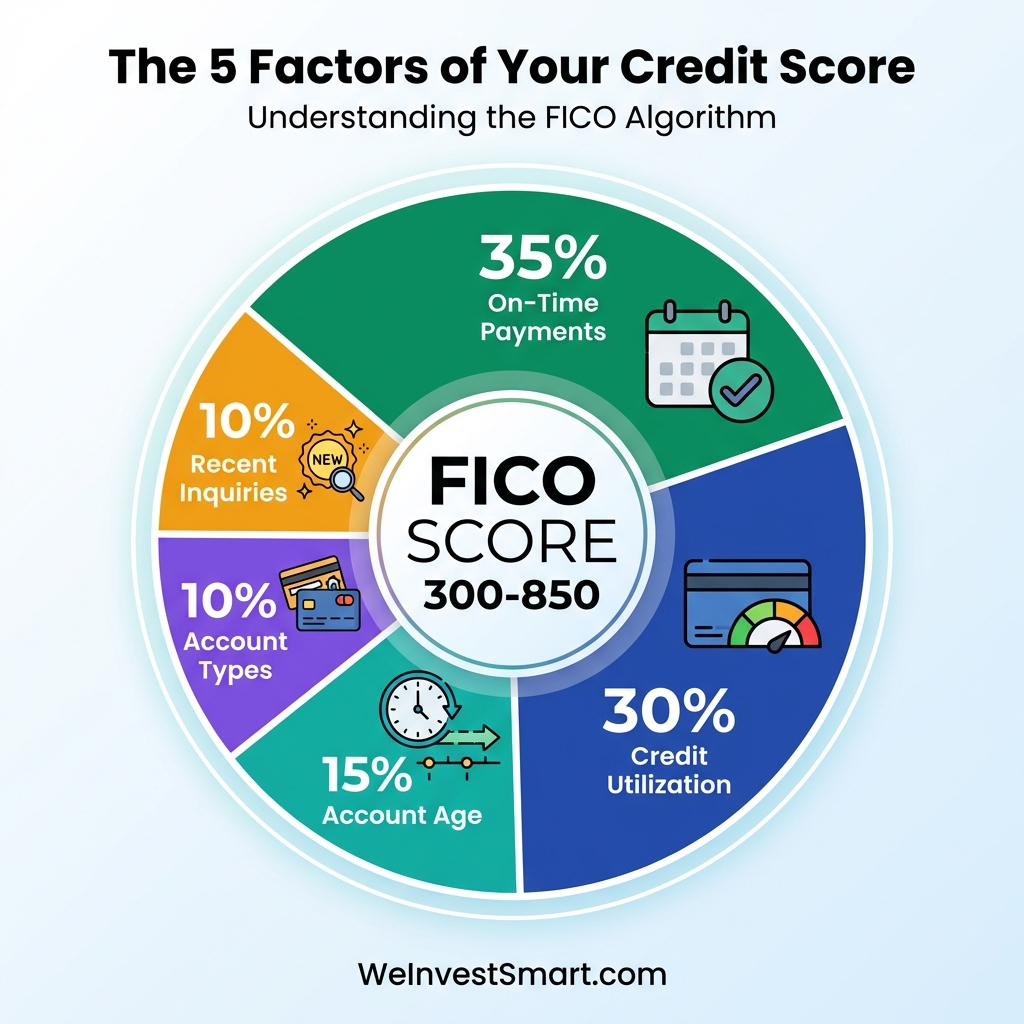

Before we dissect the algorithm, let’s establish what we’re talking about. A credit score is a numerical representation of your creditworthiness. Lenders use it to predict the likelihood that you will pay back the money you borrow on time. The most widely used score is the FICO score, which ranges from 300 to 850 according to FICO.

Think of it as your financial trust score. A high score (typically 740+) tells lenders you are a reliable, low-risk borrower. A low score (typically below 670) signals that you are a higher risk, so they will charge you more in interest to compensate for that risk, or they may refuse to lend to you at all. The Consumer Financial Protection Bureau defines credit scores as one of the pillars of your financial health.

Factor 1: Payment History (35% of Your Score) – The Unforgiving Giant

You may also be interested in: Are You a W-2 Employee or a 1099 Contractor? Understanding Your Tax Status

Going straight to the point, payment history is the single most important factor in your entire credit score. It answers the most fundamental question a lender has: “If I lend you money, will you pay it back as agreed?”

This category tracks whether you’ve made your payments on time for all your credit accounts, including credit cards, retail store cards, installment loans (like auto loans or mortgages), and student loans. A single late payment can have a significant and immediate negative impact on your score, and it can stay on your credit report for up to seven years.

The funny thing is that we often stress about complex credit-building strategies while neglecting the simple, brutal power of this one factor. You can have a perfect mix of credit and low balances, but if your payment history is littered with late payments, you will not have a good score. It’s like trying to be a world-class chef who consistently burns the toast. The basics matter most.

Actionable Tip: The most powerful action you can take to build credit or improve your credit score is to set up automatic payments for at least the minimum amount due on every single one of your accounts. This simple act makes it nearly impossible to have a late payment, creating a perfect track record that forms the bedrock of a high score.

Factor 2: Amounts Owed (30% of Your Score) – The Nuance of Debt

This factor is the second heavyweight, but it’s more nuanced than just the total amount of debt you have. The algorithm cares less about your total debt and more about your credit utilization ratio.

Going straight to the point, your credit utilization ratio is the percentage of your available revolving credit that you are currently using. It’s primarily calculated on your credit cards.

Formula: (Total Credit Card Balances / Total Credit Card Limits) x 100

Let’s use a simple analogy. Think of your total credit limit as the maximum RPM of a car’s engine. If you have a $10,000 credit limit and a $1,000 balance, you’re only using 10% of your engine’s power. The engine is running smoothly. But if you have a $9,000 balance on that same limit, you’re using 90% of your power. The engine is redlining, showing signs of strain and risk. Lenders see high utilization as a red flag that you might be overextended and reliant on credit to make ends meet.

Here’s where things get interesting. Most people believe they need to carry a balance on their credit cards to build credit. This is a dangerous and costly myth. You do not need to pay a single penny in interest to build a great credit score. You can use your card, pay the statement balance in full every month, and the algorithm will see a perfect payment history and low (or zero) utilization on the day it’s reported.

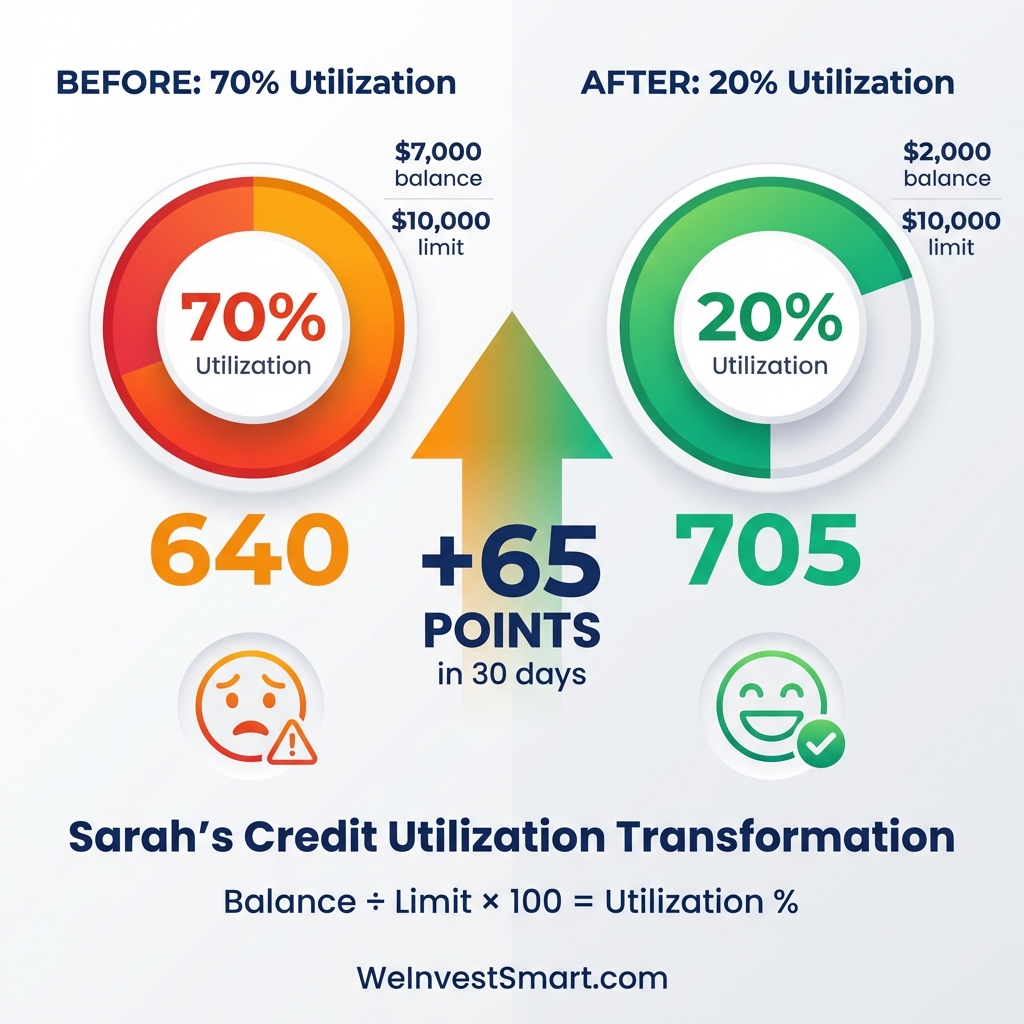

Let’s use a case study to illustrate the power of utilization: Meet Sarah, who has two credit cards with a combined credit limit of $10,000. She currently carries a $7,000 balance across both cards, giving her a 70% utilization ratio ($7,000 ÷ $10,000 × 100 = 70%). Her credit score sits at 640—not terrible, but not good enough for the best rates.

Sarah’s transformation:

- Month 1: She pays down $5,000 of her debt, reducing her balance to $2,000

- New utilization: $2,000 ÷ $10,000 × 100 = 20%

- Result: Within 30 days of the new utilization being reported, her score jumps from 640 to 705—a 65-point increase from this single change

This isn’t hypothetical. According to the Federal Trade Commission’s guidance on credit reports, high credit utilization is one of the fastest ways to damage your score, and reducing it is one of the fastest ways to repair it.

Actionable Tip: For an excellent score, aim to keep your overall credit utilization ratio below 30%, and for the best scores, keep it below 10%. If your utilization is high, making it a priority to pay off debt, specifically credit card balances, is the fastest way to see a significant jump in your score.

Factor 3: Length of Credit History (15% of Your Score) – The Value of Time

You may also be interested in: The Complete Personal Budgeting Guide: Take Control of Your Finances

This factor is straightforward: lenders like to see a long and established track record of responsible credit management. A longer credit history gives them more data to predict your future behavior.

Going straight to the point, your length of credit history is calculated based on several data points, including:

- The age of your oldest credit account.

- The age of your newest credit account.

- The average age of all your accounts.

This sounds like a trade-off, because it’s the one factor you can’t really control in the short term, but it’s actually a desirable thing to understand. We covet this knowledge because it teaches us a crucial lesson: don’t needlessly close old credit cards.

Here’s a common mistake beginners make. They pay off a credit card—often their very first one—and immediately close the account to be “responsible.” But what they’ve just done is amputate their oldest credit account, which can cause their average age of credit history to plummet, leading to a drop in their credit score. As long as the old card doesn’t have an annual fee, it’s often best to keep it open, use it for a small recurring purchase once every few months (like a streaming service), and pay it off in full to keep it active.

You may also be interested in: The Beginner’s Guide to Using Credit Cards Responsibly (And Why You Should) Actionable Tip: If you are just starting to build credit, start as soon as possible, even with a simple secured card. The clock on your credit history starts ticking the day you open your first account. Be patient and think long-term.

Factor 4: Credit Mix (10% of Your Score) – The Power of Variety

Lenders like to see that you can responsibly manage different types of credit. This shows that you are a well-rounded and experienced borrower.

Going straight to the point, credit mix refers to the variety of accounts on your credit report. The two main types are:

- Revolving Credit: Accounts where you have a credit limit and can carry a balance, like credit cards, store cards, and lines of credit.

- Installment Loans: Loans with a fixed number of equal payments, like a mortgage, auto loan, or student loan. You borrow a lump sum and pay it back over a set term.

But what do we do with this information? And here is where things get interesting. You should never take on debt you don’t need just to improve your credit mix. This factor is a small piece of the puzzle. It tends to build itself naturally over a normal financial life. As you finance a car, take out student loans, and eventually get a mortgage, your credit mix will diversify on its own. The positive impact of having a good mix is minor compared to the massive importance of paying your bills on time and keeping your balances low.

Actionable Tip: Focus on the big two factors first. Don’t worry about your credit mix. It is the seasoning on the dish, not the main ingredient.

Factor 5: New Credit (10% of Your Score) – A Tale of Caution

You may also be interested in: Lifestyle Creep: The Silent Killer of Wealth (And How to Combat It)

This final factor looks at your recent activity in seeking new credit. Applying for a lot of credit in a short period can be a red flag for lenders.

Going straight to the point, new credit is evaluated based on two main things:

- Hard Inquiries: When you formally apply for a loan or credit card, the lender pulls your credit, creating a “hard inquiry” on your credit report. Each inquiry can cause a small, temporary dip in your score (usually less than five points). The FTC explains how hard inquiries work and their impact on your overall credit health.

- New Accounts: Opening several new accounts quickly can lower your average age of credit history and make you look risky or desperate for credit.

The funny thing is that many people become terrified of hard inquiries. They avoid applying for anything for fear of hurting their score. This is an overcorrection. A single hard inquiry has a minimal and short-lived impact. Shopping for the best rate on a mortgage or auto loan over a couple of weeks is also treated as a single inquiry, so you are not penalized for being a smart consumer. The danger lies in “credit seeking” behavior, like applying for five different retail store cards at the mall in one weekend.

Actionable Tip: Be thoughtful and strategic when applying for new credit. Only apply for what you actually need. Space out your applications by at least six months if possible to minimize the impact on your FICO score.

How to Build Your Credit Score from Scratch

If you’re a young adult or new to the country, you might be in a “credit desert,” with no score at all. Here is your simple, step-by-step plan to build credit from scratch:

- Become an Authorized User: Ask a family member with a long history of responsible credit use to add you as an authorized user on one of their old credit cards. You don’t even have to use the card; their positive payment history can be “copied” onto your credit report, giving you an instant foundation.

- Get a Secured Credit Card: This is the best tool for beginners. You provide a small security deposit (e.g., $300), and that amount becomes your credit limit. You use it like a regular credit card, and the bank reports your payments to the credit bureaus. After 6-12 months of on-time payments, the bank will often refund your deposit and upgrade you to a regular, unsecured card.

- Consider a Credit-Builder Loan: These are small loans designed specifically to help you build credit. The bank deposits the loan amount into a locked savings account. You make small monthly payments, and once the loan is paid off, the funds are released to you. Each on-time payment is reported to the credit bureaus.

Let’s use a real-world example: Meet Marcus, age 22, who just graduated college with no credit history. Here’s his 12-month credit-building journey:

Marcus’s Starting Point (Month 0):

- Credit score: None (no credit file)

- Income: $45,000/year from first job

- Action: Opens secured credit card with $500 deposit

Marcus’s Progress:

- Month 1-3: Uses secured card for small purchases ($50-100/month), pays in full each month

- Month 3: Added as authorized user on mom’s 15-year-old credit card (with perfect payment history)

- Month 3 result: First credit score appears: 670 (Fair)

- Month 3-6: Continues perfect payment history, keeps utilization below 10% ($50 balance on $500 limit)

- Month 6 result: Score climbs to 710 (Good)

- Month 6-12: Opens second credit card (unsecured, $1,500 limit), continues perfect habits

- Month 12 result: Score reaches 750 (Excellent)

Total time invested: 12 minutes per month (setting up autopay + reviewing statements)

Total interest paid: $0 (paid in full each month)

Total score increase: 0 → 750 in 12 months

The Bottom Line: You Are in the Driver’s Seat

You may also be interested in: Your Financial Report Card: How to Calculate Your Net Worth (And Why It’s the Only Number That Matters)

Your credit score is not a passive number that defines you. It is an active, dynamic score that reflects your habits. It is a tool, and now you have the instruction manual.

By understanding these five factors, you’ve demystified the entire system. You know that the game is won by paying your bills on time, every time, and by using only a small fraction of your available credit. The rest is just noise.

And this is just a very long way of saying that building an excellent credit score isn’t about secret tricks or complex financial wizardry. It’s about consistency, patience, and a handful of simple, powerful habits. You have the blueprint. It’s time to start building.

How Your Credit Score Works FAQ

What is a credit score?

A credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. It’s calculated by credit bureaus and used by lenders to assess the risk of lending you money.

How is a credit score calculated?

A credit score is calculated based on five main factors: payment history (35%), amounts owed (30%), length of credit history (15%), credit mix (10%), and new credit (10%).

What are the five factors that affect credit score?

The five factors are: 1) Payment history (35%), 2) Amounts owed (30%), 3) Length of credit history (15%), 4) Credit mix (10%), 5) New credit (10%).

How can I improve my credit score?

To improve your credit score, pay bills on time, reduce credit utilization below 30%, avoid opening too many new accounts, and maintain a good credit mix. Building a positive payment history is the most important step.

How long does it take to build credit?

Building credit takes time. With consistent good habits, you can see improvements in 3-6 months. Significant improvements for a poor score may take 6-12 months or longer, depending on your situation.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.