· WeInvestSmart Team · investment-strategies · 14 min read

Smart Investing Guide: How to Build Wealth for Beginners

Learn the fundamentals of smart investing and how to build long-term wealth with proven strategies. Perfect for beginners looking to start their investment journey.

Most people think investing is about picking the next big stock or timing the market perfectly. But here’s the uncomfortable truth: that’s not how real wealth gets built. Going straight to the point, smart investing is about making consistent, informed decisions that compound over time, regardless of what the market does tomorrow. You get the gist: it’s not about getting rich quick—it’s about getting rich slowly and surely.

Why Most People Get Investing Wrong (And How You Can Do Better)

We live in a world where everyone wants instant results. Social media shows overnight millionaires, news headlines scream about market crashes, and financial gurus promise “secret strategies” that will make you rich in months. But what if we told you that the most successful investors aren’t the ones chasing hot tips or trying to outsmart the market? They’re the ones who understand that investing is a marathon, not a sprint.

Here’s where things get interesting: the average investor loses money trying to time the market. According to Dalbar’s Quantitative Analysis of Investor Behavior, attempting to buy low and sell high actually reduces returns by 2-3% annually. That might not sound like much, but over 30 years, it can cost you hundreds of thousands of dollars. In fact, the funny thing is that the most profitable investment strategy is often the simplest one: buy good investments and hold them for the long term.

You may also be interested in: How to Build a Dividend Portfolio for Passive Income: A Step-by-Step Guide

The Foundation: Understanding What Investing Really Means

Before we dive into strategies, let’s establish what investing actually is. Going straight to the point, investing means putting your money to work for you, generating returns that outpace inflation and build wealth over time. That is to say, it’s not about speculation or gambling—it’s about ownership and growth.

Think of it this way: when you invest in a company, you’re becoming a partial owner of that business. If the company grows, your investment grows with it. If we think about the sequence “I bought shares in a tech startup,” what word is likely to come next? A strong candidate is “and watched it grow,” but “and lost everything” also sounds just about right. Thus, to make up our minds on which outcome is more likely, we need to understand the fundamentals of smart investing.

You may also be interested in: Investing with Your Conscience: An Introduction to ESG and Socially Responsible Investing

The Power of Compound Growth: Your Secret Weapon

Most people don’t realize that compound growth is the eighth wonder of the world. But even though we’ve all heard about it, we must acknowledge that few truly understand its power. Let me explain: compound growth means your money earns returns, and then those returns earn their own returns, creating exponential growth over time.

Here’s a concrete example that might surprise you. Imagine you invest $10,000 at age 25, earning 7% annual returns. By age 65, that investment would grow to approximately $76,000. But what if you add just $200 monthly? That same investment would balloon to over $500,000. You get the gist: small, consistent investments can create extraordinary wealth through the magic of compounding.

This sounds like a trade-off, but it’s actually a desirable thing: we covet this slow, steady growth because it builds wealth without requiring constant attention or market timing. In fact, the most successful investors are those who start early and stay consistent, letting compound growth do the heavy lifting.

You may also be interested in: Your Guide to the Alphabet Soup of Retirement: 401(k) vs. Roth IRA vs. Traditional IRA

Why Investing Matters More Than Ever

You might be wondering: with all the economic uncertainty, why bother investing at all? The answer lies in an uncomfortable truth most people don’t want to face: inflation is eating away at your savings. Going straight to the point, if you keep your money in a savings account earning 1%, but inflation is running at 3%, you’re actually losing 2% of your purchasing power each year. The Federal Reserve tracks inflation data that shows this erosion of purchasing power over time.

But here’s where things get interesting: historically, the stock market has returned about 7% annually after inflation. That means smart investors aren’t just keeping up with inflation—they’re beating it. And this is just a very long way of saying that investing isn’t optional for building wealth; it’s essential.

You may also be interested in: How to Build an Emergency Fund That Actually Works

You may also be interested in: The Anatomy of a Stock: A Beginner’s Guide to Reading a Stock Ticker Page

Core Principles of Smart Investing

Now that we understand the “why,” let’s talk about the “how.” Going straight to the point, smart investing follows a few fundamental principles that have stood the test of time.

1. Start Early and Invest Consistently

The earlier you start, the more time compound growth has to work its magic. But what do we mean by that? In other words, even small amounts invested regularly can grow into substantial sums over decades.

If we think about the sequence “I started investing at age 25,” what word is likely to come next? A strong candidate is “and never looked back,” but “and wished I started sooner” also sounds just about right. Thus, to make up our minds on which path to take, we can examine various scenarios: starting at 25 with $200 monthly versus starting at 35 with $400 monthly. The math shows that the early starter ends up with significantly more wealth, despite contributing less total money.

2. Diversify Your Investments

Don’t put all your eggs in one basket. That is to say, spread your money across different types of investments to reduce risk. In fact, diversification is one of the few free lunches in investing— it reduces volatility without sacrificing returns.

Here’s a concrete example: imagine you invest all your money in one tech stock. If that company has a bad quarter, your entire portfolio suffers. But if you spread that same money across 50 different companies in various industries, a single company’s poor performance has minimal impact on your overall returns.

3. Keep Costs Low

High fees are the silent killer of investment returns. Going straight to the point, a 1% annual fee might not sound like much, but over 30 years, it can reduce your portfolio by 25% or more. In fact, the funny thing is that most actively managed funds underperform low-cost index funds after fees.

4. Stay Disciplined Through Market Volatility

Markets go up and down—that’s normal. But what do we do when the market crashes? And here is where things get interesting: successful investors don’t panic and sell; they stay the course and often buy more when prices are low.

This sounds like a trade-off, but it’s actually a desirable thing: we covet this discipline because it allows us to buy assets at discounted prices during market downturns. Let me explain: when everyone else is selling in fear, smart investors are buying opportunities.

You may also be interested in: Understanding Market Capitalization: Why Large-Cap, Mid-Cap, and Small-Cap Stocks Matter

Investment Options for Smart Investors

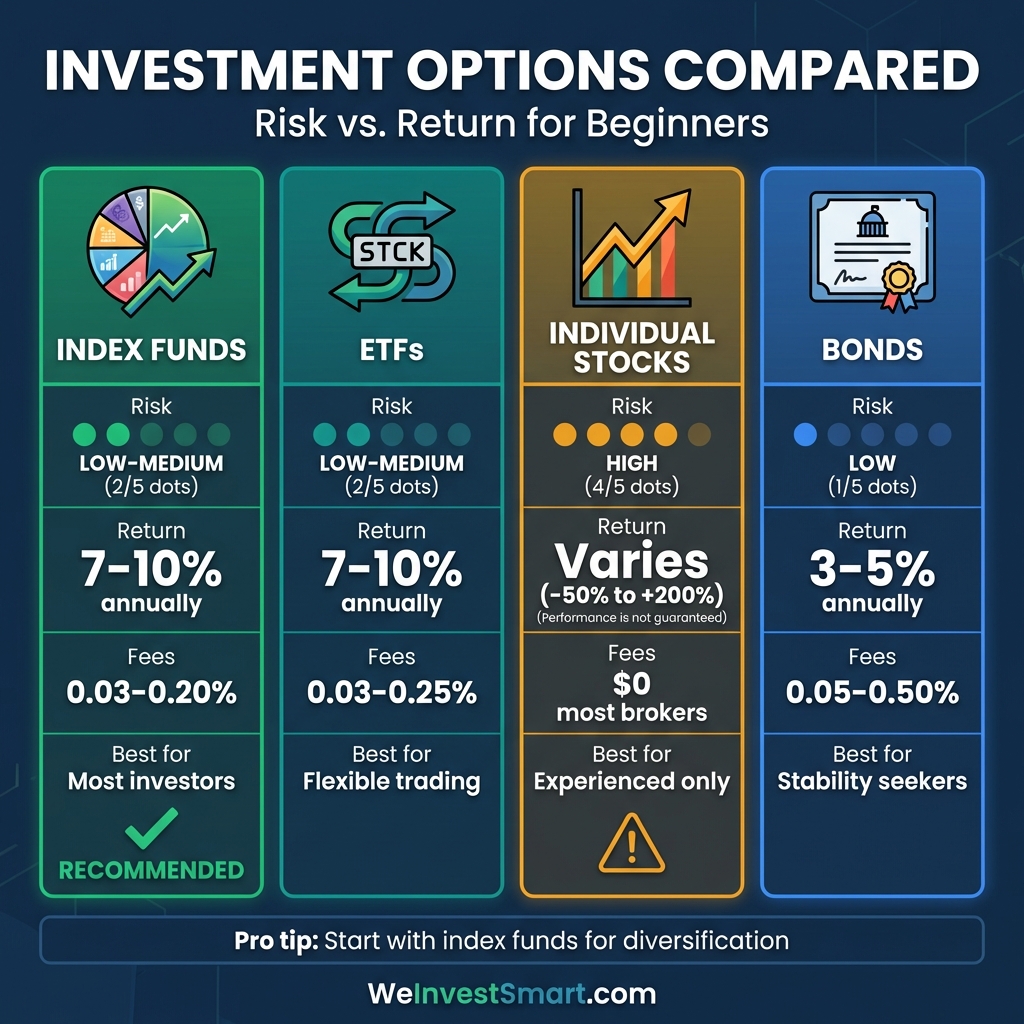

Now that we have the principles, let’s explore what to invest in. Going straight to the point, there are several options, each with different risk and return profiles.

Index Funds: The Smart Investor’s Best Friend

Index funds are collections of stocks that track market indexes like the S&P 500. They offer instant diversification, low costs, and market-matching returns. According to SEC investor education resources, index funds have outperformed 80% of actively managed funds over the past decade.

Here’s a concrete example: the S&P 500 index has returned about 10% annually over the past 50 years. An index fund tracking this index would give you similar returns, minus tiny fees. You get the gist: you’re getting professional management and diversification for a fraction of the cost of traditional mutual funds.

You may also be interested in: Understanding Stocks, Bonds, and Index Funds: A Beginner’s Guide

Exchange-Traded Funds (ETFs): Flexibility and Diversification

ETFs are similar to index funds but trade like individual stocks throughout the day. They offer the same benefits as index funds but with more flexibility. In fact, ETFs have exploded in popularity because they allow investors to buy into virtually any market segment.

Individual Stocks: For the More Experienced

While individual stocks can offer higher returns, they also carry higher risk. Going straight to the point, only invest in individual companies after you understand their business and have a diversified foundation. That is to say, individual stocks should be a small portion of your portfolio, not the majority.

Bonds: Stability in Uncertain Times

Bonds provide income and stability, especially during market downturns. They act as a counterbalance to stocks in your portfolio. In fact, a mix of stocks and bonds can help you weather market storms while still capturing growth.

Building Your First Investment Portfolio

Here’s where things get practical. Going straight to the point, building a portfolio isn’t about picking winners—it’s about creating a diversified mix that matches your goals and risk tolerance.

Step 1: Assess Your Risk Tolerance

Before investing a single dollar, understand how much volatility you can handle. Are you comfortable with 20% annual swings, or do you prefer more stability? In fact, your risk tolerance should align with your time horizon and financial goals.

Step 2: Choose Your Asset Allocation

A common rule of thumb is to subtract your age from 110 to determine your stock allocation. For example, a 30-year-old might have 80% stocks and 20% bonds. But what do we mean by that? In other words, younger investors can afford more risk because they have time to recover from market downturns.

Step 3: Select Low-Cost Investments

Focus on index funds and ETFs with expense ratios below 0.20%. Going straight to the point, these funds provide broad market exposure without the high fees that eat into your returns.

Step 4: Automate Your Investing

Set up automatic contributions to your investment accounts. This ensures you invest consistently, regardless of market conditions. In fact, dollar-cost averaging—investing fixed amounts regularly—reduces the impact of market volatility on your portfolio.

Common Investing Mistakes to Avoid

Even smart people make investing mistakes. Here’s where things get interesting: recognizing these pitfalls can save you thousands of dollars.

Trying to Time the Market

Most people think they can predict market movements, but the evidence shows otherwise. Going straight to the point, attempting to time the market reduces returns by 2-3% annually. That is to say, it’s better to be invested consistently than to try to be clever.

Lack of Diversification

Putting all your money in one investment is like betting your entire savings on a single hand of poker. In fact, proper diversification can reduce portfolio volatility by 50% or more without sacrificing returns.

Emotional Decision-Making

Fear and greed drive most poor investment decisions. But what do we do when the market crashes? And here is where things get interesting: successful investors have a plan and stick to it, regardless of short-term market movements.

High Fees and Costs

Fees might seem small, but they compound over time. Going straight to the point, a 1% annual fee can cost you $100,000 over 30 years on a $100,000 investment. In fact, the funny thing is that most investors don’t realize how much fees impact their long-term returns.

The Psychology of Successful Investing

Investing isn’t just about numbers—it’s about behavior. Going straight to the point, your biggest enemy might be yourself. That is to say, understanding investor psychology can help you avoid costly mistakes.

Overcoming Loss Aversion

Humans are wired to feel losses twice as strongly as gains. This leads to selling winners too early and holding losers too long. In fact, studies show that investors who avoid this bias significantly outperform those who don’t.

The Power of Patience

Markets reward patience. Going straight to the point, investors who stay invested through market cycles capture the full benefits of compound growth. That is to say, short-term volatility is noise—long-term trends drive wealth.

Tax Considerations in Smart Investing

Taxes can significantly impact your investment returns. Going straight to the point, understanding tax-efficient strategies can add 1-2% annually to your returns.

Tax-Advantaged Accounts

Use retirement accounts like 401(k)s and IRAs to defer taxes on investment growth. According to IRS guidelines for 2026, you can contribute up to $23,000 to a 401(k) and $7,000 to an IRA (or $30,500 and $8,000 respectively if you’re 50 or older). In fact, these accounts can save you thousands in taxes over your lifetime.

Case Study: The Power of Tax-Advantaged Investing

Let’s use a case study: Meet Sarah, a 30-year-old software engineer earning an annual salary of $85,000.

Sarah’s Smart Investing Strategy for 2026:

- 401(k) contribution: $10,200 annually (12% of salary)

- Employer 4% match: $3,400 annually

- Roth IRA contribution: $7,000 annually (max allowed in 2026)

- Total annual investment: $20,600

The Math:

- 401(k) pre-tax savings: $10,200 × 22% tax bracket = $2,244 tax savings annually

- Employer match: $3,400 free money annually

- At 7% average returns over 35 years: $20,600 × 35 years of compound growth = approximately $2.8 million by age 65

The funny thing is, Sarah feels like she’s only investing $17,556 out of pocket (after the tax savings and employer match), yet she’s building nearly $3 million in retirement wealth.

Tax-Loss Harvesting

Sell losing investments to offset gains from winning investments. This strategy can reduce your tax bill while maintaining portfolio diversification. In fact, tax-loss harvesting can add 0.5-1% annually to your after-tax returns.

Getting Started Today: Action Steps

Enough theory—let’s get practical. Going straight to the point, here are the steps to start your investing journey:

- Open an investment account with a reputable broker

- Start with index funds for instant diversification

- Set up automatic investments to build consistency

- Educate yourself continuously through books and resources

- Review your portfolio annually and rebalance as needed

The Bottom Line: Your Investment Journey Begins Now

Smart investing isn’t about getting rich quickly—it’s about building wealth steadily over time. By following evidence-based principles, keeping costs low, and staying disciplined, you can harness the power of the markets to achieve your financial goals.

Remember, the best time to start investing was yesterday. The second-best time is today. Going straight to the point, even small steps today can lead to extraordinary results tomorrow. You get the gist: start now, stay consistent, and let compound growth work its magic.

And this is just a very long way of saying that investing is about changing how you think about money—from something you spend to something that works for you. The funny thing is that once you make this mental shift, wealth building becomes not just possible, but inevitable.

Introduction to Smart Investing FAQ

What is smart investing?

Smart investing involves making consistent, informed decisions that compound over time. It focuses on long-term wealth building through diversified investments, low costs, and disciplined strategies rather than trying to time the market.

Why is investing important?

Investing is important because it helps beat inflation, build long-term wealth, and achieve financial goals. Historically, the stock market has returned about 7% annually after inflation, allowing investors to grow their money over time.

What are the core principles of smart investing?

Core principles include starting early, diversifying investments, keeping costs low, staying disciplined through market volatility, and focusing on long-term growth rather than short-term gains.

What are some common investing mistakes to avoid?

Common mistakes include trying to time the market, lack of diversification, emotional decision-making, high fees, and not having a written investment plan.

How do I get started with investing?

To get started, open an investment account with a reputable broker, start with index funds for diversification, set up automatic contributions, educate yourself continuously, and review your portfolio annually.

This article is for educational purposes only and should not be considered personalized investment advice. Consider consulting with a financial advisor for guidance specific to your situation.