· Michael Chen · personal-finance · 10 min read

Personal Budgeting Guide: Take Control of Your Money

Master the art of budgeting with our comprehensive guide. Learn proven budgeting methods, track your expenses, and build a sustainable financial plan.

Most people think budgeting is about restricting yourself and living like a miser. But here’s the uncomfortable truth: a well-designed budget actually gives you more freedom, not less. Going straight to the point, budgeting is about making intentional choices with your money so you can spend on what matters most to you. You get the gist: it’s not about deprivation; it’s about empowerment and peace of mind.

Why Budgeting Matters: The Financial Reality We Face

We live in a world where 64% of Americans live paycheck to paycheck. But what do we mean by that? In other words, most people are one unexpected expense away from financial disaster. Going straight to the point, budgeting isn’t just a nice-to-have skill—it’s essential for financial survival and success.

Here’s where things get interesting: people who budget save 19% more than those who don’t, according to Bureau of Labor Statistics consumer expenditure data. That is to say, budgeting isn’t about being cheap; it’s about being smart with your money. In fact, the funny thing is that once you start budgeting, you’ll wonder why you didn’t start sooner.

The Benefits That Will Surprise You

- Clarity: Know exactly where your money goes (no more wondering where your paycheck disappeared)

- Control: Make intentional spending decisions instead of impulsive ones

- Freedom: Fund your dreams and goals without financial stress

- Peace of Mind: Sleep better knowing you’re prepared for life’s surprises

This sounds like a trade-off, but it’s actually a desirable thing: we covet this financial control because it allows us to live life on our terms.

You may also be interested in: Taxes for Newbies: Understanding Your Paycheck Stub and Basic Tax Deductions

Step 1: Calculate Your Net Income—The Foundation

Before you can allocate your money, you need to know how much you actually have. Going straight to the point, your net income is what you take home after taxes and deductions, not your gross salary.

For Salaried Employees

Take your monthly take-home pay and subtract any automatic deductions. In fact, this is the money you can actually spend or save.

For Variable Income

If your income fluctuates, use the lowest month as your baseline. That is to say, budget based on your worst-case scenario, then save the surplus from good months.

You may also be interested in: Rent vs. Buy: The Real Math Behind the Biggest Financial Decision of Your Life

Step 2: Track Your Current Spending—Knowledge is Power

You can’t manage what you don’t measure. Going straight to the point, tracking your spending for at least a month reveals patterns you never knew existed. Research in financial behavior shows that individuals who track their expenses are significantly more likely to achieve their savings goals. In fact, most people are shocked by how much they spend on small, unnecessary items.

Tracking Methods That Actually Work

Apps and Tools:

- Mint, YNAB, or Personal Capital for automatic categorization

- Spreadsheets for complete customization

- Bank statements for a reality check

The Manual Method: Some people swear by pen and paper. Going straight to the point, writing down every expense creates awareness and accountability.

Categorizing Your Spending

Fixed Expenses (The Non-Negotiables):

- Rent/Mortgage

- Insurance premiums

- Minimum debt payments

- Utilities

- Phone/Internet

Variable Expenses (The Flexible Ones):

- Groceries

- Transportation

- Medical costs

- Household supplies

Discretionary Spending (The Fun Stuff):

- Dining out

- Entertainment

- Shopping

- Subscriptions

- Hobbies

You may also be interested in: 7 Common Tax Deductions You Might Be Missing Out On

Step 3: Choose Your Budgeting Method—The Right Tool for the Job

Not all budgets are created equal. Going straight to the point, different methods work for different personalities and lifestyles. That is to say, find the one that you’ll actually stick with.

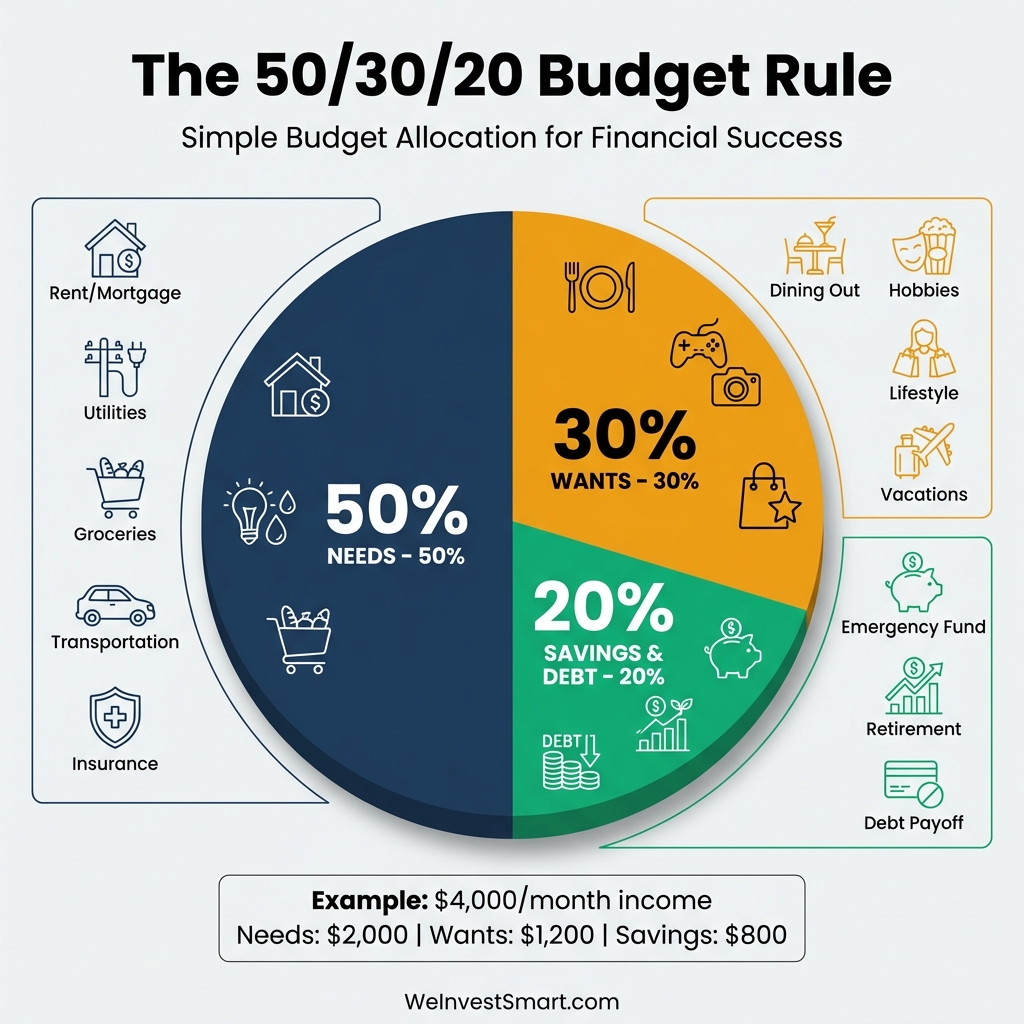

The 50/30/20 Rule: Simplicity at Its Best

Perfect for beginners who want straightforward guidelines. Going straight to the point, allocate your after-tax income as follows:

- 50% Needs: Essential expenses you can’t avoid

- 30% Wants: Entertainment and lifestyle choices

- 20% Savings & Debt: Emergency fund and debt repayment

Example: On $4,000 monthly income:

- Needs: $2,000

- Wants: $1,200

- Savings/Debt: $800

Zero-Based Budgeting: Every Dollar Has a Job

This method forces intentionality. Going straight to the point, your income minus all expenses and savings should equal zero. That is to say, you assign every dollar a specific purpose before the month begins.

How to Implement:

- List your monthly income

- Assign every dollar to categories

- Adjust until you reach zero

- Track spending throughout the month

Envelope Method: Cash-Based Discipline

Use physical envelopes for different spending categories. Going straight to the point, when the envelope is empty, you’re done spending in that category for the month.

Digital Version: Use budgeting apps with virtual envelopes if you prefer cards over cash.

Pay Yourself First: The Mindset Shift

Treat savings like a bill that must be paid. Going straight to the point, set up automatic transfers to savings before you spend on anything else. In fact, this method works because it removes decision-making from the equation.

You may also be interested in: The Beginner’s Guide to Using Credit Cards Responsibly (And Why You Should)

Step 4: Build Your Emergency Fund—The Financial Safety Net

Before focusing on other goals, establish an emergency fund. Going straight to the point, this is money for life’s unexpected events, not vacations or shopping sprees.

Start Small, Think Big

- Initial Goal: $1,000 for immediate peace of mind

- Full Fund: 3-6 months of living expenses

- Location: High-yield savings account (currently 4-5% interest according to Federal Reserve data)

What Counts as an Emergency?

Yes:

- Job loss

- Major car or home repairs

- Medical emergencies

- Family crises

No:

- New clothes

- Restaurant meals

- Concert tickets

- Regular expenses you forgot to budget for

This sounds like a trade-off, but it’s actually a desirable thing: we covet this financial security because it allows us to handle life’s curveballs without debt.

You may also be interested in: Lifestyle Creep: The Silent Killer of Wealth (And How to Combat It)

Common Budgeting Challenges and Solutions

Irregular Income

Problem: Variable pay makes consistent budgeting difficult Solution: Use lowest month as baseline, save surplus from good months

Unexpected Expenses

Problem: Life happens, budgets get derailed Solution: Include 5-10% buffer category, build emergency fund faster

Partner Differences

Problem: Spouses have different spending styles Solution: Communicate openly, find common ground, allow individual fun money

Feeling Restricted

Problem: Budgeting feels like punishment Solution: Include fun money, focus on goals, remember freedom comes from control

The Consumer Financial Protection Bureau recommends choosing a budgeting method that matches your financial goals and personal habits.

Advanced Budgeting Strategies

The 80/20 Budget

Save/invest 20% automatically, spend remaining 80% freely. Going straight to the point, this works for people who hate detailed tracking but want to save consistently.

Anti-Budget

Pay savings and bills first, spend the rest guilt-free. In fact, this method works well for disciplined spenders who need flexibility.

Percentage-Based Budgeting

Ideal for variable income: Housing 25-30%, Transportation 15%, Food 10-15%, Savings 20%, Everything else 20-30%.

Budgeting Tools and Apps

Free Options

Mint: Automatic transaction categorization and bill reminders Personal Capital: Investment tracking with budgeting features

Paid Options

YNAB (You Need A Budget): Zero-based budgeting with excellent education ($14/month) PocketGuard: Prevents overspending with smart categorization

DIY Spreadsheets

Complete customization but requires Excel/Google Sheets knowledge.

Making Your Budget Stick: The Psychology of Success

Review Weekly

Check progress, adjust categories, identify problems early.

Plan for Fun

Include entertainment money, budget for small splurges, don’t be too restrictive.

Be Flexible

Life changes, budgets should too. Focus on long-term trends, not daily perfection.

Automate Everything Possible

Set up automatic bill pay, savings transfers, and investment contributions.

Budget Success Stories: Real People, Real Results

Sarah’s Debt Payoff Journey

Let’s use a case study: Meet Sarah, who earns an annual salary of $50,000 ($4,167 monthly take-home after taxes).

Situation: $35,000 credit card debt across 3 cards, living paycheck to paycheck with no savings

Strategy: Implemented 50/30/20 budget and attacked debt aggressively

Sarah’s Monthly Budget Breakdown:

- 50% Needs ($2,083): Rent $950, utilities $150, groceries $450, insurance $300, minimum loan payments $233

- 30% Wants ($1,250): Reduced to $500 initially (dining out $200, entertainment $150, subscriptions $50, clothing $100)

- 20% Savings & Extra Debt ($833): Emergency fund $100, extra debt payments $733

The Math That Changed Everything: By cutting wants from $1,250 to $500, Sarah freed up $750 monthly. Combined with the 20% allocation ($833), she was paying $1,483 monthly toward debt—that’s 36% of her take-home pay.

Calculation: $35,000 debt ÷ $1,483 monthly = 23.6 months (under 2 years!)

With interest, it took 29 months total, but Sara cleared all $35,000 by her 3-year mark.

Result: Debt-free in 3 years, now saves 25% of income ($1,042/month), built $12,500 emergency fund in year 4.

Mike’s House Down Payment

Let’s use a case study: Meet Mike, who earns $72,000 annually ($5,400 monthly after taxes).

Situation: Making good money but minimal savings ($2,000), wanted 10% down payment on $400,000 home = $40,000 goal

Strategy: Envelope method for spending control + automated ninja-level savings

Mike’s Aggressive Savings Plan:

- Housing: $1,300 (roommate situation)

- Transportation: $400 (paid-off car, gas only)

- Food: $500 (packed lunches, strategic grocery shopping)

- Bills/Insurance: $350

- Fun Money Envelopes: $350 (entertainment, dining, hobbies)

- Automated Savings: $2,500/month (46% saving rate!)

The Breakdown: Mike’s secret was automating his down payment savings the day he got paid. $2,500 went automatically to a high-yield savings account (earning 4.5% interest), making it impossible to spend.

Over 24 months: $2,500 × 24 = $60,000 saved + $1,200 interest = $61,200 total

But Mike only needed $40,000, which he hit in just 16 months. He kept saving for closing costs.

Result: Saved $42,000 in down payment + $8,000 in closing costs in 18 months, bought his first home, continues aggressive saving for investments.

Your Budget Action Plan: Get Started Today

Week 1: Assessment

- Calculate net monthly income

- Track all expenses for one week

- Review last 3 months of bank statements

- Identify spending patterns

Week 2: Setup

- Choose budgeting method

- Create spending categories

- Set up tracking system

- Establish initial budget amounts

Week 3: Implementation

- Start following your budget

- Track daily spending

- Set up automatic savings transfers

- Automate bill payments

Week 4: Adjustment

- Review first month’s results

- Identify areas for improvement

- Adjust categories as needed

- Plan for next month

The Bottom Line: Budgeting Changes Everything

Budgeting isn’t about perfection—it’s about progress. Going straight to the point, your first budget won’t be flawless, and that’s okay. The key is starting, learning from experience, and continuously improving.

Remember why you’re budgeting: whether it’s paying off debt, saving for a home, building wealth, or simply reducing financial stress, keep your goals front and center. Every dollar you budget intentionally brings you closer to your dreams.

The best budget is the one you’ll actually use. Start simple, be consistent, and adjust as you learn what works for your lifestyle and goals.

And this is just a very long way of saying that budgeting is about taking control of your financial future. The funny thing is that once you start, you’ll never look back.

Personal Budgeting Guide FAQ

What is budgeting?

Budgeting is the process of creating a plan for your money, tracking income and expenses, and making intentional choices about how to spend and save to achieve financial goals.

Why is budgeting important?

Budgeting is important because it helps you take control of your finances, reduce financial stress, build savings, pay off debt, and work towards long-term financial goals.

What are different budgeting methods?

Common budgeting methods include the 50/30/20 rule, zero-based budgeting, envelope method, pay yourself first, and percentage-based budgeting. Choose one that fits your lifestyle.

How do I create a budget?

To create a budget, calculate your net income, track your expenses for a month, categorize spending, choose a budgeting method, set spending limits, and review and adjust regularly.

How do I stick to a budget?

To stick to a budget, set realistic goals, automate savings and bill payments, track spending regularly, be flexible, and focus on your financial goals for motivation.

This article provides general budgeting guidance and should not be considered personalized financial advice. Your optimal budgeting approach may vary based on your individual circumstances and goals.