· WeInvestSmart Team · personal-finance · 12 min read

Rent vs. Buy: The Real Math Behind Your Decision

Go beyond the emotional arguments and provide a framework for a financial comparison. Include a calculator or spreadsheet that accounts for factors like property taxes, maintenance, opportunity cost of the down payment, and expected time in the home.

The idea that renting is “throwing money away” is one of the most pervasive and financially destructive myths of our time. It’s a belief passed down through generations, an emotional argument masquerading as financial wisdom. Going straight to the point, this is a dangerous oversimplification. The uncomfortable truth is that homeownership also involves “throwing money away”—often far more than you think—on things like property taxes, mortgage interest, insurance, and maintenance. These are the unrecoverable costs that don’t build a single cent of equity.

We’ve been conditioned to see homeownership as the ultimate sign of financial success, a mandatory step on the path to building wealth. According to U.S. Census Bureau data, the national homeownership rate hovers around 66%, driven largely by cultural expectations rather than pure financial analysis. But this is an absurd standard. Making the single biggest financial decision of your life based on a folksy saying is like navigating a cross-country road trip using a hand-drawn map from your grandfather. It’s nostalgic, but it ignores the data, the tools, and the realities of the modern landscape.

Here’s where things get interesting. The rent vs. buy decision isn’t a moral or emotional question; it’s a math problem. And when you strip away the social pressure and the romanticism of the “American Dream,” the numbers often tell a very different story. What if we told you that, in many scenarios, a disciplined renter can end up significantly wealthier than a homeowner? And this is just a very long way of saying that it’s time to ignore the noise and build a real financial framework to find the right answer for you.

The Phantom Costs: Why Your Mortgage Payment is a Lie

Before we can compare renting and buying, we have to understand the true, all-in cost of homeownership. Most people make a critical mistake: they compare a monthly rent payment to a monthly mortgage payment. This is a fundamentally flawed comparison. Your mortgage payment is composed of four parts, often called PITI: Principal, Interest, Taxes, and Insurance. Of these four, only the principal portion is actually building your equity. The rest is money you will never see again.

You may also be interested in: How to Build a $1,000 Emergency Fund in 30 Days (Even on a Tight Budget)

Going straight to the point, to compare owning to renting, you must compare the unrecoverable costs of both. For a renter, this is easy: it’s your monthly rent payment. For a homeowner, it’s much more complex. The unrecoverable costs of owning are:

- Mortgage Interest: Especially in the early years of a loan, the vast majority of your payment goes to the bank, not to your equity.

- Property Taxes: A significant, ongoing expense that can rise over time.

- Homeowners Insurance: A non-negotiable cost to protect the asset.

- Maintenance & Repairs: The leaky roof, the broken water heater, the new furnace. A common rule of thumb is to budget 1-2% of the home’s value per year for this. For a $400,000 home, that’s $4,000-$8,000 a year, or $333-$667 per month.

This sounds like a trade-off—paying these costs for the benefit of owning—but it’s actually just the beginning of the real calculation. We covet clarity, and the real math requires us to uncover the biggest hidden cost of all.

The Opportunity Cost of a Down Payment: The Wealth Killer You’re Ignoring

This is the concept that most people don’t know, and it’s the one that can completely flip the rent vs. buy equation on its head. When you buy a house, you take a massive sum of money—your down payment and closing costs—and lock it up in a relatively low-return, illiquid asset. That money is no longer working for you.

Going straight to the point, opportunity cost is the potential return you give up by using that money for a down payment instead of investing it in something else, like a low-cost S&P 500 index fund. For example, if you put $80,000 down on a house, you are forfeiting the potential growth that money could have generated in the stock market. Historically, the stock market has returned an average of around 10% per year, while Federal Reserve data shows that median home price appreciation has historically been closer to 3-4% annually. While your home might appreciate, you have to subtract all the costs of ownership to find your true return, which is often much lower.

You may also be interested in: Introduction to Smart Investing: Building Wealth for Beginners

The funny thing is, we mentally write off the down payment as part of the “investment,” but we fail to calculate its cost. A disciplined renter, on the other hand, can take that same $80,000, invest it, and let it compound for years. This single factor can allow a renter to outpace a homeowner’s wealth creation, especially in the first decade.

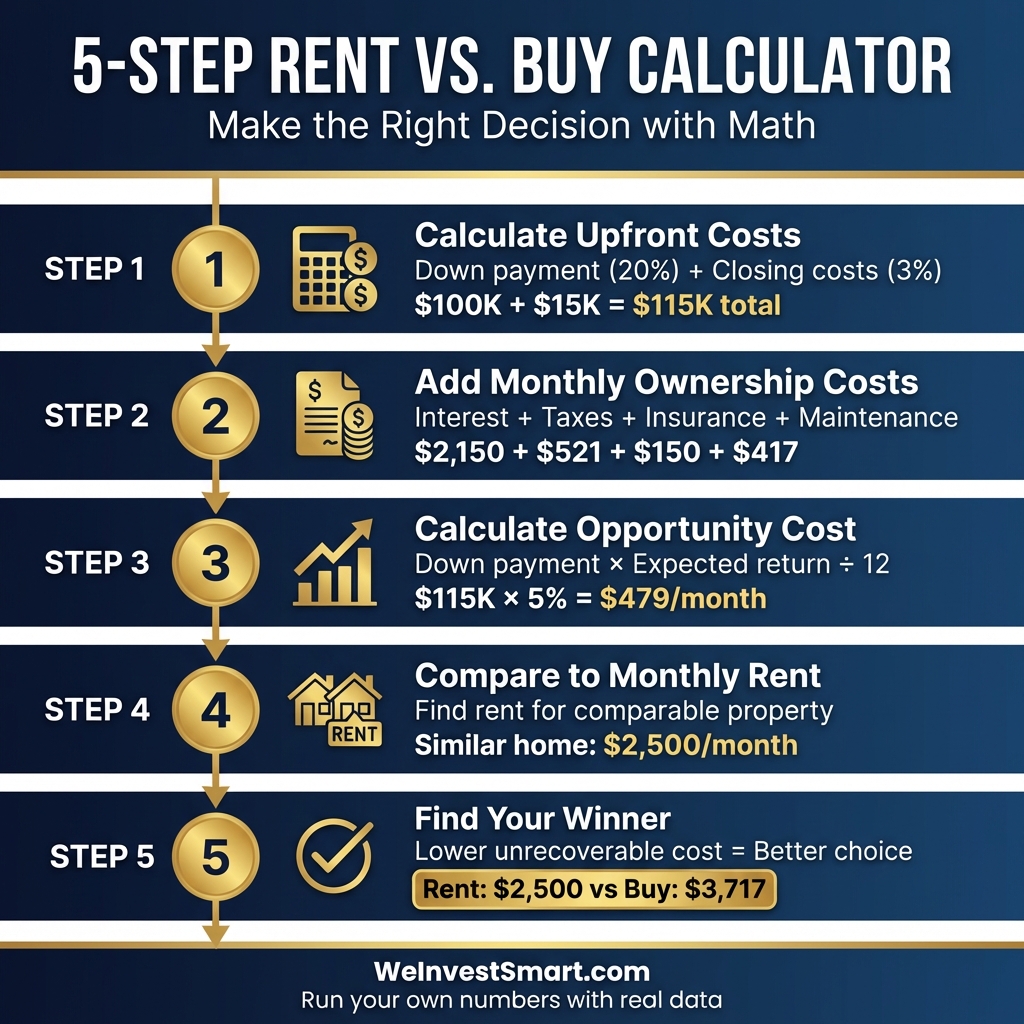

The Rent vs. Buy Framework: Your Step-by-Step Calculation

Let’s build the calculator. Forget the emotional arguments and run the numbers for a specific property you are considering. We need to compare apples to apples.

You may also be interested in: Before You Even Make a Budget: The 5 Foundational Money Mindsets You Need to Adopt

Scenario: You are considering buying a $500,000 house. A comparable house in the same neighborhood rents for $2,500/month.

Step 1: Calculate the Total Upfront Cash Needed to Buy

- Down Payment (20%): $100,000

- Closing Costs (3%): $15,000 (This covers lender fees, appraisal, title insurance, etc.)

- Total Initial Cash Outlay: $115,000

Step 2: Calculate the Monthly Unrecoverable Costs of Owning

This is the math that matters. We’re calculating the equivalent of “rent” for the homeowner.

- Mortgage Interest: Let’s assume a $400,000 loan at 6.5% interest. In the first year, you’ll pay roughly $25,800 in interest, which is $2,150/month.

- Property Taxes: Assume 1.25% of the home’s value per year. ($500,000 * 0.0125) / 12 months = $521/month.

- Homeowners Insurance: A reasonable estimate is $150/month.

- Maintenance: Using the 1% rule. ($500,000 * 0.01) / 12 months = $417/month.

Now for the big one…

- Opportunity Cost: You have $115,000 tied up. What could that earn elsewhere? Let’s use a conservative 5% annual return to account for market fluctuations. ($115,000 * 0.05) / 12 months = $479/month.

Total Monthly Unrecoverable Owning Cost: $2,150 (Interest) + $521 (Taxes) + $150 (Insurance) + $417 (Maintenance) + $479 (Opportunity Cost) = $3,717 per month.

Step 3: Compare the Costs and Find the Verdict

- Unrecoverable Cost of Owning: $3,717 / month

- Unrecoverable Cost of Renting: $2,500 / month

In this very realistic scenario, the true cost of “throwing money away” on this house is $1,217 more per month than renting a comparable property. That difference of $1,217 is money the disciplined renter can now invest every single month, further accelerating their wealth-building advantage.

You may also be interested in: The 50/30/20 Rule: The Simplest Budget for People Who Hate Budgeting

But what about home appreciation and building equity? And here is where things get interesting. Yes, your home will likely appreciate, and you are building equity through your principal payments. However, the renter is also building equity—in their investment portfolio. To make a fair comparison, you would have to project the future value of the home (minus selling costs of ~6-8%) against the future value of the renter’s investment portfolio (the down payment plus the monthly savings difference, all compounding). In many cases, especially if your time horizon is less than 7-10 years, the renter comes out ahead.

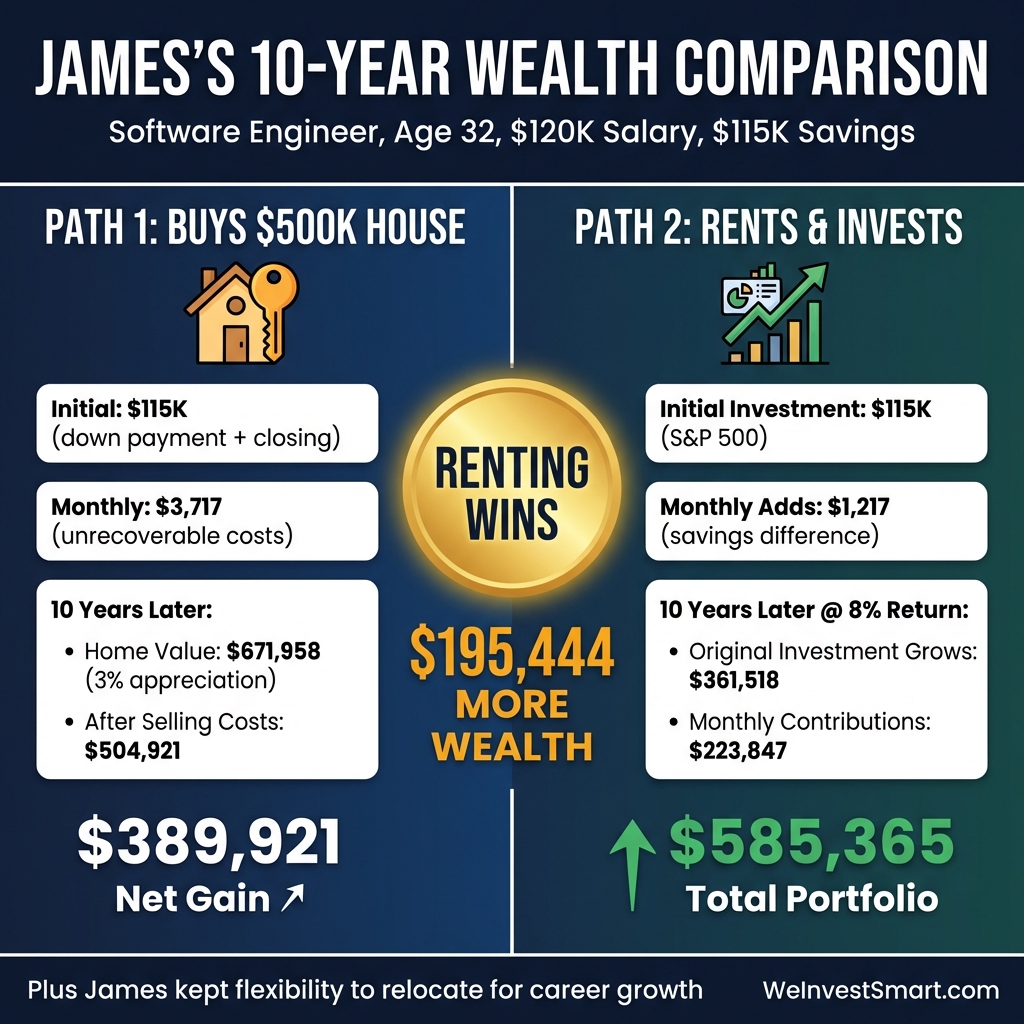

Real-World Case Study: Meet James, Software Engineer

Let’s use a case study to illustrate this concept with real numbers. Meet James, a 32-year-old software engineer earning an annual salary of $120,000. He’s been saving diligently and has $115,000 available for either a down payment or investment.

Path 1: James Buys the $500,000 House

- Initial cash outlay: $115,000 (down payment + closing costs)

- Monthly unrecoverable costs: $3,717 (as calculated above)

- After 10 years: Assuming 3% annual home appreciation, his home is worth $671,958. After paying off ~$80,000 in principal and subtracting 7% selling costs ($47,037), his net proceeds are ~$504,921. Subtract his initial $115,000, and his net gain is roughly $389,921.

Path 2: James Rents and Invests

- Initial investment: $115,000 in a low-cost S&P 500 index fund

- Monthly investment of savings: $1,217 (the difference between owning costs and rent)

- After 10 years at 8% annual return: His portfolio is worth approximately $361,518 from the initial $115,000, plus $223,847 from monthly contributions = $585,365 total

James’s Verdict: By renting and investing, James ends up with $585,365 - $389,921 = $195,444 more in wealth compared to buying. Plus, he maintained complete flexibility to relocate for career opportunities during those 10 years.

You may also be interested in: How to Create a Financial Plan in 2026: Step-by-Step Template

The X-Factor: Time and Flexibility

The math we just did is a snapshot in time. The single biggest factor that can tilt the scales back in favor of buying is how long you plan to stay in the home. The high upfront transaction costs of buying (and eventually selling) are spread out over your ownership period. If you stay in a home for only three years, those costs can be financially devastating. If you stay for 30 years, they become much more manageable. According to National Association of Realtors research, most experts agree that you need to stay in a home for a minimum of 5-7 years to have a fighting chance of breaking even.

But what do we do when our life is uncertain? When we might get a job offer in another state or want to downsize after the kids leave? Renting provides immense flexibility. A renter can move with a 30-day notice and a broken lease fee. A homeowner is tethered to an illiquid asset that can take months to sell, with no guarantee of a profit. This flexibility has real, tangible value that doesn’t show up in a spreadsheet but is critical to consider.

The Bottom Line: Redefining “Throwing Money Away”

It’s time to retire the phrase “renting is throwing money away.” It’s a financially illiterate statement. You are not throwing money away; you are purchasing a service: shelter, with flexibility and predictable costs. The real question is whether the cost of that service (rent) is higher or lower than the unrecoverable costs of owning a home.

And this is just a very long way of saying that the rent vs. buy decision should be made with a calculator, not with your heart. The “right” answer is not universal; it is deeply personal and dependent on your local market, your career path, your financial discipline, and your life goals. For some, the stability and emotional benefits of owning will always outweigh a purely financial calculation, and that’s a perfectly valid choice. But it must be a choice, made with full knowledge of the real costs involved.

You get the gist: run the numbers. Be honest about all the costs. And redefine what you consider to be a “good investment.” The best investment might not be a plot of land with a white picket fence, but a diversified portfolio and the freedom to live where you want, when you want.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.

Rent vs. Buy FAQ

Is it better to rent or buy a house?

The answer depends on a financial calculation, not just emotion. It involves comparing the total unrecoverable costs of renting (your monthly rent) with the total unrecoverable costs of owning (property taxes, maintenance, insurance, interest, and the opportunity cost of your down payment). The better option depends on your local market, how long you plan to stay, and your financial goals.

What is the opportunity cost of a down payment?

Opportunity cost is the potential return you miss out on by tying up your money in a down payment instead of investing it elsewhere, like in the stock market. This is a critical, often-overlooked cost of homeownership that can significantly impact the rent vs. buy calculation.

How long do I need to live in a house for it to be worth buying?

While it varies by market, a common rule of thumb is that you need to stay in a home for at least 5-7 years to break even. This is because the high upfront transaction costs of buying and selling (closing costs, agent fees) need time to be offset by potential appreciation and equity growth.

What are the hidden costs of owning a home?

The hidden, or unrecoverable, costs of owning include mortgage interest, property taxes, homeowners insurance, private mortgage insurance (PMI), and ongoing maintenance (often estimated at 1-2% of the home’s value annually). These costs do not build equity and are the true financial equivalent of rent.

How can I calculate if renting or buying is better for me?

To compare accurately, you must compare apples to apples. Calculate the total monthly unrecoverable costs of owning (interest, taxes, insurance, maintenance, opportunity cost) and compare that figure to the monthly rent of a similar property. The option with the lower unrecoverable monthly cost is financially superior.