· WeInvestSmart Team · retirement-planning · 13 min read

How Much Do You Actually Need to Retire? The 4% Rule Explained

Detailing the popular retirement withdrawal guideline. We explain how to use it to calculate your "Financial Independence" number and discuss its modern-day pros and cons.

Most retirement advice is a masterclass in useless vagueness. “Save early and often.” “Invest for the long term.” “Live below your means.” It’s all true, of course, but it’s like telling an aspiring pilot to “fly high and don’t crash.” It lacks the one thing people desperately need: a number. A concrete, tangible target to aim for.

Here’s the uncomfortable truth: most people are saving for a future they can’t define, hoping they’ll magically have “enough” when the time comes. They are flying blind. Going straight to the point, what if there was a simple, back-of-the-napkin calculation that could give you that number in under 30 seconds?

There is. It’s called the 4% Rule, and it has been the bedrock of retirement planning for a generation. It’s the rule that kickstarted the Financial Independence, Retire Early (FIRE) movement and gave millions of people a clear goal for the first time. But in today’s world of volatile markets and rising inflation, is this simple rule a trusty compass or a dangerous relic?

Here’s where things get interesting. Understanding the 4% rule—not just what it is, but where it came from and where it falls short—is one of the most powerful things you can do for your financial future. This isn’t just about a number. It’s about understanding the engine of your own financial freedom. And this is just a very long way of saying that by the end of this article, you will not only know your retirement number but also understand the risks and strategies that turn a simple rule of thumb into a robust, personal plan.

Your Retirement Number Demystified: What Is the 4% Rule?

Let’s demystify this powerful concept. It’s shockingly simple.

Going straight to the point, the 4% rule states that you can safely withdraw 4% of your investment portfolio in your first year of retirement. In every subsequent year, you take out that same initial dollar amount, adjusted for inflation. If you follow this guideline, the theory is that there’s a very high probability your money will last for at least 30 years.

Let’s use a concrete example:

- Imagine you retire with a $1 million portfolio.

- In your first year of retirement, you would withdraw $40,000 (4% of $1 million).

- If inflation is 3% the following year, your second-year withdrawal would be $41,200 ($40,000 x 1.03).

- The year after that, you adjust the $41,200 by that year’s inflation rate, and so on.

Notice that you only use the 4% calculation in the very first year. After that, the portfolio’s balance doesn’t matter for the calculation; you’re just adjusting last year’s spending for inflation.

The funny thing is, the real magic of this rule isn’t the withdrawal part; it’s the planning part. It allows us to work backward to find our target retirement number. And for that, we use its alter ego: the Rule of 25.

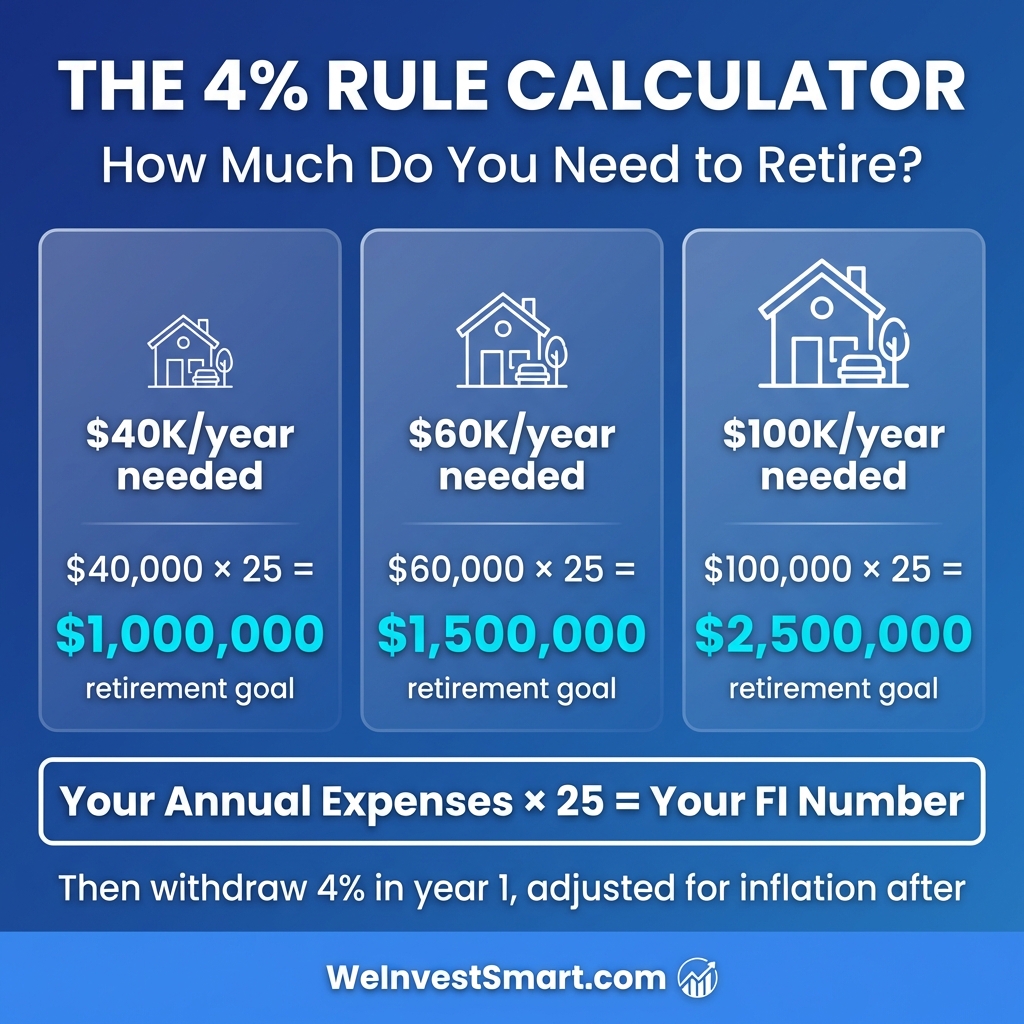

The Rule of 25: Calculating Your “Financial Independence” Number

If you can withdraw 4% of your portfolio each year, it means your total portfolio needs to be 25 times your annual expenses (because 1 / 0.04 = 25). This gives us a beautifully simple formula:

Your Annual Expenses x 25 = Your Financial Independence (FI) Number

This is the number. This is the tangible goal.

- If you want to live on $40,000 per year in retirement, you need a nest egg of $1 million ($40,000 x 25).

- If your desired lifestyle costs $60,000 per year, you need $1.5 million ($60,000 x 25).

- If you need $100,000 per year, your FI number is $2.5 million.

You get the gist: the entire game of retirement planning is suddenly distilled into two key variables: how much you spend and how much you can save to reach 25 times that amount. This is the core calculation that drives the FIRE movement and gives savers a concrete finish line to run towards.

You may also be interested in: Retirement Planning Basics: How to Secure Your Financial Future

Where Did This “Magic” Rule Come From? The Uncomfortable Truth Behind the Numbers

This rule didn’t just appear out of thin air. It came from a landmark piece of research that changed financial planning forever. To understand its strengths and weaknesses, we need to go to the heart of the problem, which most people don’t know: the historical data it was built on.

In 1994, a financial advisor named William Bengen grew tired of the vague withdrawal advice given to retirees. He decided to do something radical: he stress-tested retirement portfolios against the worst economic disasters in modern history, including the Great Depression and the stagflation of the 1970s. He used historical data on stock and bond returns from 1926 to 1976 and asked a simple question: “What is the highest withdrawal rate that would have survived any 30-year period in history?”

His conclusion was that a 4% initial withdrawal, adjusted for inflation, was the “safe maximum,” or what he called the SAFEMAX. In his research, no historical case existed where a portfolio with at least 50% in stocks was depleted in under 33 years using this method.

A few years later, three professors from Trinity University published a similar paper, now famously known as the Trinity Study, which largely confirmed Bengen’s findings and catapulted the 4% rule into the mainstream.

And this is just a very long way of saying that the 4% rule is not a forward-looking prediction. It’s a backward-looking observation based on historical U.S. market data. And that, right there, is both its greatest strength and its most significant potential weakness.

You may also be interested in: The Health Savings Account (HSA): The Secretly Best Retirement Account You’ve Never Heard Of

The Great Debate: Is the 4% Rule a Reliable Guide or a Dangerous Fossil?

For years, the 4% rule was treated as gospel. But today, many financial experts are sounding the alarm, arguing that the conditions that made the rule work in the past may not exist in the future. So, what do we do? We have to look at both sides of the coin.

The Case FOR the 4% Rule: Why It’s Still a Great Starting Point

Even its critics admit the rule has powerful benefits.

- It’s Simple and Actionable: Its primary virtue is its clarity. It transforms a complex, abstract goal (“save for retirement”) into a simple, concrete number you can track.

- It’s Historically Resilient: This rule was born from a worst-case scenario analysis. It was designed to withstand the most brutal market downturns and inflationary periods of the 20th century.

- It Provides a Psychological Anchor: Having a defined goal is incredibly motivating. It provides a framework for your entire financial life, helping you understand the direct trade-off between your current spending and your future freedom.

The Case AGAINST the 4% Rule: The Uncomfortable Truths

But even though it’s a great starting point, we must acknowledge the very real cracks that have appeared in its foundation. Relying on it blindly could be a catastrophic mistake.

Lower Expected Future Returns: The historical period the Trinity Study analyzed saw incredible economic growth. Today, many financial institutions, like Morningstar research on safe withdrawal rates, are forecasting lower returns for both stocks and bonds over the coming decades. If your portfolio doesn’t grow as fast as it did historically, withdrawing 4% becomes much riskier. In fact, some recent analyses suggest a safer rate is closer to 3.7% or even lower.

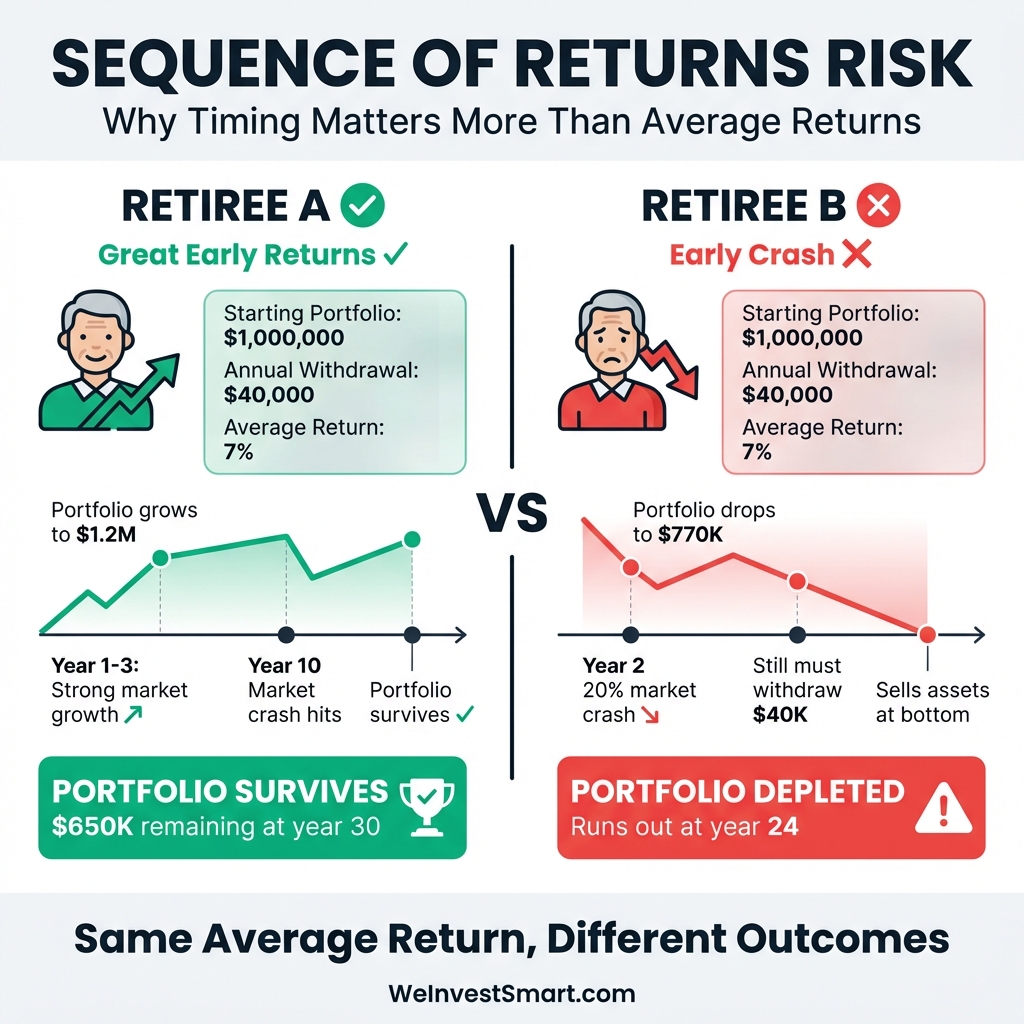

The Terrifying Impact of “Sequence of Returns Risk”: This is the monster hiding in every retiree’s closet, and it’s the single most important concept to understand. Sequence of returns risk is the danger that a major market downturn in the first few years of your retirement will permanently cripple your portfolio’s ability to recover.

Think of it this way. Imagine two retirees, both with $1 million portfolios, both withdrawing $40,000 a year, and both earning the exact same average return of 7% over 30 years.

- Retiree A has great returns in their first few years. Their portfolio grows to $1.2 million even while they’re making withdrawals. When a market crash eventually happens 10 years later, their portfolio is large enough to withstand it.

- Retiree B gets hit with a 20% market crash in their second year of retirement. Their portfolio drops from ~$960k to ~$770k. But they still have to withdraw their inflation-adjusted $40,000+. They are forced to sell their assets at rock-bottom prices to generate cash, permanently depleting their capital base. Even when the market recovers, their smaller portfolio can’t catch up. They run out of money.

This sounds like a trade-off, but it’s actually the entire ballgame. The 4% rule is most vulnerable to bad luck right at the beginning of retirement.

Increased Longevity Risk: The original studies were based on a 30-year retirement. That was a reasonable assumption for someone retiring at 65. But what if you’re part of the FIRE movement and want to retire at 45? You might need your money to last 50 or even 60 years. According to Social Security Administration longevity data, a 65-year-old today has a significant chance of living into their 90s. The success rate of the 4% rule drops significantly over these longer time horizons. For very long retirements, a more conservative rate of 3.5% is often suggested as a safer floor.

High Inflation Can Break the Model: The rule assumes you’ll make steady, predictable inflation adjustments. But what happens when inflation spikes to 9%, as it did recently? An inflation-adjusted withdrawal in a year when the market is also down is a double-whammy that dramatically accelerates portfolio depletion.

It’s Incredibly Rigid: The rule assumes you spend like a robot, increasing your withdrawal by the exact rate of inflation every single year, no matter what the market is doing. Real life doesn’t work that way. Most people’s spending naturally declines in their later years, and in a market crash, most people would instinctively tighten their belts. The rule doesn’t account for this human flexibility.

You may also be interested in: Financial Milestones by Age: Are You on Track for a Comfortable Retirement?

So, What Do We Do? Smarter Withdrawal Strategies for Today

If the 4% rule is a flawed compass, should we throw it away? Absolutely not. It’s still the best tool for calculating your initial target number. But when it comes to actually spending your money in retirement, we need a more sophisticated approach.

And here is where things get interesting. We can evolve from a rigid “rule” to a flexible “strategy.” Here are a few modern alternatives:

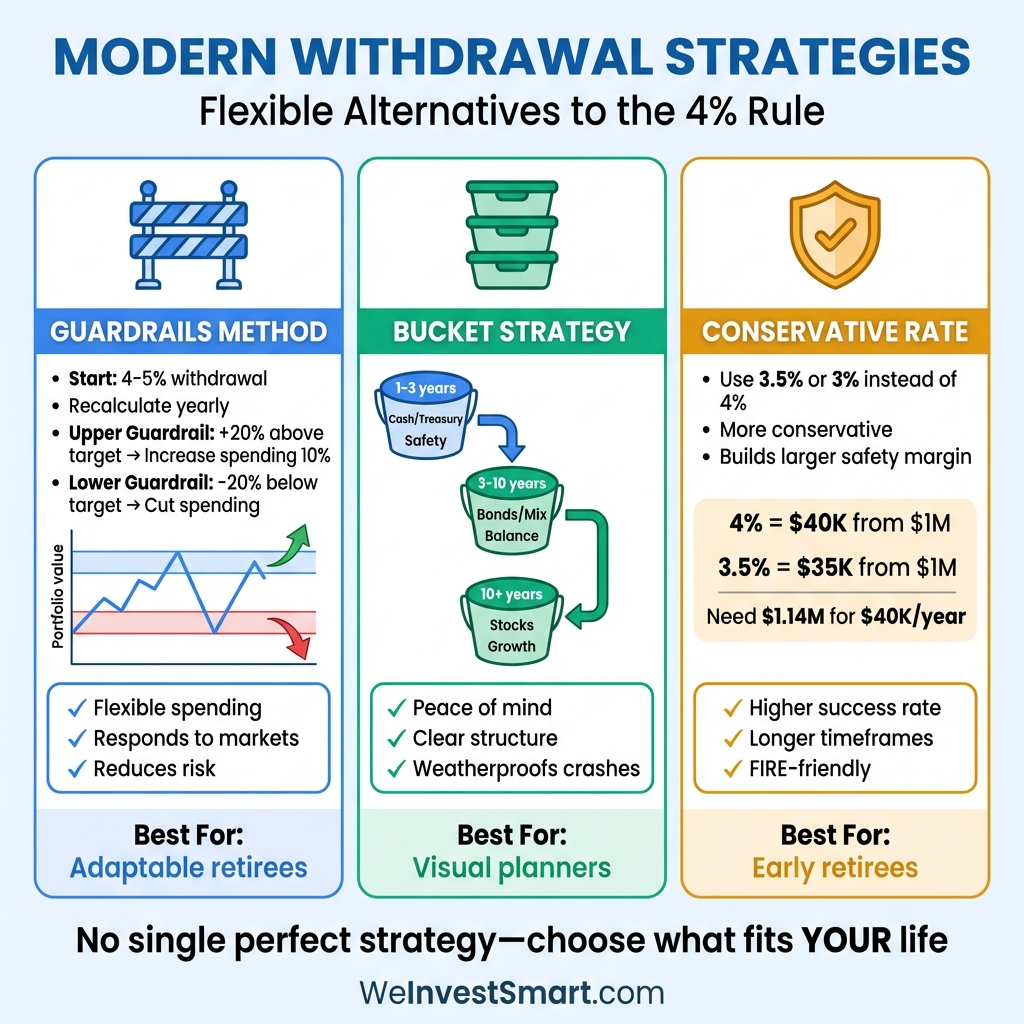

1. The Guardrails Method (Dynamic Withdrawals)

This is perhaps the most popular and intuitive alternative. Instead of blindly taking the same inflation-adjusted amount every year, you set “guardrails” that guide your spending based on market performance.

- The Concept: You start with a target withdrawal rate, maybe 4% or 5%. Each year, you recalculate what that percentage is of your current portfolio.

- The Upper Guardrail: If strong market returns cause your withdrawal rate to drop to, say, 20% below your target (e.g., your 4% withdrawal is now only 3.2% of your bigger portfolio), you give yourself a raise! You increase your withdrawal by 10% on top of inflation.

- The Lower Guardrail: If a market crash causes your withdrawal rate to jump 20% above your target (e.g., your 4% withdrawal is now 4.8% of your smaller portfolio), you cut back. You forgo your inflation adjustment for that year.

This common-sense approach allows you to spend more when times are good and automatically forces you to be prudent when times are tough, dramatically reducing your sequence of returns risk.

2. The Bucket Strategy

This strategy is more about managing your assets to meet your spending needs. It’s a psychological trick that works wonders for peace of mind. You divide your portfolio into three “buckets.”

- Bucket 1 (1-3 Years of Expenses): This is filled with cash and cash equivalents (like high-yield savings accounts or short-term treasury bills). When the market is down, you draw your living expenses from this bucket, giving the rest of your portfolio time to recover without being forced to sell low. You may also be interested in: How to Build an Emergency Fund: The Complete Guide to Financial Security

- Bucket 2 (3-10 Years of Expenses): This bucket contains a balanced mix of bonds and maybe some conservative stocks. Its goal is to generate modest returns and refill Bucket 1 as needed.

- Bucket 3 (10+ Years of Expenses): This is your long-term growth engine, invested aggressively in a diversified portfolio of stocks. It’s meant to be touched only in the distant future, giving it ample time to ride out market volatility. You may also be interested in: Introduction to Smart Investing: A Beginner’s Guide to Building Wealth

3. Lower the Withdrawal Rate

The simplest and most conservative approach is to just choose a lower number. Many financial planners now advise clients, especially early retirees, to use a starting withdrawal rate of 3.5% or even 3% to build in a greater margin of safety against all the risks we’ve discussed.

You may also be interested in: Roth vs. Traditional Withdrawals in Retirement: Which Account to Tap First and Why

The Bottom Line: From a Simple Rule to a Personal Strategy

Completing the exercise of calculating your FI number using the Rule of 25 is a profound psychological victory. It gives you a clear target, a destination on your financial map. For that purpose, the 4% rule is, and remains, an invaluable tool.

But it’s a starting point, not a sacred text. The uncomfortable truth is that there is no single “magic number” that guarantees a successful retirement. Market conditions change, inflation surprises us, and our own lives are unpredictable.

And this is just a very long way of saying that the goal is not to blindly follow a rule but to build a resilient and flexible plan. Use the 4% rule to estimate how much you need to save. But when you retire, use a dynamic strategy like the guardrails method to manage your withdrawals. You get the gist: The number gets you to the starting line of retirement, but it’s the strategy that gets you successfully to the finish line.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.