· WeInvestSmart Team · investing · 12 min read

The Tax Advantages of Investing in a 529 Plan for Education

We detail how 529 plans offer tax-deferred growth and tax-free withdrawals for qualified education expenses, making them a superior vehicle to a standard brokerage account for college savings.

Most parents saving for their children’s education are unknowingly fighting with one hand tied behind their back. They diligently put money into a standard savings or brokerage account, watch it grow, and feel a sense of accomplishment, completely oblivious to the tax torpedo heading straight for their hard-earned gains. But here’s the uncomfortable truth: every dollar of growth in a normal investment account is a taxable event waiting to happen. Going straight to the point, saving for college in a taxable account is like trying to fill a bucket with a hole in it—you’re constantly losing value to tax drag.

We’ve all heard the terrifying statistics about the rising cost of higher education. It’s a financial mountain that seems to grow taller every year. The natural instinct is to simply save and invest, hoping the market’s returns will outpace tuition inflation. But what if we told you there’s a vehicle specifically engineered by the government to supercharge those savings by completely shielding them from taxes?

Here’s where things get interesting. The government actually wants you to save for education, and they’ve created a powerful incentive program to help you do it. It’s called a 529 plan, and it’s not just a savings account; it’s a tax shelter designed for one purpose: to make your education savings grow as efficiently as humanly possible. And this is just a very long way of saying that ignoring the 529 plan is a deliberate choice to pay more taxes than you need to.

The Problem with “Normal” Investing: A Slow Leak Called Tax Drag

Before we can appreciate the genius of the 529 plan, we must first understand why a standard brokerage account is a fundamentally inefficient tool for this specific goal. When you invest in stocks or mutual funds in a regular taxable account, you create an ongoing tax liability.

Let’s say you invest $10,000 in a mutual fund. Throughout the year, that fund generates dividends and may sell some of its holdings for a profit, creating capital gains. Even if you reinvest every penny, the IRS requires the fund to distribute these gains and dividends to you. At the end of the year, you receive a Form 1099-DIV, and you owe taxes on that “phantom income” you never actually touched. This is tax drag. It’s the slow, silent erosion of your returns, forcing you to pay taxes on your gains every single year, which reduces the amount of capital you have left to compound. Over 18 years, this seemingly small leak can result in thousands of dollars lost.

You may also be interested in: Retirement Accounts Explained: Your Guide to Tax-Advantaged Investing

The 529 Plan: A Tax-Advantaged Fortress for Your Savings

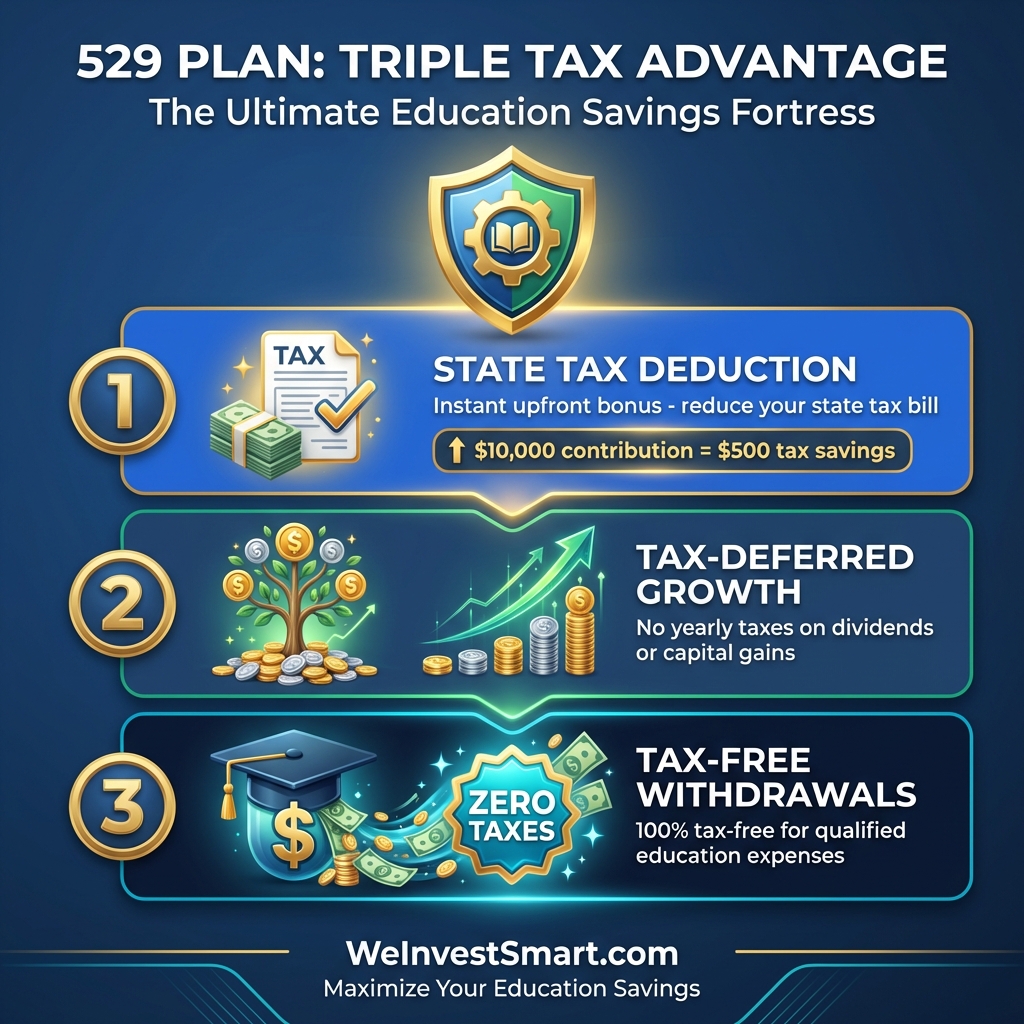

A 529 plan is a state-sponsored investment account that flips this entire script on its head. Named after Section 529 of the Internal Revenue Code, these plans are authorized by the IRS as qualified tuition programs and offer a trifecta of tax benefits that makes them one of the most powerful savings vehicles ever created. According to the SEC’s investor guide on 529 plans, these accounts provide significant tax advantages compared to traditional savings methods. Think of it as a financial fortress designed to protect your education savings from the onslaught of taxes.

Tax Advantage #1: State Tax Deduction on Contributions (The Upfront Bonus)

This is the first reward you get for saving. While there is no federal deduction for contributing to a 529 plan, more than 30 states offer a full or partial state income tax deduction or credit for contributions made to their plan, as detailed by Savingforcollege.com’s state-by-state 529 tax benefit comparison. Going straight to the point, your state will literally pay you to save for education. If you live in a state with a 5% income tax and you contribute $10,000 to your state’s 529 plan, you could instantly reduce your state tax bill by $500. This is an immediate, guaranteed return on your investment that a brokerage account simply cannot offer.

Tax Advantage #2: Tax-Deferred Growth (The Compounding Engine)

This is the core engine of the 529 plan. Just like in a 401(k) or an IRA, the money you invest in a 529 plan grows tax-deferred. This means that for years, even decades, you will pay absolutely no taxes on the dividends, interest, or capital gains your investments generate. All that money that would have been skimmed off by the IRS in a taxable account now stays in your account, working for you. This allows your money to compound on itself with maximum efficiency. It’s the difference between a leaky bucket and a hermetically sealed one.

Tax Advantage #3: Tax-Free Withdrawals for Education (The Grand Prize)

Here’s where things get really interesting. This is the feature that elevates the 529 plan to an elite level. When it’s time to pay for college, you can withdraw your contributions and all the earnings completely, 100% tax-free, as long as the money is used for qualified education expenses. This is the grand prize. You get the upfront tax break (in many states), years of unimpeded, tax-deferred growth, and then you get to take it all out at the end without giving a single dime of the earnings to the federal government.

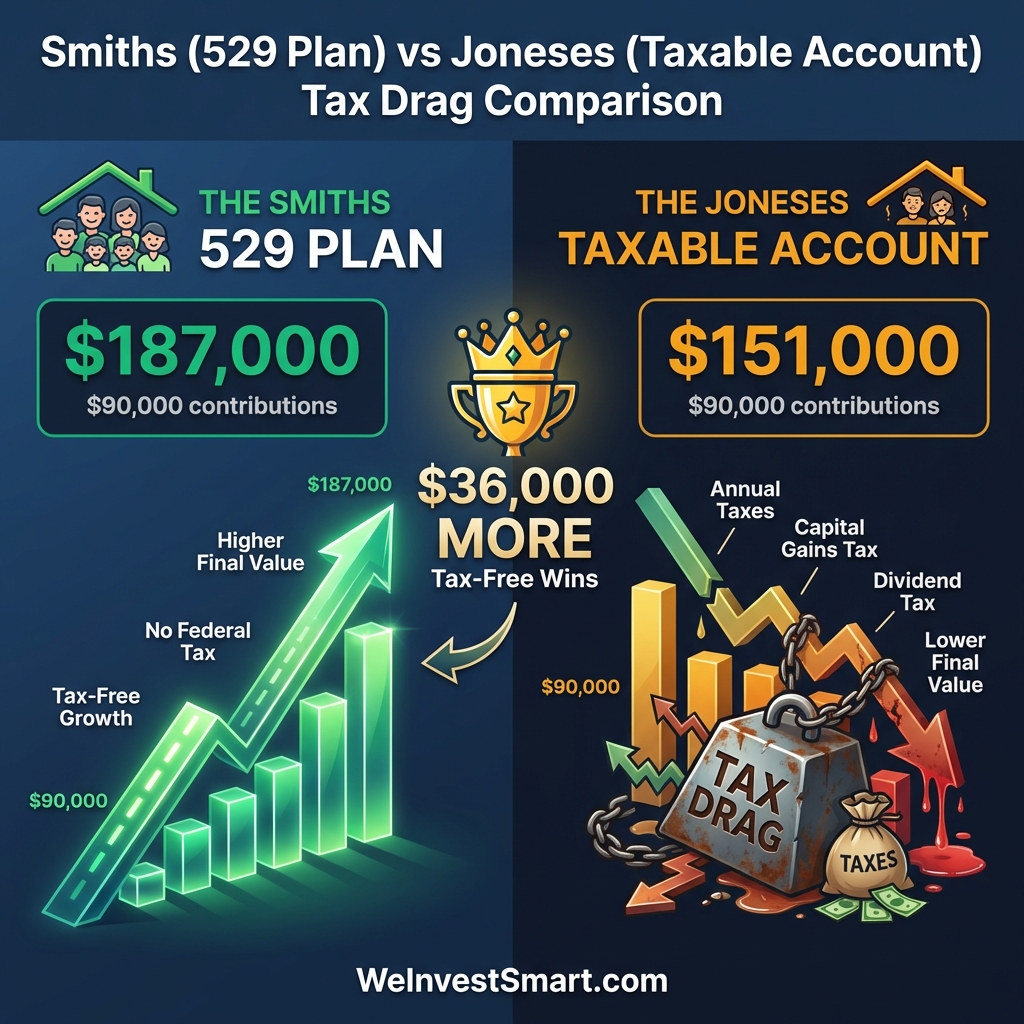

Let’s Put It to the Test: 529 Plan vs. Brokerage Account

Alright, enough theory. Let’s use a concrete example to see the staggering difference.

Imagine two families, the Smiths and the Joneses. Both have a newborn child and want to save for their education. They each invest $5,000 per year for 18 years, and their investments earn an average annual return of 7%.

- The Joneses invest in a standard taxable brokerage account.

- The Smiths invest in their state’s 529 plan.

For the Joneses, let’s assume their investment growth is subject to an average federal and state tax rate of 20% each year (a concept known as tax drag). This effectively reduces their net return. For the Smiths, their money grows completely untouched by taxes.

After 18 years:

- The Joneses’ taxable account would have grown to approximately $151,000.

- The Smiths’ 529 plan would have grown to roughly $187,000.

That’s a $36,000 difference, created solely by the magic of tax-free compounding. But the story doesn’t end there. When the Joneses sell their investments to pay for tuition, they will owe capital gains taxes on all the growth. The Smiths will withdraw their $187,000 completely tax-free. The tax advantages don’t just help you save more; they ensure you get to keep more.

A Real-World Case Study: Meet Sarah, the Strategic Saver

Let’s use a more detailed case study to drive this home. Meet Sarah, a 30-year-old marketing manager living in New York who earns an annual salary of $85,000. Sarah just had her first child, Emma, and wants to start saving for her college education right away.

Sarah’s Action Plan:

- She decides to contribute $300 per month ($3,600 per year) to her New York 529 plan

- New York offers a state tax deduction of up to $10,000 for married couples filing jointly ($5,000 for single filers)

- Sarah’s state income tax rate is 6.5%

- She invests in a diversified portfolio earning an average 7% annual return

- She continues this for 18 years until Emma starts college

Sarah’s Tax Savings Breakdown:

Year 1 immediate benefit:

- Annual contribution: $3,600

- State tax deduction: $3,600 × 6.5% = $234 saved on her state tax return

- This is like getting an instant 6.5% return before her investments even grow

After 18 years of tax-free compounding:

- Total contributions: $3,600 × 18 = $64,800

- Account value with 7% growth: $124,000

- Total growth: $59,200

- Federal and state taxes owed on growth: $0 (compared to roughly $11,840 if in a taxable account)

Sarah’s total tax advantage:

- State tax deductions over 18 years: $234 × 18 = $4,212

- Avoided federal capital gains tax (15%): $59,200 × 0.15 = $8,880

- Avoided state capital gains tax (6.5%): $59,200 × 0.065 = $3,848

- Avoided annual dividend/capital gains distribution taxes (estimated): $1,500

- Total tax advantage: $18,440

This means Sarah ends up with $124,000 in her 529 plan versus roughly $105,560 in a taxable account after all taxes. The 529 plan gave Emma an extra $18,440 for college—enough to cover nearly a full year of tuition at many state universities.

But what do we do if Emma decides not to attend college, orgets a full scholarship? Sarah has options. She can change the beneficiary to a sibling, cousin, or even herself for graduate school. She can use it for K-12 private school tuition. Starting in 2024, she can even roll up to $35,000 into a Roth IRA for Emma (if the 529 has been open for at least 15 years). The flexibility is remarkable.

You may also be interested in: Tax-Loss Harvesting: How to Turn Your Investment Losses into a Tax Win

You may also be interested in: Marginal vs. Effective Tax Rate: Understanding Your True Tax Burden

What Can You Use the Money For? The Expanding Definition of “Qualified”

The power of a 529 plan would be limited if the rules were overly strict. But the funny thing is, the definition of “qualified education expenses” has become increasingly flexible over the years. According to Federal Student Aid, these expenses now include:

- College Costs: Tuition, fees, books, supplies, and required equipment at any accredited college, university, or vocational school in the U.S. and even some abroad.

- Room and Board: Costs for housing and food, as long as the student is enrolled at least half-time.

- K-12 Tuition: You can use up to $10,000 per year, per beneficiary, for tuition at elementary or secondary public, private, or religious schools.

- Student Loan Repayment: You can use up to a lifetime limit of $10,000 to repay the beneficiary’s student loans.

- Rollover to a Roth IRA: In a game-changing new rule, starting in 2024, beneficiaries with leftover funds in a 529 account (that has been open for at least 15 years) can roll over up to $35,000 in their lifetime to a Roth IRA, tax- and penalty-free. This provides an incredible off-ramp if the money isn’t needed for education.

You may also be interested in: Understanding Capital Gains: How Long-Term vs. Short-Term Gains Affect Your Tax Bill

The Bottom Line: This Is More Than Just a Savings Account

Choosing a 529 plan isn’t just a financial decision; it’s a strategic one. It’s a declaration that you’re going to use the rules of the system to your advantage. By shielding your savings from the relentless drag of taxes, you are giving your child a significant head start before they even step foot on campus. You are maximizing the power of every dollar you save.

This isn’t about finding a loophole; it’s about using a tool for its intended purpose. The government has created a clear and powerful pathway to make saving for education more effective. And this is just a very long way of saying that opting for a taxable account when a 529 plan exists is like choosing to run a marathon with weights on your ankles. You get the gist: take the weights off, use the right vehicle, and give your education savings the tax-free fuel they need to grow.

This article is for educational purposes only and should not be considered personalized financial or tax advice. The rules for 529 plans can vary by state, and you should consider consulting with a financial advisor for guidance specific to your situation.

529 Plan Tax Advantages FAQ

What is a 529 plan?

A 529 plan is a tax-advantaged investment account specifically designed for saving for education expenses. It offers federal tax-deferred growth and tax-free withdrawals for qualified education costs, and many states also provide a state tax deduction for contributions.

What are the main tax advantages of a 529 plan?

The three main tax advantages are: 1) Contributions may be deductible on your state tax return. 2) The investments grow tax-deferred, meaning you don’t pay taxes on capital gains or dividends each year. 3) Withdrawals are completely tax-free at the federal level when used for qualified education expenses.

What are qualified education expenses for a 529 plan?

Qualified expenses include tuition and fees, room and board, books, supplies, and required equipment at eligible colleges, universities, and vocational schools. Up to $10,000 per year can also be used for K-12 tuition. Recent changes also allow for funds to be used for student loan repayment (up to a lifetime limit) and rollovers to a Roth IRA.

What happens if the money in a 529 plan isn’t used for education?

If you withdraw money from a 529 plan for non-qualified expenses, the earnings portion of the withdrawal will be subject to ordinary income tax plus a 10% federal penalty. The original contributions can always be withdrawn tax- and penalty-free.

Is a 529 plan better than a regular brokerage account for college savings?

For education savings, a 529 plan is almost always superior due to its significant tax advantages. A regular brokerage account is subject to annual taxes on dividends and capital gains distributions, and all growth is taxed upon withdrawal. The tax-free growth and withdrawals of a 529 plan allow your savings to compound much more effectively over time.