· WeInvestSmart Team · personal-finance · 15 min read

Debt Snowball vs Avalanche: The Best Payoff Method for You

Clearly compare the two most popular debt-tackling strategies. The Snowball (psychological wins) vs. The Avalanche (mathematically optimal). Use a case study to show how each one works.

Most people drowning in debt believe they have a math problem. They think if they could just earn a little more money or find a magic budgeting formula, their problems would disappear. But here’s the uncomfortable truth: for most of us, getting out of debt is not a math problem; it’s a behavior problem. It’s a battle against years of habits, emotions, and a feeling of being completely overwhelmed. Going straight to the point, you don’t need a more complicated spreadsheet; you need a better battle plan.

As of late 2025, total U.S. household debt reached a staggering $18.59 trillion, with the average American household carrying $105,056 in total debt. Credit card balances alone hit $1.23 trillion, with nearly half of Americans with revolving credit card debt expecting it to increase in 2026. These aren’t just statistics—they’re real people, just like you, staring at mounting bills and wondering how they’ll ever get ahead.

We live in a world with endless advice on how to pay off debt. We’re told to cut our spending, increase our income, and just “be more disciplined.” But when you’re staring at five different credit card bills, a car loan, and student loans, that advice feels useless. The real challenge isn’t knowing that you should pay off debt; it’s figuring out where to start. This paralysis is the enemy, keeping you stuck in a cycle of minimum payments and growing interest charges.

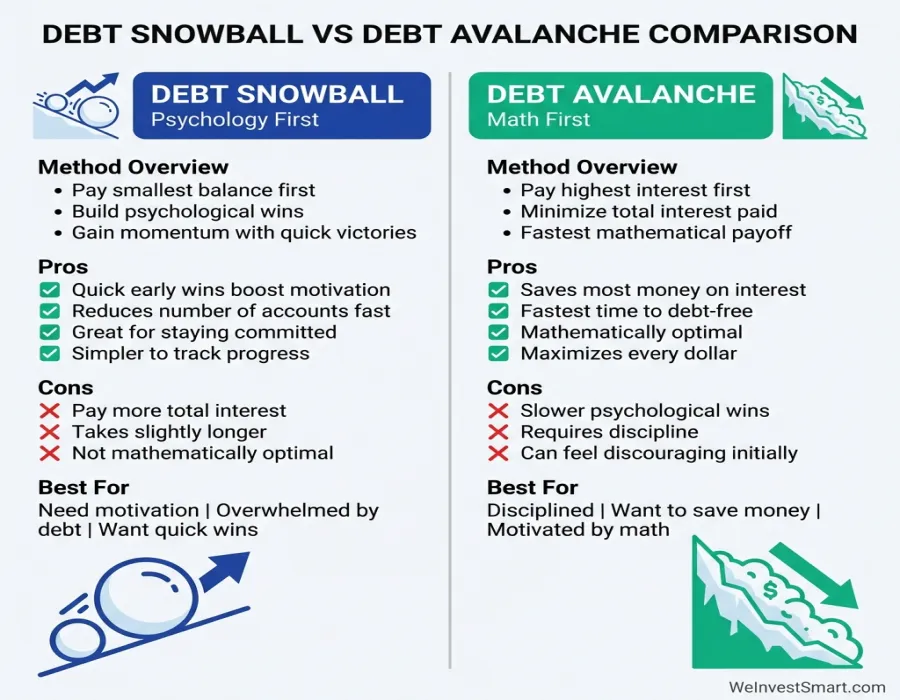

But what if we told you there are two proven, battle-tested strategies that have helped millions achieve financial freedom? And what if the “best” one has nothing to do with math and everything to do with your personality? Here’s where things get interesting. The great debate in debt management comes down to two methods: the Debt Snowball and the Debt Avalanche. This is a classic showdown between psychology and mathematics, between gut feel and cold, hard logic. And choosing the right one for you can be the difference between failure and finally becoming debt-free.

The Debt Snowball: Riding a Wave of Psychological Wins

The Debt Snowball method is the brainchild of financial personality Dave Ramsey, and its power lies in its deep understanding of human psychology. It’s designed for people who feel overwhelmed and need to see progress to stay motivated.

The science backs this up. Research from Northwestern University’s Kellogg School of Management found that consumers who focus repayments on one account at a time, particularly starting with the smallest balance, are significantly more likely to eliminate their entire debt compared to those who spread payments across multiple accounts or focus solely on interest rates. The researchers discovered a phenomenon called “debt account aversion”—people’s psychological drive to reduce the total number of outstanding debts, even when it’s not mathematically optimal.

Going straight to the point, here’s how the Debt Snowball works:

- List Your Debts: Write down all your debts (excluding your mortgage) in order from the smallest balance to the largest balance, regardless of the interest rates.

- Pay Minimums on Everything: Continue to make the required minimum payments on all of your debts. You cannot fall behind on any of them.

- Attack the Smallest Debt: Throw every single extra dollar you can find in your budget at the debt with the smallest balance. This is your single point of focus.

- Roll It Up: Once that smallest debt is paid off completely, you experience a huge psychological win. You then take the full amount you were paying on that debt (the minimum payment plus all the extra money) and “roll” it onto the next-smallest debt on your list.

You get the gist: as you pay off each debt, your “snowball” of payment grows larger, allowing you to attack the next debt with even more force.

The funny thing is that, mathematically, this method is almost always suboptimal. You’ll likely pay more in interest than with the alternative. So why is it so popular? Because it works. The psychology of money tells us that motivation feeds on progress. That feeling of closing an account, of being able to rip up a credit card statement and know it’s gone forever, provides a powerful dopamine hit. These quick wins build momentum and give you the emotional fuel to keep going when the journey gets long.

The Debt Snowball is likely right for you if:

- You feel overwhelmed and don’t know where to start.

- You’ve tried to pay off debt before but gave up due to a lack of progress.

- You are motivated by seeing tangible, quick results.

- You need to build confidence in your ability to manage money.

You may also be interested in: Your Financial Report Card: How to Calculate Your Net Worth (And Why It’s the Only Number That Matters)

The Debt Avalanche: The Cold, Hard, Mathematically Optimal Path

If the Snowball is about emotion, the Debt Avalanche method is about pure, unadulterated math. This strategy is for the person who wants the most efficient, cost-effective, and fastest route out of debt, period.

The mathematical principle here is undeniable: interest compounds as a percentage of your outstanding balance. By attacking your highest-interest debts first, you minimize the total amount of money lost to interest charges over time. Every dollar you throw at a 24% APR credit card saves you far more in future interest than the same dollar applied to a 5% car loan.

Going straight to the point, here’s how the Debt Avalanche works:

- List Your Debts: Write down all your debts in order from the highest interest rate (APR) to the lowest interest rate, regardless of the balance.

- Pay Minimums on Everything: Just like the Snowball, you must stay current on all your payments.

- Attack the Highest-Interest Debt: Throw every extra dollar you can find at the debt with the highest APR. This is almost always high-interest credit card debt.

- Roll It Down: Once that high-interest debt is gone, you take the full payment amount and apply it to the debt with the next-highest interest rate.

This sounds like a trade-off, because you might not get a quick win, but it’s actually a desirable thing for the financially disciplined. We covet this method because it minimizes the total amount of interest you pay to lenders. Your money is working as efficiently as possible, saving you hundreds or even thousands of dollars over the life of your loans.

And this is just a very long way of saying that the Debt Avalanche is the shortest distance between you and being debt-free. However, the challenge is mental. If your highest-interest debt is also a large-balance loan (like a personal loan), it could take months or even years to pay it off. You need the discipline to keep going without the frequent reinforcement of closing accounts.

The Debt Avalanche is likely right for you if:

- You are motivated by efficiency and saving the most money possible.

- You are disciplined and don’t need quick wins to stay on track.

- You have a clear understanding of how interest rates work and are infuriated by the idea of paying more than you have to.

- You can trust the process and stay focused on the long-term goal.

You may also be interested in: Insurance 101: The 4 Types of Insurance You Absolutely Need and Why

A Case Study: Meet Alex and Their $31,000 in Debt

Enough theory. Let’s see how these two debt payoff methods work in the real world. Meet Alex, who has four common debts and has managed to find an extra $500 a month in their budget to put toward them.

Here is Alex’s “Debt Inventory”:

| Debt Name | Balance | Interest Rate (APR) | Minimum Payment |

|---|---|---|---|

| Store Credit Card | $1,500 | 24.99% | $50 |

| Personal Loan | $8,000 | 11.5% | $250 |

| Car Loan | $15,000 | 5.0% | $300 |

| Student Loan | $6,500 | 6.8% | $100 |

| Totals | $31,000 | $700 |

Alex’s total minimum payments are $700, and they have an extra $500. So, Alex’s total monthly debt payoff “weapon” is $1,200 ($700 minimums + $500 extra).

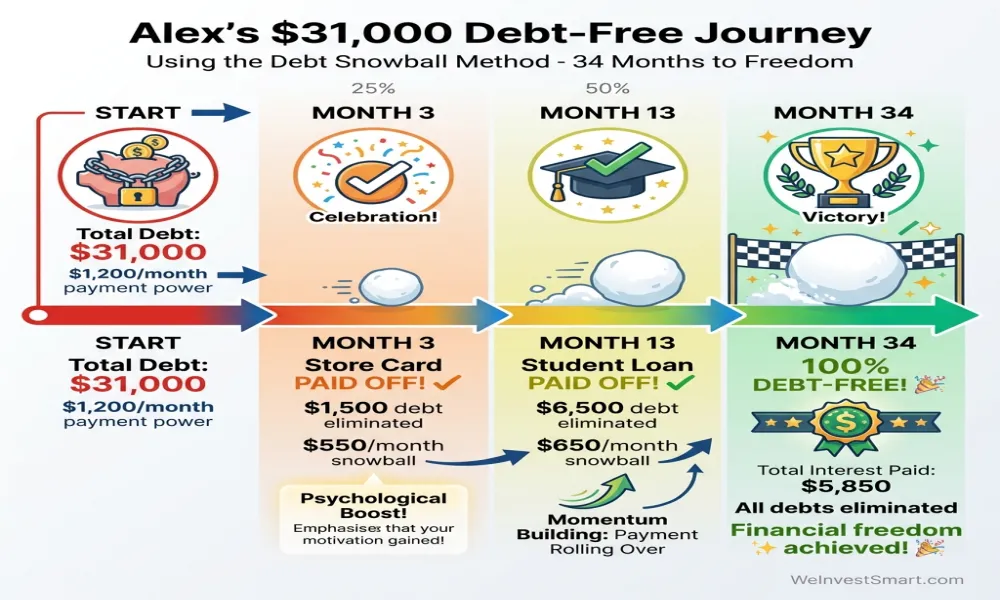

Alex Chooses the Debt Snowball Method (Psychology First)

Alex feels overwhelmed and needs a win, fast. They choose the Snowball.

Order of Attack (Smallest to Largest Balance):

- Store Credit Card ($1,500)

- Student Loan ($6,500)

- Personal Loan ($8,000)

- Car Loan ($15,000)

The Snowball in Action:

- Months 1-3: Alex pays the minimums on everything else ($250 + $300 + $100 = $650). They take the Store Card’s minimum ($50) plus their extra $500, for a total of $550 per month directed at the card. In just under 3 months, the store card is gone! Alex gets a huge confidence boost.

- Months 4-12: The first snowball has formed. Alex now takes that full $550 and rolls it onto the Student Loan’s minimum payment ($100). The new payment is $650 per month. In about 10 more months, the student loan is paid off.

- The Rest of the Journey: The snowball is now massive. The $650 payment rolls onto the Personal Loan’s $250 minimum, becoming a $900 monthly payment. Once that’s gone, the final snowball of $1,200 ($900 + $300 minimum) is applied to the car loan, wiping it out quickly.

Alex Chooses the Debt Avalanche Method (Math First)

Now, let’s rewind. What if Alex was purely logical and chose the Avalanche?

Order of Attack (Highest to Lowest APR):

- Store Credit Card (24.99%)

- Personal Loan (11.5%)

- Student Loan (6.8%)

- Car Loan (5.0%)

The Avalanche in Action:

- Months 1-3: Wait a minute… this looks familiar! In Alex’s specific case, the smallest balance debt is also the highest-interest debt. So, the first step is identical. They pay $550 per month and eliminate the store card in under 3 months.

- Months 4-15: Here’s where the paths diverge. The next highest interest rate is the Personal Loan (11.5%). Alex takes the freed-up $550 and adds it to the Personal Loan’s $250 minimum, attacking it with $800 per month. This will take about 12 more months.

- The Rest of the Journey: After the Personal Loan is gone, the $800 payment rolls onto the Student Loan (6.8%), creating a $900 monthly payment. Finally, that $900 rolls onto the Car Loan, creating a final payment of $1,200.

You may also be interested in: Marginal vs. Effective Tax Rate: The Difference and Why It Matters

The Final Results: Which Plan Was “Better” for Alex?

So, after all that, which method came out on top? Let’s look at the numbers.

| Method | Time to Be Debt-Free | Total Interest Paid |

|---|---|---|

| Debt Snowball | 34 Months | $5,850 |

| Debt Avalanche | 32 Months | $5,400 |

The Verdict: The Debt Avalanche got Alex out of debt 2 months faster and saved them $450 in interest.

But what do we do with this information? And here is where things get interesting. The math clearly says the Avalanche is superior. But the difference is $450 over nearly three years. For some people, that $450 is a small price to pay for the motivational power of the Snowball, which might be the only thing that keeps them in the game. If Alex had chosen the Avalanche but gotten discouraged and quit after a year, they would be far worse off.

You may also be interested in: Financial Intimacy: 5 Essential Money Conversations to Have With Your Partner

But What If You Could Combine Both? The Hybrid Approach

Here’s where things get interesting: you’re not locked into choosing just one method. Many financial experts now recommend a hybrid approach that captures the psychological benefits of the Snowball while maintaining some of the mathematical efficiency of the Avalanche.

The Hybrid Strategy works like this:

Start with a Quick Win: Choose your absolute smallest debt (regardless of interest rate) and eliminate it first. Get that dopamine hit, that feeling of closing an account. This builds momentum and proves to yourself that you can do this.

Then Switch to Avalanche: Once you’ve got that first win under your belt and your confidence is building, switch to the Avalanche method. Attack your highest-interest debts in order, now that you’ve proven to yourself you can stick with the plan.

Make Strategic Exceptions: If you have a small debt that’s very close to being paid off (say, less than 3 months away at your current payment), consider knocking it out first even if it’s not the highest interest rate. The mental bandwidth freed up by having one fewer bill to track can be worth the small mathematical difference.

When the Hybrid Approach Makes Sense:

- You have one very small debt (under $1,000) but other debts are high-interest

- You’ve tried debt payoff before and failed due to lack of motivation

- You’re disciplined enough to switch strategies mid-journey

- You want to balance psychology and mathematics

The hybrid approach acknowledges a fundamental truth: personal finance is personal. What’s mathematically optimal on a spreadsheet might not be psychologically optimal for your brain. And when it comes to paying off $31,000 in debt, the plan you’ll actually follow is infinitely better than the “perfect” plan you’ll abandon.

Common Debt Payoff Mistakes to Avoid

No matter which method you choose, avoid these pitfalls that derail even the best intentions:

1. Not Having a Written Budget

You cannot pay off debt aggressively without knowing exactly where your money is going. Before you start either method, create a zero-based budget where every dollar has a job. If you can’t find extra money in your current spending, you won’t have ammunition for the Snowball or Avalanche.

2. Continuing to Add New Debt

This should go without saying, but it needs to be said: you cannot dig yourself out of a hole while simultaneously digging deeper. Put the credit cards away. Stop financing new purchases. The only exception should be true emergencies—and no, a vacation or a new TV is not an emergency.

3. Not Building a Small Emergency Fund First

Before you throw every extra dollar at debt, save $500-$1,000 in a starter emergency fund. Why? Because if you’re living paycheck to paycheck with zero cushion, the first unexpected expense (car repair, medical bill) will force you right back onto a credit card, undoing all your progress. This small buffer prevents that backslide.

4. Ignoring Minimum Payments on Other Debts

Both methods require you to make minimum payments on all debts except the one you’re currently attacking. Missing payments destroys your credit score, triggers late fees, and can increase your interest rates. Never, ever skip a minimum payment to throw more at your target debt.

5. Giving Up After a Setback

Life happens. You might have a bad month, an unexpected expense, or a moment of weakness where you use a credit card. This doesn’t mean you’ve failed; it means you’re human. The difference between people who become debt-free and people who don’t is that successful people get back on track after a setback instead of giving up entirely.

6. Not Celebrating Milestones

Paying off $31,000 in debt is a marathon, not a sprint. If you wait until you’re completely debt-free to celebrate, you’ll burn out. Set milestones (every $5,000 paid off, every account closed) and celebrate them in small, budget-friendly ways. These celebrations reinforce that you’re making progress and keep your motivation high.

The Bottom Line: The Best Debt Payoff Method Is the One You’ll Stick With

The debate between the Snowball and the Avalanche isn’t about numbers; it’s about self-awareness. You are the expert on you. Do you need the quick, emotional wins to keep your head in the game, or does the cold, hard logic of mathematical efficiency fire you up?

What’s more important to you—saving $450 in interest over 34 months, or having the psychological momentum of quick wins that keeps you from quitting? There’s no wrong answer. The wrong answer is the method you won’t follow.

The biggest mistake you can make is to spend weeks agonizing over the “perfect” plan and never actually start. Choose one. Commit to it for 90 days. Build a written budget, find that extra money, and start attacking your debt with focus and intensity.

And this is just a very long way of saying that both the Snowball and the Avalanche are paths that lead to the same beautiful destination: financial freedom. The journey is hard, but the destination is worth it. Pick your path, take the first step, and don’t look back.

Debt Snowball vs. Debt Avalanche FAQ

What is the debt snowball method?

The debt snowball method involves paying off debts from smallest to largest balance, regardless of interest rate. You make minimum payments on all debts and throw extra money at the smallest debt until it’s paid off, then roll that payment to the next smallest.

What is the debt avalanche method?

The debt avalanche method involves paying off debts from highest to lowest interest rate. You make minimum payments on all debts and throw extra money at the highest-interest debt until it’s paid off, then roll that payment to the next highest-interest debt.

Which debt payoff method is better?

The best method depends on your personality. The avalanche saves more money mathematically, but the snowball provides psychological wins that can keep you motivated. Choose the one you’ll actually stick with.

How do I choose between snowball and avalanche?

Choose snowball if you need quick wins and motivation from closing accounts. Choose avalanche if you’re disciplined and want to minimize total interest paid. Consider your debt amounts and interest rates when deciding.

What if my expenses don’t fit either method?

If your expenses don’t fit, focus on creating a budget that frees up extra money for debt payoff. Both methods work best when you have consistent extra funds to apply. Consider increasing income or cutting expenses to accelerate payoff.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.