· WeInvestSmart Team · personal-finance · 13 min read

The 7 Biggest Financial Mistakes Beginners Make (And How to Avoid Them)

A highly shareable listicle that summarizes key lessons. Include mistakes like lifestyle inflation after a raise, not starting to invest early, paying high fees, trying to time the market, and ignoring your 401(k) match.

Most people believe that building wealth requires a stroke of genius. They think you need to find the next Amazon, predict the next market crash, or have some secret knowledge that the rest of us don’t. But here’s the uncomfortable truth: building wealth has almost nothing to do with doing brilliant things. It has everything to do with consistently not doing stupid things. Going straight to the point, your financial success is defined more by the mistakes you avoid than by the masterstrokes you make.

We live in a world that sells financial complexity. Gurus promise “secret strategies,” and headlines scream about “hot stocks.” We’re led to believe that the path to riches is a complicated maze. But the reality is that the path is surprisingly simple, and it’s guarded by a handful of predictable, well-known traps.

What if we told you that by simply learning to recognize and sidestep these seven common financial mistakes for beginners, you would outperform the vast majority of your peers? Here’s where things get interesting. These aren’t esoteric errors; they are fundamental blunders in behavior and psychology that millions of smart people make every single day. And this is just a very long way of saying that it’s time to learn the rules of the game by studying how most people lose.

Mistake #1: Not Starting to Invest Yesterday (The Tyranny of Delayed Compounding)

This isn’t just another item on the list. This is the single biggest financial mistake a person can make, capable of costing you hundreds of thousands, or even millions, of dollars over your lifetime.

Going straight to the point, every day you fail to invest, you are losing your most powerful ally: compound growth. It’s the force that makes your money work for you, creating a snowball of wealth that grows exponentially over time. The key ingredient for that magic is time, and it is a non-renewable resource.

The funny thing is that young people often think, “I’ll start investing when I make more money.” This is a catastrophic error in logic. A small amount of money invested early is infinitely more powerful than a large amount of money invested late.

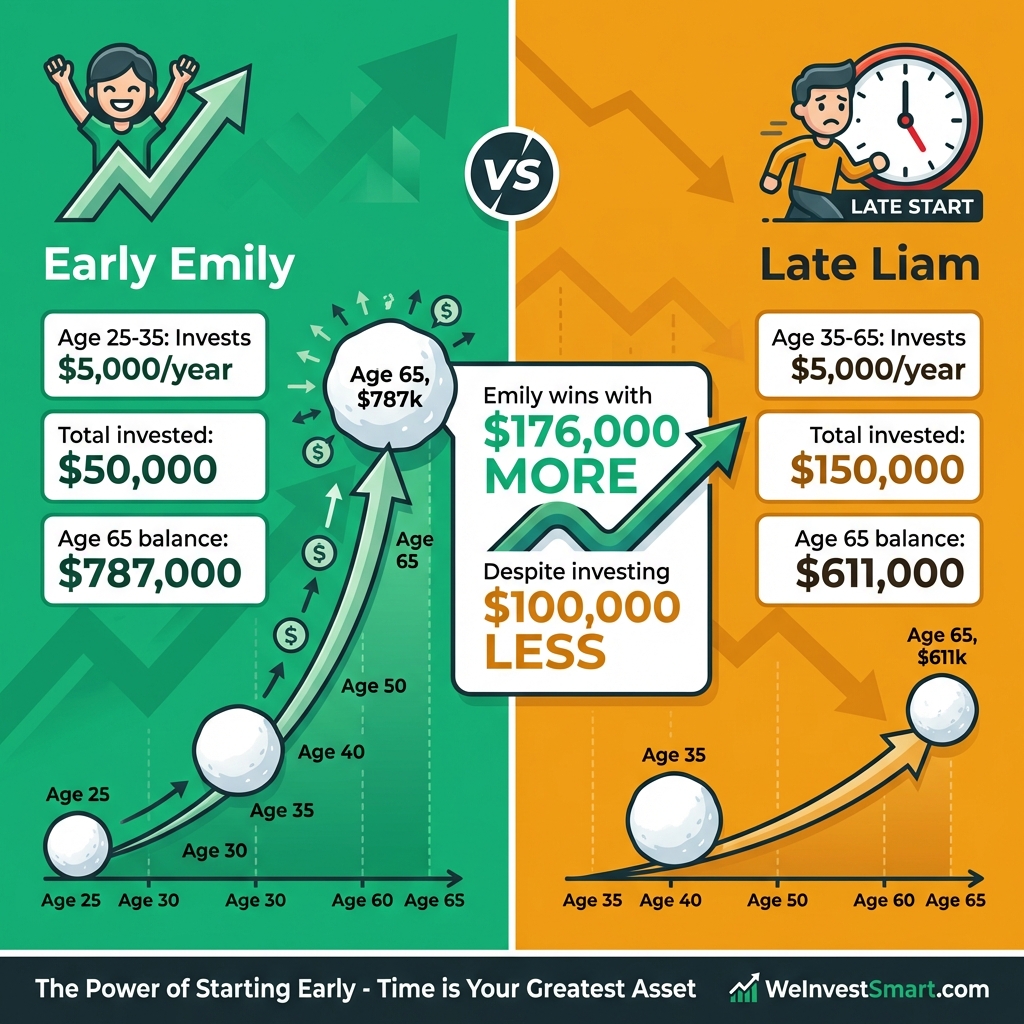

Let’s look at a concrete, shocking example. Meet Early Emily and Late Liam.

- Early Emily starts investing at age 25. She invests $5,000 every year for just 10 years, until she is 35. Then she stops completely and never invests another penny. Total contribution: $50,000.

- Late Liam waits until he’s 35 to start. He invests $5,000 every single year for 30 years, until he is 65. Total contribution: $150,000.

Assuming an 8% average annual return, who has more money at age 65?

- Late Liam, who invested three times as much money, ends up with about $611,000.

- Early Emily, who only invested for 10 years and stopped, ends up with over $787,000.

Emily contributed $100,000 less but ended up with $176,000 more because her money had an extra decade to compound. The uncomfortable truth is that the cost of waiting is a price you can never afford to pay. Start investing early, even if it’s just a small amount.

You may also be interested in: The 5 Levels of Financial Independence: Where Are You on the Journey?

Mistake #2: Ignoring Your 401(k) Match (Willfully Burning Free Money)

This mistake is so common and so financially devastating that it’s almost painful to write about. If your employer offers a 401(k) match and you are not contributing enough to get the full amount, you are making one of the most clear-cut financial mistakes possible.

Going straight to the point, a company match is a core part of your compensation package. It is not a gift. It is free money that you have already earned. To claim it, you simply have to contribute to your own 401(k). A common formula is a dollar-for-dollar match up to 5% of your salary.

According to the IRS 2026 401(k) contribution limits, you can contribute up to $23,000 annually (or $30,500 if you’re 50 or older), making this one of the most powerful wealth-building tools available.

Here’s where things get interesting. A 100% match on your contribution is a 100% return on investment. Instantly. Guaranteed. There is no other investment in the world that offers this. The stock market might return 10% in a good year. Your 401(k) match gives you 100% in one second.

And this is just a very long way of saying that capturing your full company match should be your absolute top financial priority, above paying off high-interest debt, above saving for a house, above everything else except perhaps building a tiny starter emergency fund. Not doing so is the equivalent of taking a portion of your paycheck, putting it in a pile on your desk, and setting it on fire.

You may also be interested in: How to Perform a Monthly Financial “Fire Drill”: Your 1-Hour Financial Health Checkup

Mistake #3: Letting Lifestyle Inflation Consume Your Raises (The Golden Handcuffs)

Here’s a familiar story: you get a promotion and a 10% raise. You feel rich! So you upgrade your apartment, get a nicer car, and start dining out more. A year later, despite earning more, you feel just as broke as you did before. This is lifestyle inflation.

Going straight to the point, lifestyle inflation is the phenomenon of your spending increasing as your income increases. It is the single biggest reason why even high-income earners often fail to build significant wealth. They upgrade their lifestyle at the same pace as their income, never actually increasing the gap between what they earn and what they spend.

Think of it like this: your ability to save is like the speed of a car. Your income is the engine power. A raise is like upgrading the engine. But lifestyle inflation is like adding hundreds of pounds of unnecessary weight to the car at the same time. You have more power, but you’re not going any faster.

But what do we do? The solution is a simple, powerful rule: Pay Your Future Self First… From Every Raise.

- The Action: The very day you get a raise, before you see a single dollar of it in your paycheck, log in to your 401(k) or IRA and automate an increase in your contribution. A great starting point is to commit to saving at least 50% of every future raise.

- The Result: You still get to enjoy the other 50% of your raise, so you feel the reward of your hard work. But you’ve also guaranteed that your savings rate accelerates, breaking the cycle of lifestyle inflation.

You may also be interested in: How to Lower Your Taxable Income (Legally): A Guide to Tax Credits and Deductions

Mistake #4: Trying to Time the Market (The Ultimate Fool’s Errand)

Every beginner investor has the same tempting thought: “If I can just pull my money out before the market crashes and jump back in at the bottom, I’ll be rich!” This is called market timing.

The uncomfortable truth is that no one—not you, not me, not the most brilliant hedge fund manager on Wall Street—can consistently and accurately predict short-term market movements. Trying to time the market is not an investment strategy; it is a form of gambling.

Here’s where things get interesting. Studies have shown that trying to time the market is the single biggest destroyer of investor returns. The reason is that the market’s best days often happen in very close proximity to its worst days. If you sell out of fear during a downturn, you are almost guaranteed to miss the powerful rebound that follows.

A study by Fidelity looked at the S&P 500 from 1980 to 2020. If you stayed fully invested, a $10,000 investment would have grown to over $790,000.

- But if you missed just the 10 best days in that 40-year period, your final balance would be only $367,000.

- If you missed the 30 best days, it drops to just $127,000.

The lesson is clear: The secret to success is not “timing the market.” It is “time in the market.” Your job is to create a diversified, low-cost portfolio and then stay invested, through good times and bad.

You may also be interested in: Good Debt vs. Bad Debt: A Beginner’s Guide to Understanding and Prioritizing Your Loans

Mistake #5: Paying High Investment Fees (The Silent Killer of Returns)

This is the most insidious of all the beginner investing mistakes because it happens silently, in the background, slowly bleeding your portfolio dry for decades.

Going straight to the point, all investment funds charge a fee, known as an expense ratio. It’s expressed as a percentage of the assets you have in the fund. A 1% expense ratio might not sound like much, but it is a financial cancer.

The SEC’s Mutual Fund Cost Calculator demonstrates how even small differences in fees can dramatically impact your long-term returns. This is why understanding expense ratios is critical for every investor.

Let’s look at another concrete example. Two friends, Low-Cost Laura and High-Fee Harry, each invest $100,000 for 30 years and earn an average annual return of 7%.

- Laura invests in a low-cost index fund with an expense ratio of 0.10%.

- Harry invests in an actively managed mutual fund with a seemingly reasonable expense ratio of 1.10%.

After 30 years, what’s the difference?

- Laura’s portfolio grows to approximately $685,000.

- Harry’s portfolio grows to only $520,000.

Harry paid over $165,000 more in fees, which not only disappeared from his account but also lost their own ability to compound and grow. The solution is simple: stick to low-cost index funds and ETFs. There is almost no reason for a beginner to ever pay an expense ratio higher than 0.20%.

You may also be interested in: The Snowball vs. The Avalanche: Which Debt Payoff Method is Right for You?

Mistake #6: Lack of Diversification (The All-or-Nothing Bet)

It’s tempting to go all-in on a “hot” tip. You hear about a friend who made a fortune on a single tech stock or a new cryptocurrency, and you want in on the action. This is a catastrophic mistake.

Going straight to the point, diversification is the principle of not putting all your eggs in one basket. It means spreading your investments across many different companies, industries, and even countries. This is the only “free lunch” in investing—it can reduce your risk without necessarily reducing your expected returns.

Consider this example: If you had invested $10,000 into Enron in 2000, you would have lost everything when the company collapsed in 2001. But if that same $10,000 was spread across a diversified index fund containing 500 companies, Enron’s collapse would have represented less than 0.2% of your portfolio—essentially unnoticeable.

The easiest way to achieve instant, broad diversification is by buying a total stock market index fund. With a single purchase, you become a part-owner of thousands of companies. If one of them fails spectacularly, it’s a tiny blip in your overall portfolio. But if you had put your entire life savings into that one company, you would be wiped out.

Research from University of Chicago Booth School of Business confirms that diversification remains one of the most effective ways to manage investment risk without sacrificing long-term returns.

Mistake #7: Letting Fear and Greed Drive Your Decisions (The Emotional Enemy)

The biggest threat to your long-term investment success is not the stock market. It is the person staring back at you in the mirror.

The two emotions that destroy investors are fear and greed.

- Greed (FOMO): You see a stock or a sector skyrocketing, and you jump in at the top, terrified of missing out.

- Fear: The market crashes, and you panic-sell everything at the bottom, locking in your losses.

This is the classic “buy high, sell low” cycle that devastates amateur investors. But what do we do? How do we conquer our own worst instincts? The answer is automation. Set up automatic, recurring investments into your chosen index funds every single month, regardless of what the market is doing. This strategy, called dollar-cost averaging, forces you to remain disciplined. It removes emotion from the equation and ensures you are consistently buying, whether the market is up or down.

The Bottom Line: Success is the Avoidance of Error

Building wealth is not a game of brilliant, complex moves. It is a game of simple, consistent habits and the disciplined avoidance of a few key errors.

By committing to start investing early, capturing your full 401(k) match, controlling lifestyle inflation, staying invested for the long term, minimizing fees, diversifying your holdings, and automating your decisions, you are not just avoiding mistakes. You are building a powerful, resilient system for financial success.

And this is just a very long way of saying that you don’t have to be a genius to win the game of money. You just have to refuse to lose it.

Biggest Financial Mistakes for Beginners FAQ

What are the biggest financial mistakes beginners make?

The biggest financial mistakes beginners make include not starting to invest early, ignoring 401(k) match, lifestyle inflation, trying to time the market, paying high fees, lack of diversification, and letting emotions drive decisions.

Why is starting to invest early so important?

Starting to invest early is crucial because of compound growth. Money invested earlier has more time to grow exponentially. For example, investing $5,000 annually for 10 years starting at age 25 can result in more wealth than investing $5,000 annually for 30 years starting at age 35, due to the power of compounding.

What is lifestyle inflation and how to avoid it?

Lifestyle inflation occurs when your spending increases as your income rises, preventing wealth accumulation. To avoid it, automate savings increases with each raise (aim for 50% of raises going to savings) and consciously decide how to allocate additional income before spending it on upgrades.

How can I avoid trying to time the market?

Avoid market timing by staying invested long-term and using dollar-cost averaging. Instead of trying to predict market movements, focus on building a diversified portfolio and maintaining regular contributions. Studies show that missing just a few of the market’s best days can significantly reduce returns.

What are the benefits of low-cost index funds?

Low-cost index funds offer broad diversification and minimal fees (typically 0.10-0.20% expense ratios). They track market indices rather than trying to beat them, which most active funds fail to do. Over time, lower fees compound to create substantial savings compared to high-fee actively managed funds.

This article is for educational purposes only and should not be considered personalized financial advice. Consider consulting with a financial advisor for guidance specific to your situation.