· WeInvestSmart Team · personal-finance · 10 min read

7 Common Tax Deductions You Might Be Missing Out On

A listicle exploring often-overlooked tax deductions that could save you thousands. We cover student loan interest, HSA contributions, self-employment expenses, IRA contributions, and more.

Most people treat tax season like a visit to the dentist: a necessary evil filled with anxiety, confusion, and the resigned acceptance of a painful outcome. They gather their forms, plug numbers into software, and pray for a small refund, completely unaware that they are likely leaving hundreds, if not thousands, of dollars on the table. But here’s the uncomfortable truth: the IRS isn’t going to call you to point out the deductions you missed. Going straight to the point, your tax bill is a direct reflection of your financial literacy, and passivity is an expensive mistake.

We’ve all been trained to think of taxes as something that happens to us. Money is taken from our paychecks, and at the end of the year, we settle the score. But for the financially savvy, tax planning isn’t a once-a-year event; it’s a year-round strategy. They view the tax code not as a book of punishments, but as a rulebook filled with opportunities.

What if we told you that paying student loans, saving for medical expenses, or even cleaning out your closet could directly reduce the amount you owe the government? And what if the only thing stopping you was a lack of knowledge? Here’s where things get interesting. A tax deduction isn’t a loophole or a trick; it’s a deliberate incentive placed in the tax code by the government to encourage specific behaviors. And this is just a very long way of saying that the government is literally offering to pay you to make smart financial moves. It’s time to start collecting.

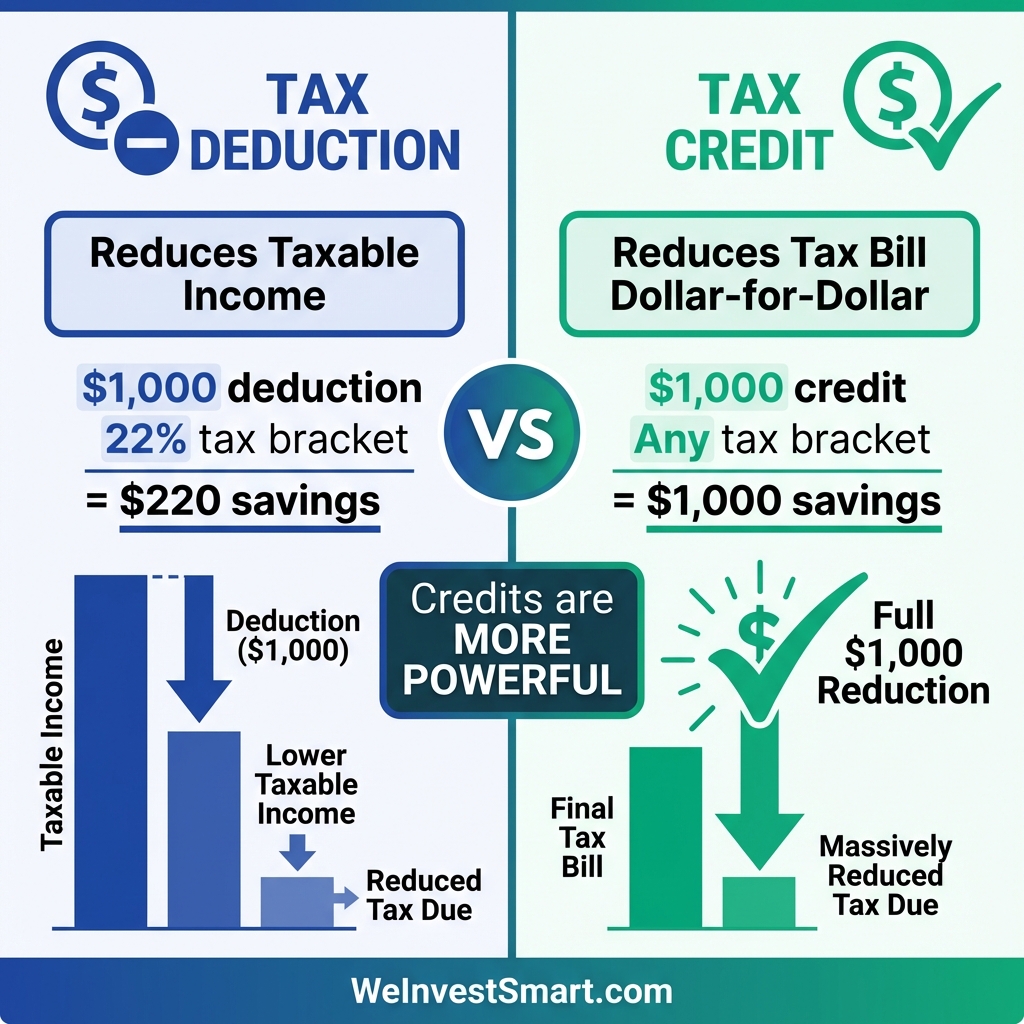

A Quick Primer: Deductions vs. Credits

Before we dive in, let’s clarify a crucial point. A tax deduction reduces your taxable income. If you’re in the 22% tax bracket, a $1,000 deduction saves you $220. A tax credit, on the other hand, is a dollar-for-dollar reduction of your actual tax bill. A $1,000 credit saves you $1,000. While credits are more powerful, a series of well-planned deductions can dramatically lower your overall tax burden. Many of the deductions on this list are “above-the-line” deductions, meaning you don’t even need to itemize to claim them. You can take the standard deduction and still take these.

You may also be interested in: How to Use a “Balance Transfer” Credit Card to Crush High-Interest Debt

The funny thing is, most people focus on finding ways to earn more money while ignoring the easiest way to keep more: reducing what you owe in taxes through legitimate deductions.

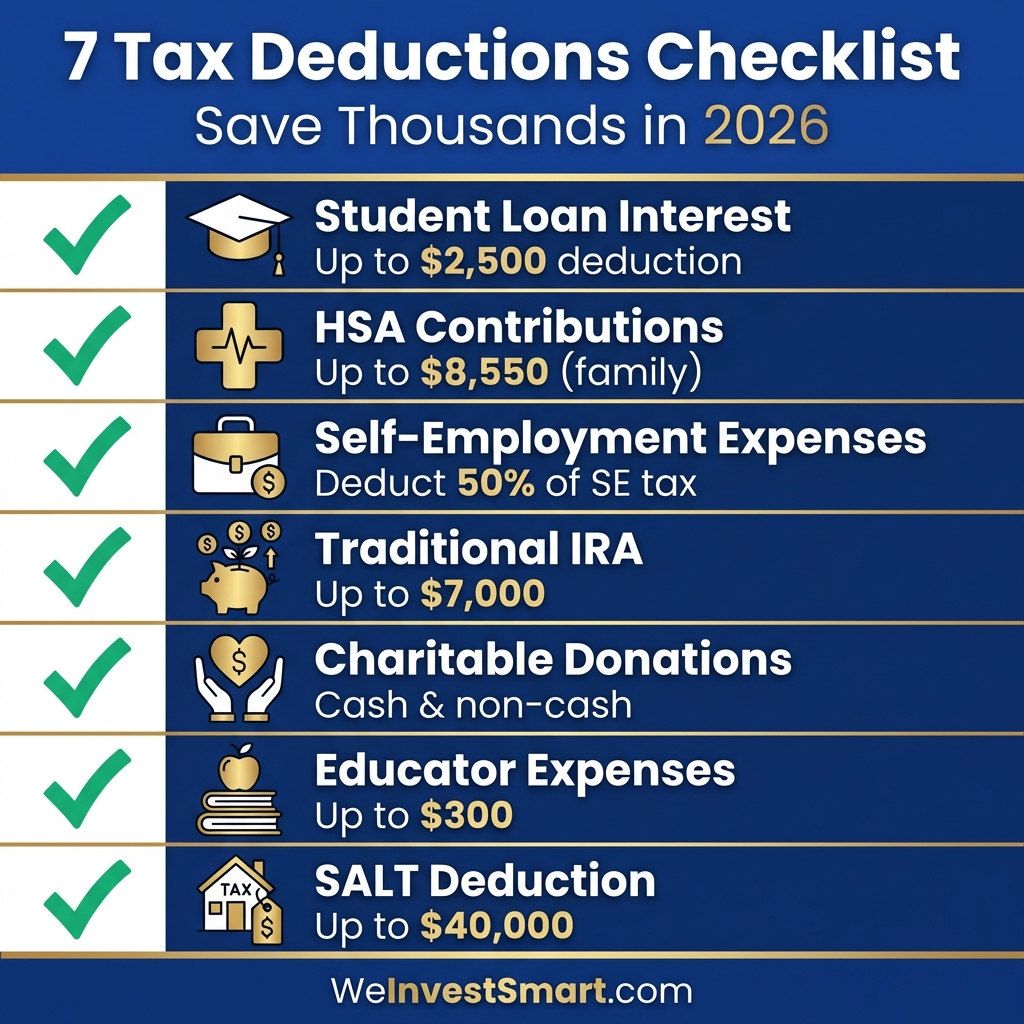

7 Overlooked Deductions That Can Save You Big Money

Alright, enough theory. Let’s get to the actionable strategies. Here are seven of the most commonly missed tax deductions that you should be looking at every single year.

1. The Student Loan Interest Deduction

Millions of Americans are burdened by student loan debt, yet many don’t realize that the interest they pay is a gift from the IRS. You can deduct the interest you pay on qualified student loans, up to a maximum of $2,500 per year. This is an incredibly valuable “above-the-line” deduction, so you can claim it even if you don’t itemize.

Going straight to the point, if you paid $2,500 in student loan interest and are in the 22% tax bracket, this deduction puts $550 back in your pocket. Your loan servicer will send you Form 1098-E if you paid $600 or more in interest, making this easy to track. The funny thing is, even if a parent helps you make payments, as long as you are legally obligated to pay the loan, you are generally the one who can take the deduction. There are income phase-outs, however. For 2026, the deduction starts to phase out for single filers with a modified adjusted gross income (MAGI) between $80,000 and $95,000 and for joint filers between $165,000 and $195,000.

2. Health Savings Account (HSA) Contributions

This is arguably the most powerful savings tool in the entire tax code, and it’s shockingly underutilized. An HSA is a triple tax-advantaged account: your contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free. If you have a high-deductible health plan (HDHP), you are eligible to contribute.

For 2026, you can contribute up to $4,300 for self-only coverage or $8,550 for family coverage. If you’re 55 or older, you can add another $1,000 as a “catch-up” contribution. Contributions made via payroll deduction are already pre-tax, but if you contribute with post-tax money directly to your HSA, you can deduct the full amount on your tax return. This sounds like a trade-off, but it’s actually an incredible deal: you’re funding future healthcare needs while getting an immediate and significant tax break today.

You may also be interested in: HSA: The Best Retirement Account You’re Not Using

3. Self-Employment Expenses (Even for Your Side Hustle)

The gig economy has exploded, but many new freelancers and side-hustlers are business owners who don’t act like it. If you earn 1099 income, you are running a business, and you can deduct your business expenses. This includes the obvious, like supplies and software, but also many things people miss.

Here’s where things get interesting. You can deduct half of your self-employment taxes. That’s right—the 15.3% you pay in Social Security and Medicare taxes? You get to deduct the “employer” portion (7.65%) from your income. You can also deduct health insurance premiums if you’re not eligible for an employer’s plan. And don’t forget the home office deduction and business use of your vehicle, which can add up to thousands in deductions. Every legitimate expense reduces your net self-employment income, which lowers both your income tax and your self-employment tax.

You may also be interested in: W-2 vs 1099 Contractor: Which is Better for You?

4. Traditional IRA Contributions

Even if you have a 401(k) at work, you may still be able to get a tax deduction for contributing to a traditional IRA. For 2026, you can contribute up to $7,000 (or $8,000 if you’re age 50 or older). Whether that contribution is deductible depends on your income and whether you’re covered by a workplace retirement plan.

Going straight to the point, if you are not covered by a retirement plan at work, you can deduct your full contribution regardless of your income. If you are covered by a workplace plan, the deduction gets phased out as your income rises. For 2026, the phase-out range for single filers is a MAGI of $79,000 to $89,000. For married couples filing jointly, it’s $126,000 to $146,000 if the spouse making the contribution is covered by a workplace plan. This is a direct reward for saving for your own future.

You may also be interested in: How to Open a Roth IRA and Start Investing for Tax-Free Retirement

5. Charitable Donations (Cash and Non-Cash)

Most people know they can deduct cash donations to qualified charities, but only if they itemize. What they often forget are the non-cash donations. That bag of clothes, furniture, or household goods you dropped off at Goodwill? That has value, and that value is deductible.

To claim this, you’ll need to keep good records and determine the item’s “fair market value”—what it would sell for in its current condition. For any non-cash donation over $500, you must file Form 8283. And if a single item is worth more than $5,000, you generally need a formal appraisal. Even the miles you drive for volunteer work can be deducted. The funny thing is that a year’s worth of spring cleaning can easily translate into a tax deduction of several hundred dollars that most people simply throw away.

6. The Educator Expense Deduction

This is a small but important deduction for the teachers, counselors, principals, and aides who often dig into their own pockets for classroom supplies. Eligible educators can deduct up to $300 of unreimbursed expenses. If you and your spouse are both educators and file jointly, you can deduct up to $600 ($300 each).

This is another “above-the-line” deduction, so you can claim it without itemizing. Qualified expenses include books, supplies, computer equipment, software, and even professional development courses. It’s a small acknowledgment of a big personal expense, and it’s one that no eligible educator should miss.

7. State and Local Tax (SALT) Deduction

This deduction is for those who itemize and it allows you to deduct taxes you’ve paid to state and local governments. This includes either your state and local income taxes OR your state and local sales taxes (you can’t take both). You can also include property taxes. However, the Tax Cuts and Jobs Act of 2017 placed a significant limitation on this.

For the 2026 tax year, the total SALT deduction cap is $40,000 per household, following legislation passed in 2025 that significantly increased the previous $10,000 cap (the increase is subject to income phase-outs). For homeowners in high-tax states like California, New York, and New Jersey, this is one of the most significant itemized deductions available and can make the difference between taking the standard deduction and a much larger itemized one.

You may also be interested in: Marginal vs Effective Tax Rate: Why Your Tax Bracket Doesn’t Tell the Whole Story

You may also be interested in: What Are High-Yield Savings Accounts (HYSAs) and Why You Need One Right Now

The Bottom Line: This Is More Than Just Saving Money

Completing your tax return shouldn’t feel like a surrender. It should be a final, strategic step in a year-long financial plan. By understanding and utilizing the deductions available to you, you are fundamentally changing your relationship with taxes. You are moving from a position of passive compliance to one of active management.

These deductions are not just numbers on a form; they are the tangible rewards for making smart life decisions—furthering your education, saving for retirement, investing in your health, and supporting your community. And this is just a very long way of saying that every dollar you save on taxes is a dollar you can redirect toward your own financial goals. You get the gist: stop overpaying the government. Start investing in yourself.

This article is for educational purposes only and should not be considered personalized tax advice. Tax laws are complex and change frequently. Consider consulting with a qualified tax professional for guidance specific to your situation.

Common Tax Deductions FAQ

What is the difference between a tax deduction and a tax credit?

A tax deduction reduces your adjusted gross income (AGI), lowering the amount of your income that is subject to tax. A tax credit is more powerful, as it provides a dollar-for-dollar reduction of your actual tax liability.

Can I claim these deductions if I take the standard deduction?

It depends. Some deductions, like those for student loan interest, traditional IRA contributions, and HSA contributions, are “above-the-line” deductions and can be taken even if you don’t itemize. Others, like charitable donations and the SALT deduction, require you to itemize.

How much student loan interest can I deduct?

You can deduct up to $2,500 of the student loan interest you paid per year. However, this deduction is subject to income limitations and begins to phase out for higher earners.

What is the maximum I can contribute to an HSA?

For 2026, the maximum contribution to a Health Savings Account (HSA) is $4,300 for self-only coverage and $8,550 for family coverage. Individuals age 55 and older can contribute an additional $1,000 catch-up contribution.

What qualifies as a deductible charitable donation?

You can deduct cash and non-cash contributions (like clothing or stocks) made to qualified 501(c)(3) organizations. To deduct these, you must itemize, and the documentation requirements increase with the value of the donation.